Does OCBC's Stable Profits Amid Margin Pressure Signal Resilience or Hidden Risks for SGX:O39?

Reviewed by Sasha Jovanovic

- Oversea-Chinese Banking Corporation Limited reported its third quarter 2025 earnings on November 7, disclosing a net interest income of S$2.23 billion and net income of S$1.98 billion, both down and flat respectively compared to the same period last year.

- Although net interest income declined year-on-year, the company maintained steady net income, highlighting the effects of margin pressures accompanied by ongoing resilience in core operations.

- We'll examine how steady net income despite lower interest earnings could reshape Oversea-Chinese Banking's investment outlook and risk factors.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Oversea-Chinese Banking Investment Narrative Recap

To be comfortable as a shareholder in Oversea-Chinese Banking Corporation (OCBC), you generally need to believe in the bank's resilience amid fluctuating interest rates and its ability to generate stable earnings from diverse sources across Asia. The recent Q3 2025 results, with flat net income despite lower net interest income, show the bank’s underlying operations holding firm; however, the outcome does not materially shift the current short-term catalyst, which remains the growth in wealth management and fee-based income, nor does it reduce the biggest risk from sustained margin pressures tied to further rate declines.

Among the recent company updates, the newly announced partnership between OCBC and Ant International to enhance cross-border fund settlements stands out. This move directly supports OCBC’s focus on fee and transaction-based revenues, tying in with current catalysts around growing non-interest income streams and the broader push for digital transformation.

However, investors should be aware that while profits held steady, persistent headwinds from falling net interest margins could challenge...

Read the full narrative on Oversea-Chinese Banking (it's free!)

Oversea-Chinese Banking's narrative projects SGD 15.7 billion revenue and SGD 7.9 billion earnings by 2028. This requires 4.7% yearly revenue growth and a SGD 0.6 billion earnings increase from SGD 7.3 billion today.

Uncover how Oversea-Chinese Banking's forecasts yield a SGD19.05 fair value, a 4% upside to its current price.

Exploring Other Perspectives

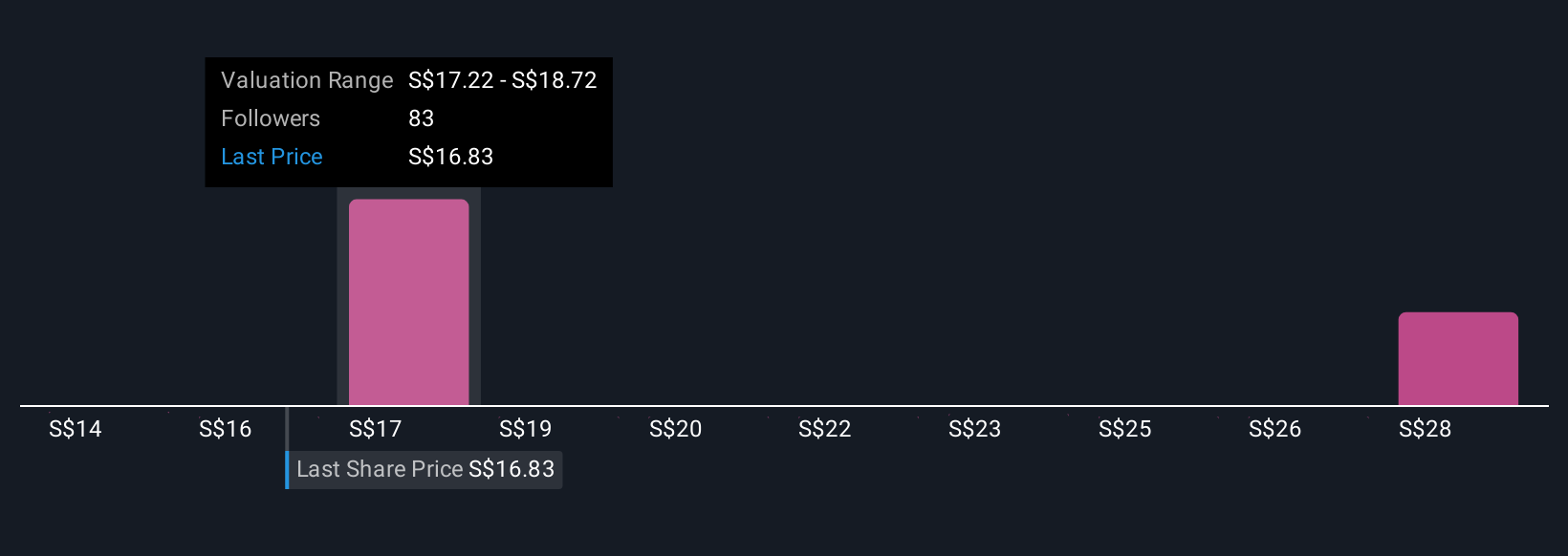

Five retail investors in the Simply Wall St Community estimated OCBC’s fair value between S$14.44 and S$30.67, a wide spectrum. Some see stable fee income and digital partnerships as supportive for future earnings growth, but your views may differ, explore the range of community perspectives above.

Explore 5 other fair value estimates on Oversea-Chinese Banking - why the stock might be worth 21% less than the current price!

Build Your Own Oversea-Chinese Banking Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oversea-Chinese Banking research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Oversea-Chinese Banking research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oversea-Chinese Banking's overall financial health at a glance.

No Opportunity In Oversea-Chinese Banking?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O39

Oversea-Chinese Banking

Provides financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives