In the wake of recent global market developments, U.S. stocks have surged to record highs, buoyed by optimism around growth prospects and tax reforms following a significant political shift. Amidst this backdrop of economic uncertainty and evolving fiscal policies, dividend stocks stand out as a stable investment option due to their potential for consistent income generation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

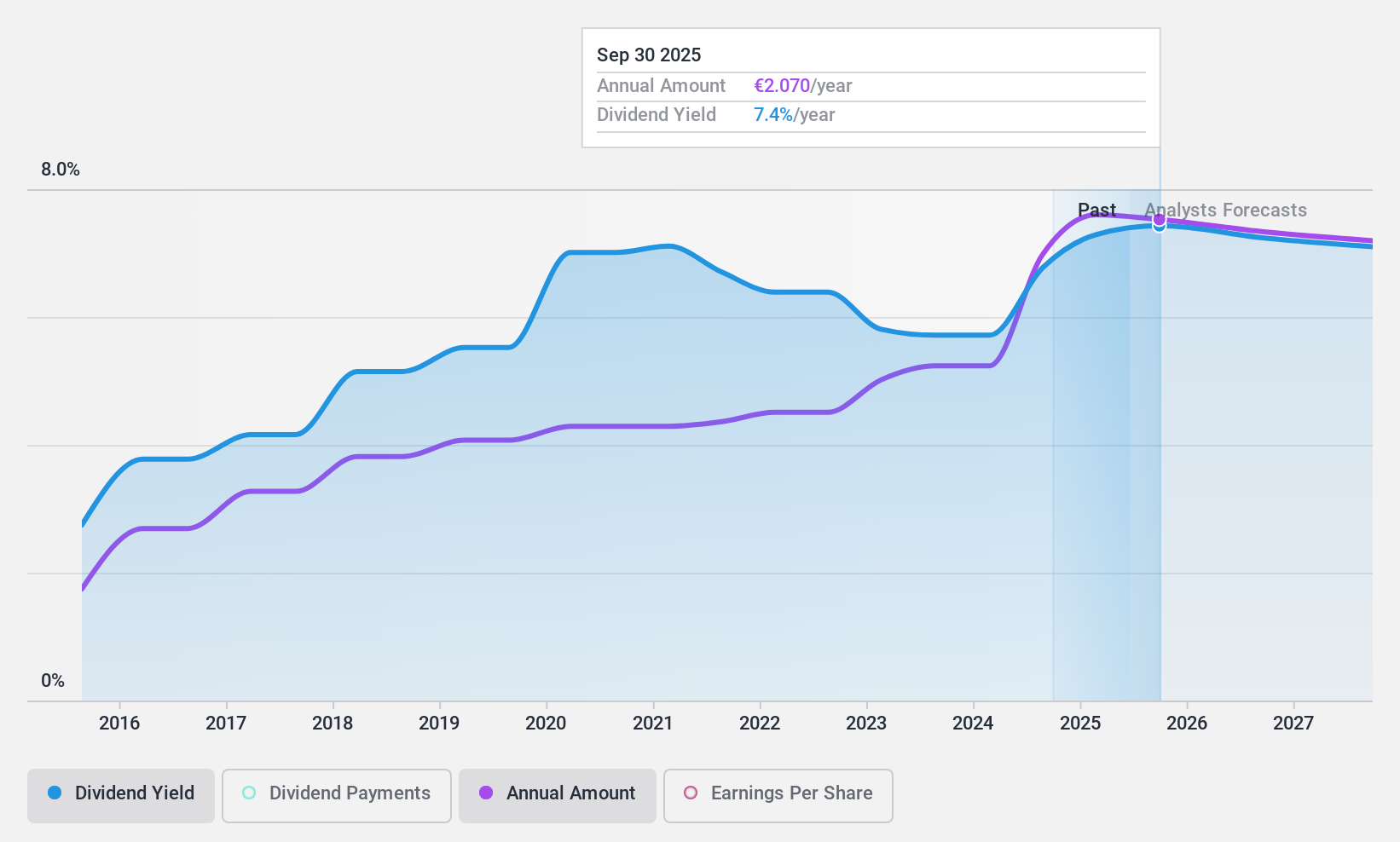

Logista Integral (BME:LOG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Logista Integral, S.A. operates as a distributor and logistics operator across Spain, France, Italy, Portugal, and Poland with a market cap of €3.88 billion.

Operations: Logista Integral, S.A. generates its revenue primarily from Tobacco and Related Products (€12.09 billion), followed by Transport (€889.98 million) and Pharmaceutical Distribution (€273.42 million).

Dividend Yield: 7.1%

Logista Integral proposed a total dividend of €2.09 per share for 2024, marking a 30% increase from the previous year. Despite this growth, the company's dividends have been historically volatile and are covered by earnings with an 89.5% payout ratio and cash flows at a 78.8% cash payout ratio. While Logista's dividend yield is among the top in Spain, its past volatility may concern some investors seeking stable income streams.

- Navigate through the intricacies of Logista Integral with our comprehensive dividend report here.

- Our valuation report here indicates Logista Integral may be undervalued.

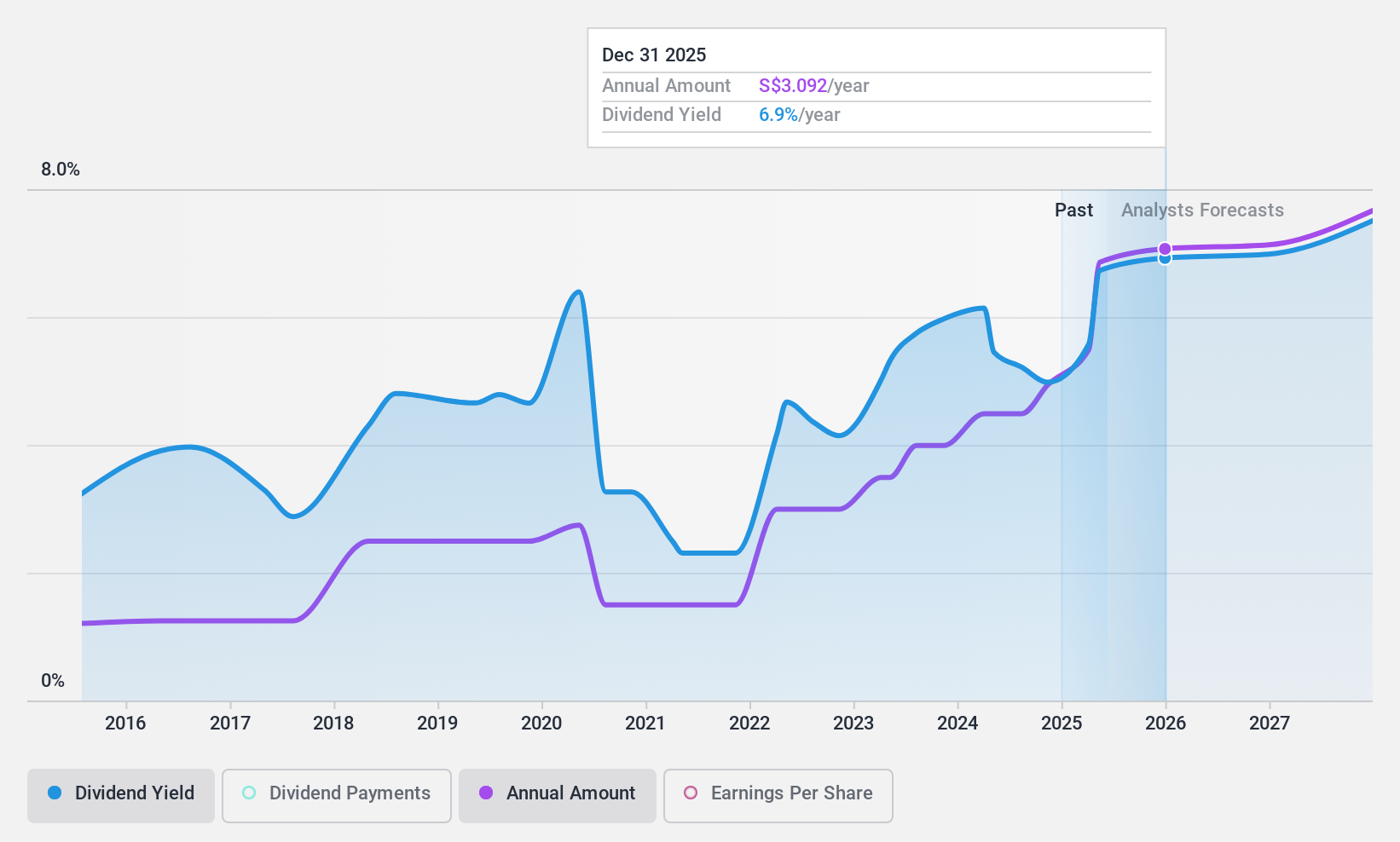

DBS Group Holdings (SGX:D05)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd offers commercial banking and financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market cap of SGD120.42 billion.

Operations: DBS Group Holdings Ltd generates revenue from its commercial banking and financial services operations in Singapore, Hong Kong, Greater China, South and Southeast Asia, and other international markets.

Dividend Yield: 5.1%

DBS Group Holdings' dividend yield of 5.1% is below the top quartile in Singapore, and its dividend history has been volatile with significant drops over the past decade. However, dividends are currently covered by earnings with a 55.2% payout ratio and are forecasted to remain sustainable at 64%. Recent earnings growth supports this stability, with third-quarter net income rising to SGD 3.03 billion. A share buyback program worth SGD 3 billion further underscores capital management efforts.

- Click here and access our complete dividend analysis report to understand the dynamics of DBS Group Holdings.

- Upon reviewing our latest valuation report, DBS Group Holdings' share price might be too pessimistic.

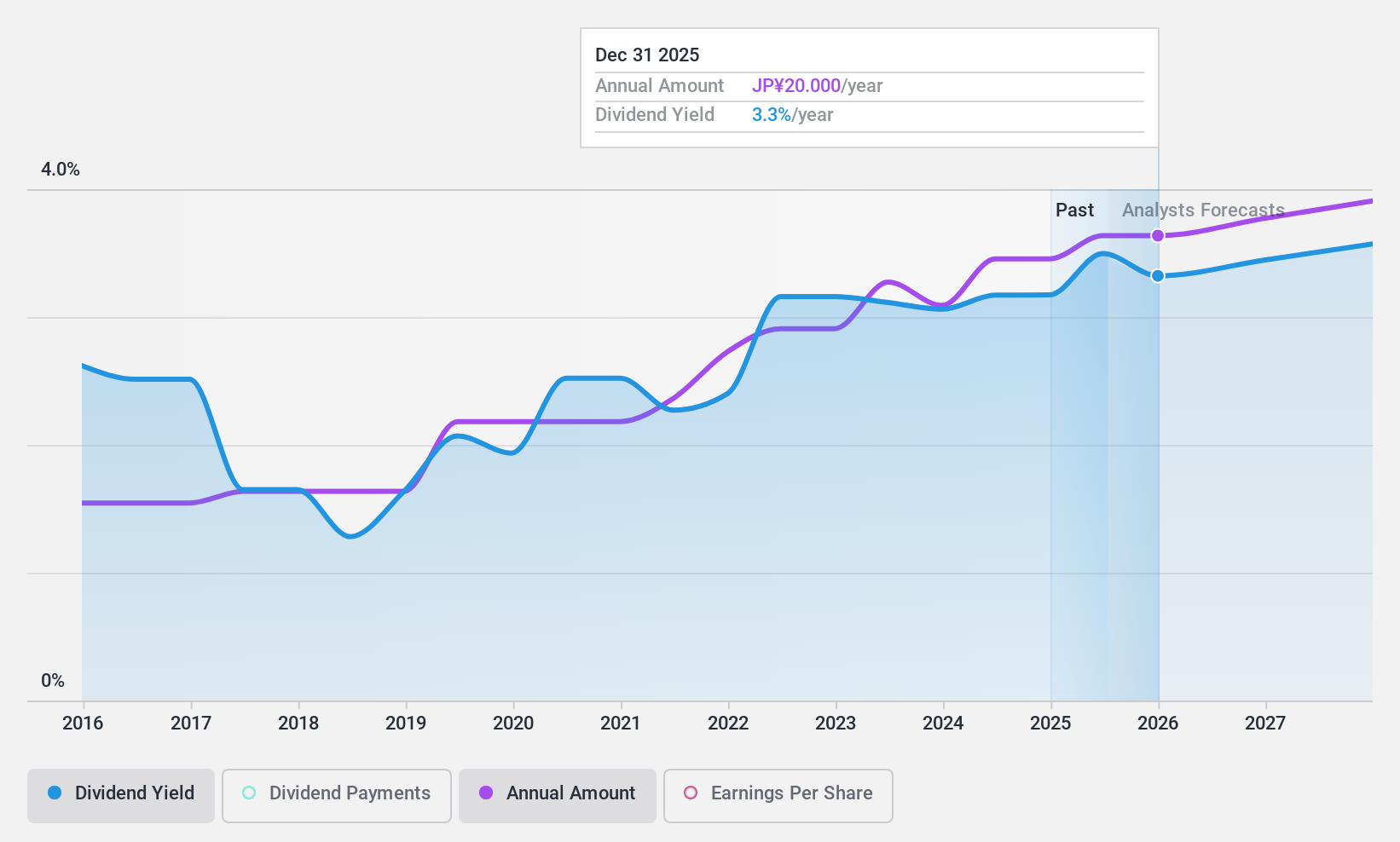

NittoseikoLtd (TSE:5957)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nittoseiko Co., Ltd. manufactures and sells industrial fasteners, tools, machinery, precision equipment, and measurement control equipment both in Japan and internationally with a market cap of ¥22.15 billion.

Operations: Nittoseiko Ltd. generates revenue from several segments, including Fasteners at ¥32.63 billion, Control Systems at ¥6.41 billion, Industrial Machinery at ¥5.64 billion, and Medical products at ¥9.93 million.

Dividend Yield: 3.1%

Nittoseiko Ltd.'s dividend yield of 3.14% is below the top quartile in Japan, and its dividend history has been volatile over the past decade. Despite this, dividends are well-covered by earnings with a payout ratio of 35.6% and cash flows at 57.4%. The stock trades at a significant discount to estimated fair value, suggesting potential for appreciation. Recent earnings growth supports future stability in dividend payments despite historical volatility concerns.

- Take a closer look at NittoseikoLtd's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that NittoseikoLtd is trading behind its estimated value.

Turning Ideas Into Actions

- Reveal the 1939 hidden gems among our Top Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:D05

DBS Group Holdings

Provides commercial banking and financial services in Singapore, Hong Kong, rest of Greater China, South and Southeast Asia, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion