- Sweden

- /

- Transportation

- /

- NGM:FREETR

Does Freetrailer Group (NGM:FREETR) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Freetrailer Group (NGM:FREETR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Freetrailer Group with the means to add long-term value to shareholders.

Freetrailer Group's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Freetrailer Group has managed to grow EPS by 25% per year over three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Freetrailer Group is growing revenues, and EBIT margins improved by 7.0 percentage points to 17%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

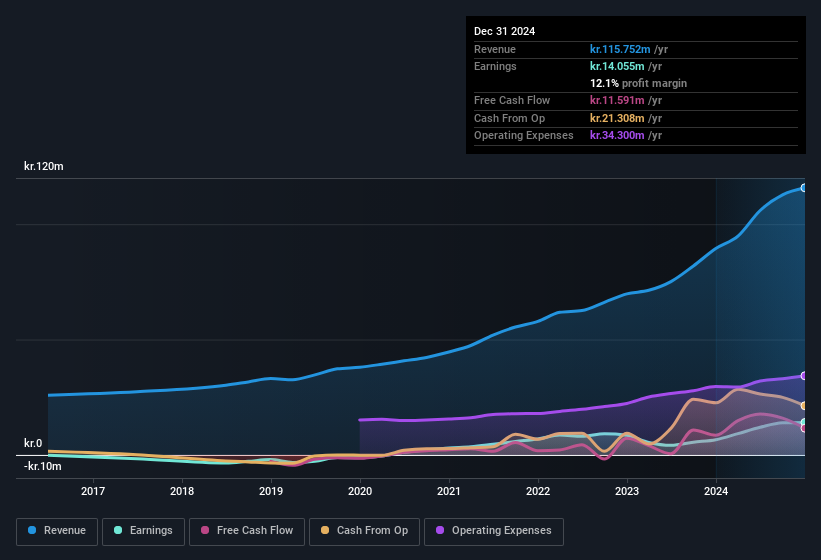

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

View our latest analysis for Freetrailer Group

Since Freetrailer Group is no giant, with a market capitalisation of kr.765m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Freetrailer Group Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Freetrailer Group followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at kr.125m. That's a lot of money, and no small incentive to work hard. Those holdings account for over 16% of the company; visible skin in the game.

Does Freetrailer Group Deserve A Spot On Your Watchlist?

You can't deny that Freetrailer Group has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Freetrailer Group , and understanding this should be part of your investment process.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in SE with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:FREETR

Freetrailer Group

A technology company, operates a sharing-economy platform for the free rental of trailers and cargo bikes in Denmark, Sweden, Germany, and the Netherlands.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion