- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TELIA

What Telia Company (OM:TELIA)'s AI-Enabled IoT Platform Launch Means for Shareholders

Reviewed by Sasha Jovanovic

- Telia Company recently introduced an AI-enabled IoT platform to help enterprises deploy and scale Internet of Things solutions, including advanced data analysis and a plug-and-play monitoring service.

- This launch signals Telia’s intent to tap into enterprise automation and the fast-growing IoT sector with value-added connectivity offerings.

- We'll explore how the AI-enabled IoT platform enhances Telia's position in digital innovation and reshapes its investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Telia Company Investment Narrative Recap

For those considering Telia Company, a key investment view centers on whether its efforts in digital transformation and enterprise connectivity can offset persistent challenges from OTT services, slow subscriber growth, and heavy capital requirements. The recent launch of Telia’s AI-enabled IoT platform highlights its push for value-added offerings in the enterprise segment, yet this innovation does not materially change the biggest near-term catalysts: sustaining broadband ARPU and managing network investment costs, while competitive and technology risks remain significant.

Of recent company news, Telia’s confirmed 2025 outlook, forecasting around 2% service revenue growth and expecting stronger momentum in the second half, directly aligns with current business catalysts. Continued growth in broadband and mobile data demand remains critical, and this IoT initiative appears directionally consistent with Telia’s revenue stabilization efforts, but does not fundamentally reshape risk or reward in the very short term.

Yet, even as Telia pursues innovation, investors should not overlook the lingering effects of intensifying price competition and the possibility that...

Read the full narrative on Telia Company (it's free!)

Telia Company is projected to generate SEK83.7 billion in revenue and SEK8.7 billion in earnings by 2028. This outlook assumes a 2.2% annual decline in revenue and an earnings increase of SEK3.3 billion from current earnings of SEK5.4 billion.

Uncover how Telia Company's forecasts yield a SEK36.70 fair value, a 4% upside to its current price.

Exploring Other Perspectives

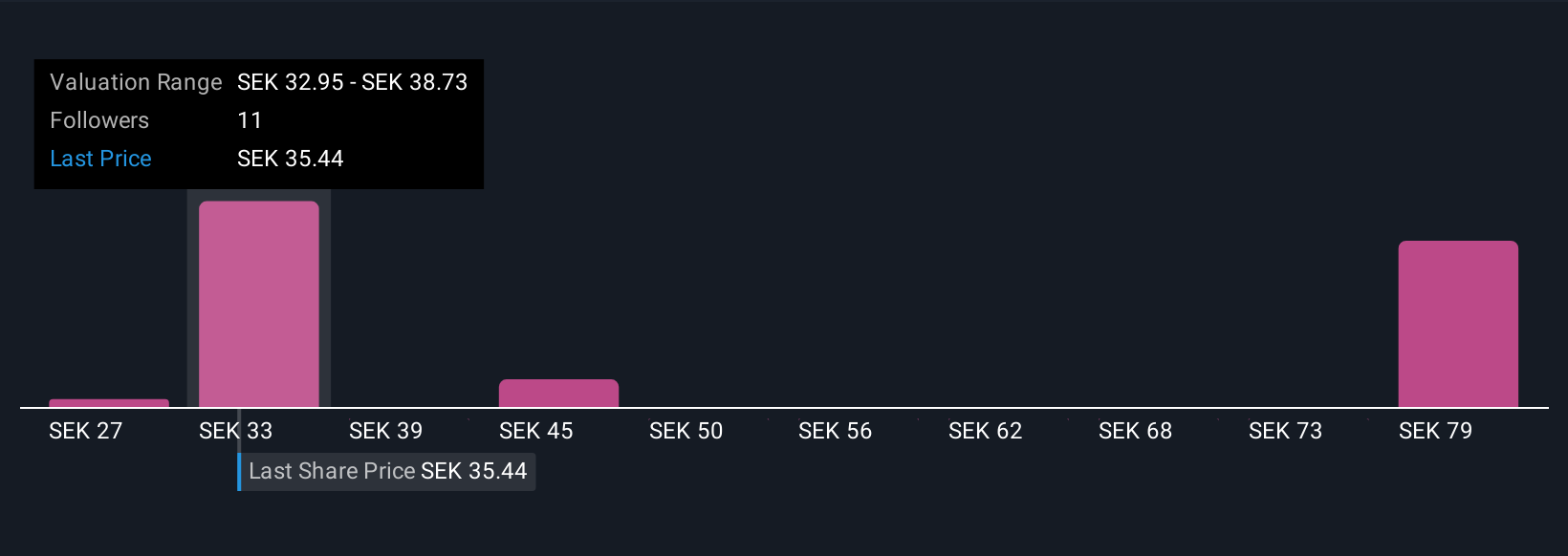

Fair value estimates from five Simply Wall St Community members range widely, from SEK27.17 to SEK84.97 per share. Many participants focus on Telia’s evolving role in enterprise connectivity amid ongoing pressure from OTT services, broadening the conversation about its financial trajectory.

Explore 5 other fair value estimates on Telia Company - why the stock might be worth 23% less than the current price!

Build Your Own Telia Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telia Company research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Telia Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telia Company's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telia Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TELIA

Telia Company

Provides communication services to businesses, individuals, families, and communities in Sweden, Finland, Norway, Denmark, Lithuania, Estonia, and Latvia.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives