- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TELIA

We Wouldn't Be Too Quick To Buy Telia Company AB (publ) (STO:TELIA) Before It Goes Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Telia Company AB (publ) (STO:TELIA) is about to trade ex-dividend in the next four days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. This means that investors who purchase Telia Company's shares on or after the 2nd of February will not receive the dividend, which will be paid on the 8th of February.

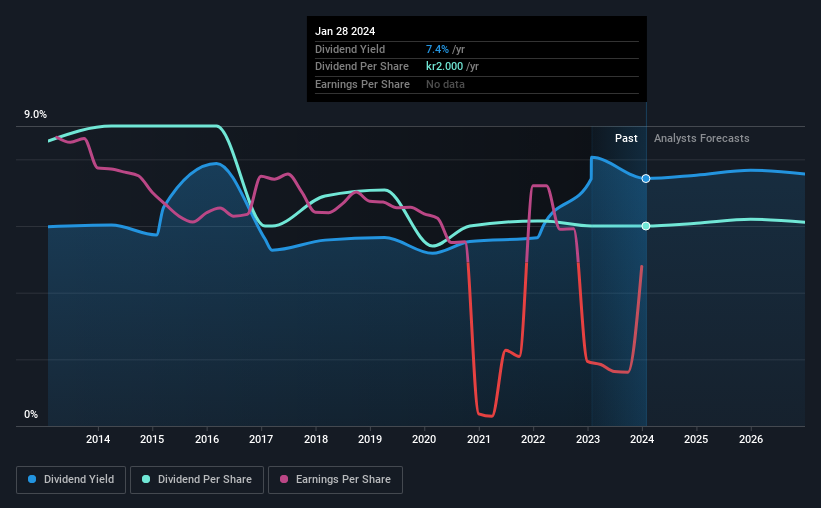

The company's next dividend payment will be kr00.50 per share. Last year, in total, the company distributed kr2.00 to shareholders. Based on the last year's worth of payments, Telia Company has a trailing yield of 7.4% on the current stock price of kr026.94. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Telia Company

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Telia Company's dividend is not well covered by earnings, as the company lost money last year. This is not a sustainable state of affairs, so it would be worth investigating if earnings are expected to recover.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Telia Company was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Telia Company has seen its dividend decline 3.5% per annum on average over the past 10 years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

We update our analysis on Telia Company every 24 hours, so you can always get the latest insights on its financial health, here.

Final Takeaway

Is Telia Company an attractive dividend stock, or better left on the shelf? This is not an overtly appealing combination of characteristics, and we're just not that interested in this company's dividend.

With that in mind though, if the poor dividend characteristics of Telia Company don't faze you, it's worth being mindful of the risks involved with this business. Every company has risks, and we've spotted 2 warning signs for Telia Company (of which 1 can't be ignored!) you should know about.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Telia Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TELIA

Telia Company

Provides communication services to businesses, individuals, families, and communities in Sweden, Finland, Norway, Denmark, Lithuania, Estonia, and Latvia.

Moderate growth potential second-rate dividend payer.