- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TELIA

Does Telia Company (STO:TELIA) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Telia Company AB (publ) (STO:TELIA) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Telia Company's Net Debt?

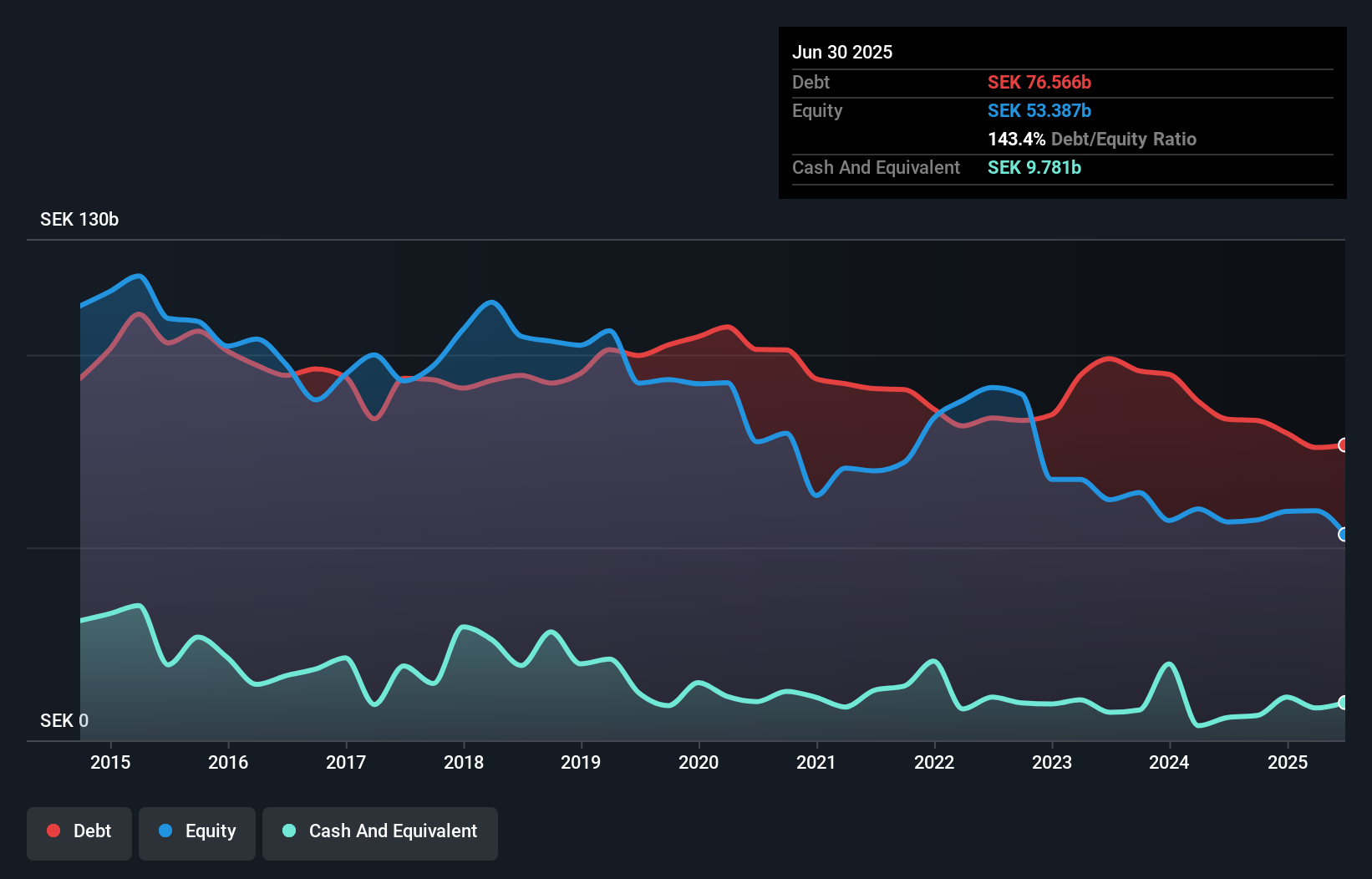

The image below, which you can click on for greater detail, shows that Telia Company had debt of kr76.6b at the end of June 2025, a reduction from kr83.3b over a year. However, it also had kr9.78b in cash, and so its net debt is kr66.8b.

How Healthy Is Telia Company's Balance Sheet?

We can see from the most recent balance sheet that Telia Company had liabilities of kr44.7b falling due within a year, and liabilities of kr97.5b due beyond that. On the other hand, it had cash of kr9.78b and kr19.0b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr113.4b.

This is a mountain of leverage even relative to its gargantuan market capitalization of kr141.1b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

View our latest analysis for Telia Company

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Telia Company has net debt worth 2.4 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 3.9 times the interest expense. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. We saw Telia Company grow its EBIT by 9.4% in the last twelve months. Whilst that hardly knocks our socks off it is a positive when it comes to debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Telia Company can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Telia Company recorded free cash flow worth 74% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

When it comes to the balance sheet, the standout positive for Telia Company was the fact that it seems able to convert EBIT to free cash flow confidently. But the other factors we noted above weren't so encouraging. For example, its level of total liabilities makes us a little nervous about its debt. When we consider all the factors mentioned above, we do feel a bit cautious about Telia Company's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Telia Company that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Telia Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TELIA

Telia Company

Provides communication services to businesses, individuals, families, and communities in Sweden, Finland, Norway, Denmark, Lithuania, Estonia, and Latvia.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.