Stock Analysis

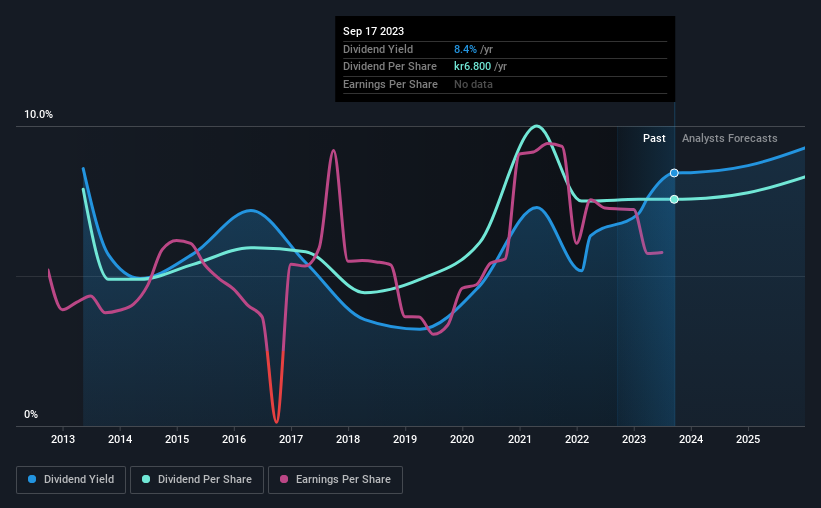

Tele2 AB (publ) (STO:TEL2 B) has announced that it will be increasing its dividend from last year's comparable payment on the 13th of October to SEK3.40. This makes the dividend yield 8.4%, which is above the industry average.

View our latest analysis for Tele2

Tele2 Doesn't Earn Enough To Cover Its Payments

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, the dividend made up 88% of cash flows, but a higher proportion of net income. The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between.

Earnings per share is forecast to rise by 22.1% over the next year. If the dividend continues on its recent course, the payout ratio in 12 months could be 107%, which is a bit high and could start applying pressure to the balance sheet.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2013, the dividend has gone from SEK7.10 total annually to SEK6.80. Dividend payments have shrunk at a rate of less than 1% per annum over this time frame. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings have grown at around 2.0% a year for the past five years, which isn't massive but still better than seeing them shrink. The company is paying out a lot of its profits, even though it is growing those profits pretty slowly. As they say in finance, 'past performance is not indicative of future performance', but we are not confident a company with limited earnings growth and a high payout ratio will be a star dividend-payer over the next decade.

Tele2's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Tele2 will make a great income stock. The payments are bit high to be considered sustainable, and the track record isn't the best. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 3 warning signs for Tele2 that you should be aware of before investing. Is Tele2 not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Tele2 is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TEL2 B

Tele2

Provides fixed and mobile connectivity, handset related data services, and entertainment services in Sweden, Lithuania, Latvia, and Estonia.

Average dividend payer with moderate growth potential.