Stock Analysis

Betsson And Two Other Swedish Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate through periods of uncertainty and fluctuation, Sweden's market presents a unique landscape for investors interested in growth companies with high insider ownership. Such stocks often signal strong confidence from those closest to the company, potentially aligning well with investor interests especially in volatile times.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.9% |

| Biovica International (OM:BIOVIC B) | 12.9% | 73.8% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| InCoax Networks (OM:INCOAX) | 18% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Here we highlight a subset of our preferred stocks from the screener.

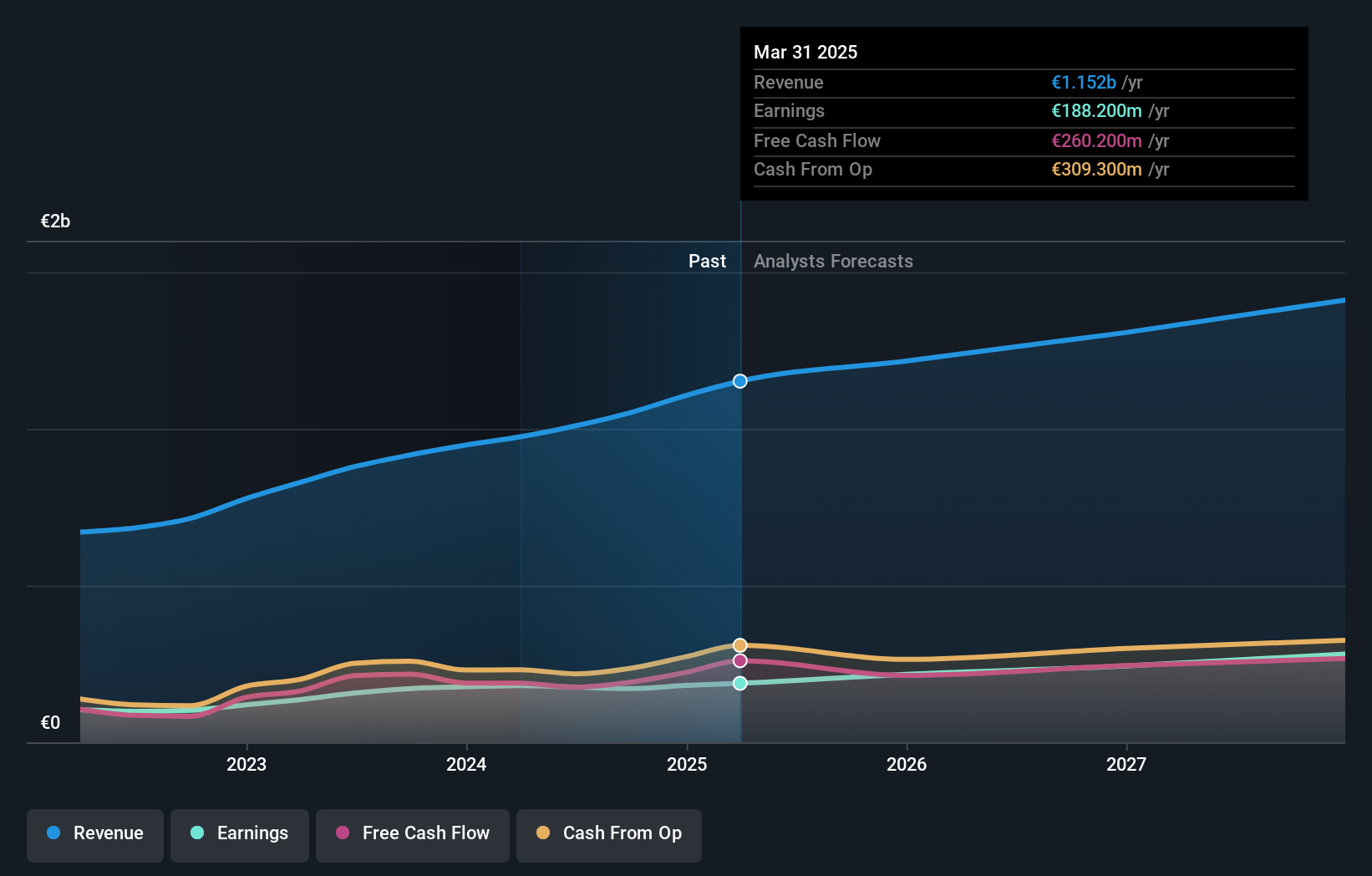

Betsson (OM:BETS B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Betsson AB operates an online gaming business across regions including the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, and Central Asia, with a market capitalization of approximately SEK 17.01 billion.

Operations: The company generates revenue primarily from its Casinos & Resorts segment, amounting to €0.97 billion.

Insider Ownership: 10.9%

Return On Equity Forecast: 23% (2027 estimate)

Betsson, a Swedish company with significant insider ownership, recently expanded its market reach by securing online gaming licenses in Peru, adding to its existing South American portfolio. While the company's dividend history is uneven, recent financials show a promising trajectory with a 9.9% annual revenue growth forecast and earnings growth outpacing the Swedish market at 14% annually. Insiders have been net buyers of shares recently, underscoring their confidence in Betsson's strategy and governance enhancements.

- Take a closer look at Betsson's potential here in our earnings growth report.

- The analysis detailed in our Betsson valuation report hints at an deflated share price compared to its estimated value.

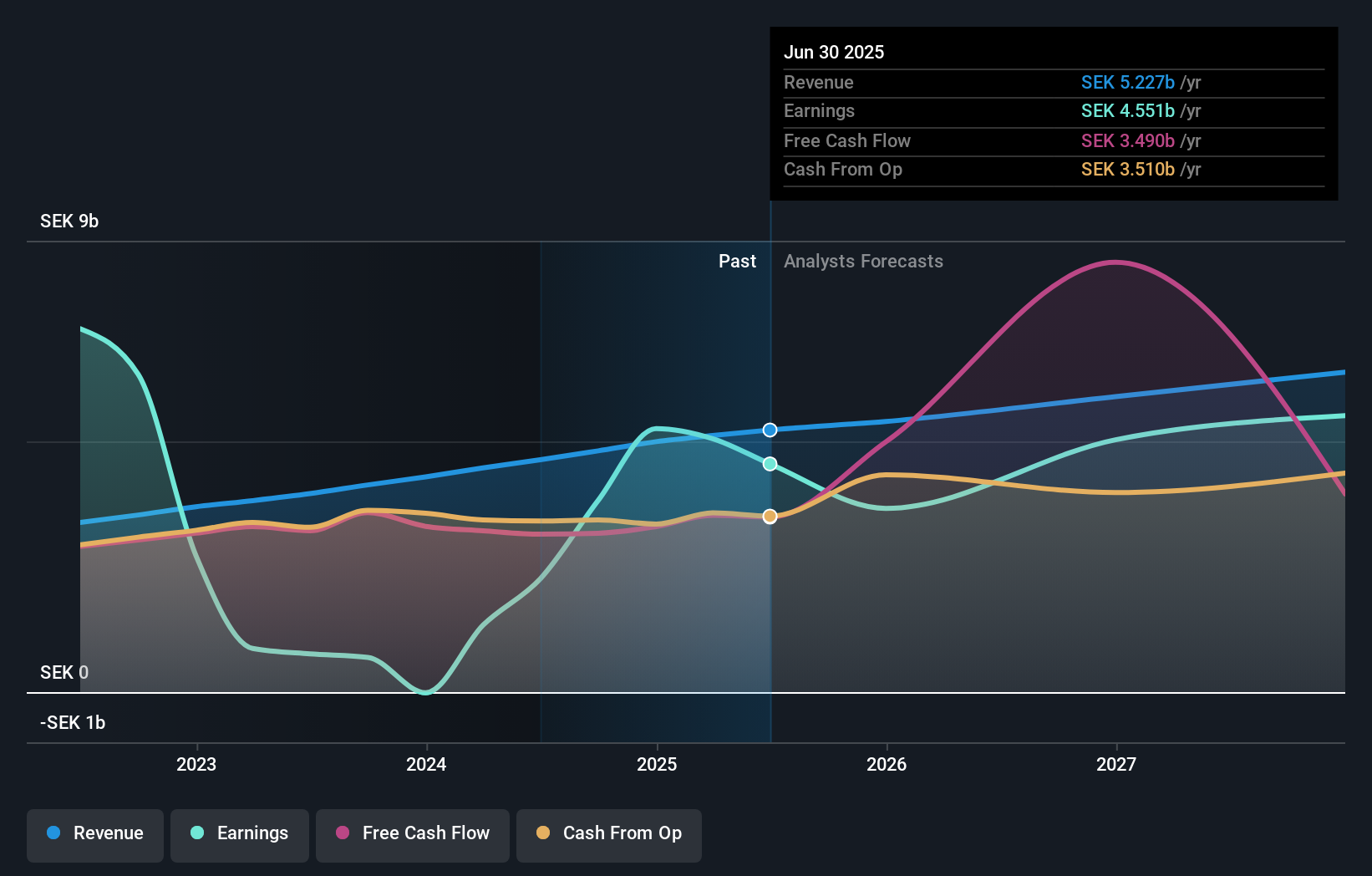

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB operates in providing financial and administrative software solutions to small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of approximately SEK 39.03 billion.

Operations: The company generates revenue through various segments, including Core Products at SEK 698 million, The Agency at SEK 327 million, Entrepreneurship at SEK 356 million, and Marketplaces at SEK 150 million.

Insider Ownership: 21%

Return On Equity Forecast: 33% (2027 estimate)

Fortnox, a Swedish software company, has shown robust financial performance with recent quarterly earnings reporting a significant increase in revenue and net income. Despite limited insider transactions recently, Fortnox's forecasted annual earnings growth of 21.1% and revenue growth of 19.7% per year outpace the broader Swedish market significantly. Additionally, its projected return on equity of 33.2% highlights strong future profitability potential. However, insider buying has not been substantial in volume over the past three months.

- Click to explore a detailed breakdown of our findings in Fortnox's earnings growth report.

- Our valuation report here indicates Fortnox may be overvalued.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European regions, boasting a market capitalization of approximately SEK 95.68 billion.

Operations: The company generates its revenue primarily through real estate rentals, amounting to SEK 4.47 billion.

Insider Ownership: 28.3%

Return On Equity Forecast: N/A (2027 estimate)

AB Sagax, a Swedish property investment firm, has demonstrated strong financial activities with significant capital raised through fixed-income offerings totaling €499.56 million for green projects. The company's earnings have surged impressively, with a reported net income of SEK 1.08 billion from SEK 1.19 billion in sales for Q1 2024, reversing previous losses. Despite high insider ownership, shareholder dilution occurred over the past year, and debt coverage by operating cash flow remains weak. However, AB Sagax's revenue and profit are expected to grow substantially above the Swedish market average in coming years.

- Get an in-depth perspective on AB Sagax's performance by reading our analyst estimates report here.

- The analysis detailed in our AB Sagax valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Gain an insight into the universe of 86 Fast Growing Swedish Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Fortnox is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FNOX

Fortnox

Provides products, packages, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations.

Outstanding track record with flawless balance sheet.