- Sweden

- /

- Wireless Telecom

- /

- OM:TEL2 B

How Rising Profit Margins in Tele2’s (OM:TEL2 B) Latest Results Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

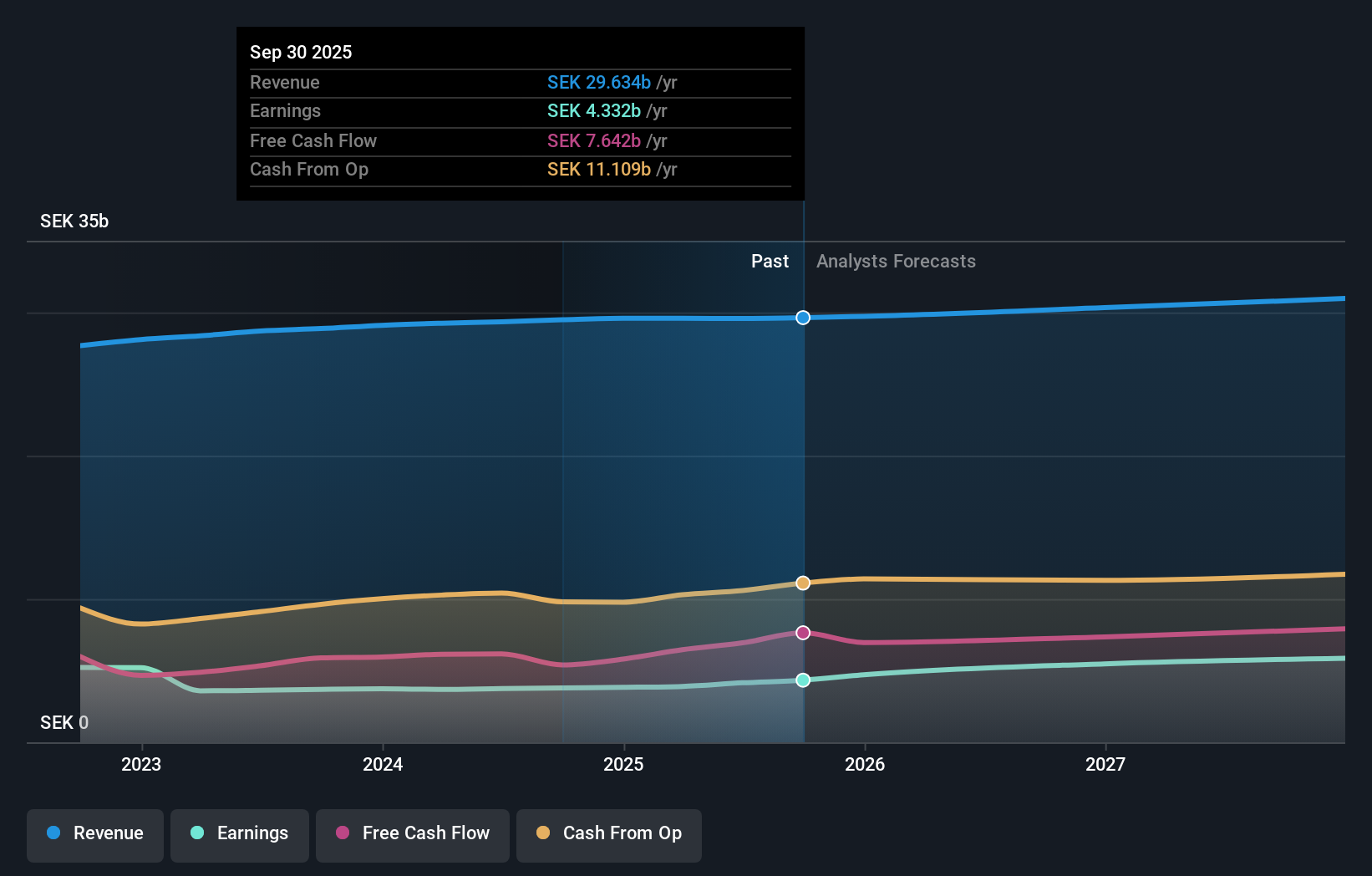

- Tele2 AB reported its third quarter and nine-month 2025 results, revealing sales of SEK 7,442 million and net income of SEK 1,290 million for the quarter, both higher than the prior year.

- Continued rises in earnings per share and net income highlight Tele2's improved profitability and operational efficiency over the last year.

- We will explore how Tele2's enhanced profit margins shape the company's updated investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tele2 Investment Narrative Recap

To be a Tele2 shareholder, you need confidence in the company’s ability to grow profits even as revenue growth remains modest, amid heavy competition and regulatory scrutiny in its core markets. The recent third-quarter results, with higher earnings and improved margins, are a positive, but they do not materially alter the most important short-term catalyst: Tele2’s ability to sustain margin gains as temporary cost cuts give way to renewed network investments. The biggest risk remains potential margin pressure if underlying revenue growth does not accelerate.

Among recent announcements, Tele2’s creation of a new tower company in the Baltics with Global Communications Infrastructure stands out. This move could support ongoing 5G expansion and operational efficiencies, providing potential support for future profitability, especially relevant as continued network upgrades may influence cost trends and margin expectations over the coming quarters. Despite positive cost trends, investors should also consider that, as higher network investments resume, the margin story may shift if new revenue growth fails to offset…

Read the full narrative on Tele2 (it's free!)

Tele2's outlook anticipates SEK31.4 billion in revenue and SEK5.6 billion in earnings by 2028. This is based on a 2.0% annual revenue growth rate and a SEK1.4 billion increase in earnings from the current level of SEK4.2 billion.

Uncover how Tele2's forecasts yield a SEK160.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Private estimates from the Simply Wall St Community range from SEK75.20 to SEK285.17 across four analyses. While many are optimistic, a key risk is that Tele2’s profit gains have relied on cost cuts, with revenue growth trailing industry peers, reminding you that community opinions can vary and are worth exploring alongside the latest earnings momentum.

Explore 4 other fair value estimates on Tele2 - why the stock might be worth 50% less than the current price!

Build Your Own Tele2 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tele2 research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tele2 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tele2's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tele2 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TEL2 B

Tele2

Provides fixed and mobile connectivity and entertainment services in Sweden, Lithuania, Latvia, and Estonia.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives