- Sweden

- /

- Wireless Telecom

- /

- OM:TEL2 B

Does Tele2's (STO:TEL2 B) Statutory Profit Adequately Reflect Its Underlying Profit?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Tele2 (STO:TEL2 B).

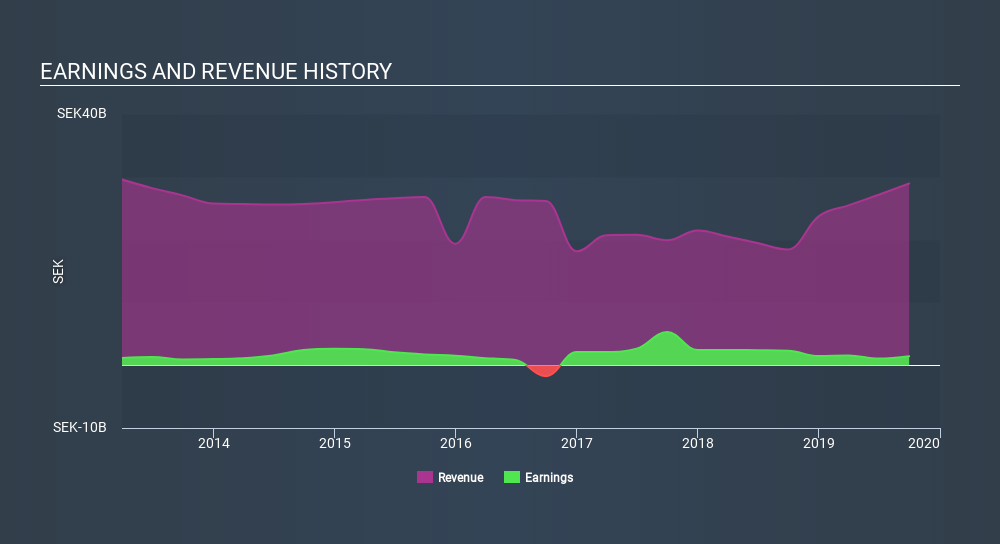

We like the fact that Tele2 made a profit of kr1.43b on its revenue of kr28.9b, in the last year. At the risk of seeming quaint, we do like to at least examine profit, even when a stock is improving revenue and considered a 'growth stock'. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

Check out our latest analysis for Tele2

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. In this article we'll look at how Tele2 is impacting shareholders by issuing new shares, as well as how unusual items have affected the income line. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, Tele2 increased the number of shares on issue by 33% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Tele2's historical EPS growth by clicking on this link.

A Look At The Impact Of Tele2's Dilution on Its Earnings Per Share (EPS).

Three years ago, Tele2 lost money. Even looking at the last year, profit was still down 38%. Sadly, earnings per share fell further, down a full 54% in that time. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, if Tele2's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that Tele2's profit suffered from unusual items, which reduced profit by kr919m in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Tele2 doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Tele2's Profit Performance

To sum it all up, Tele2 took a hit from unusual items which pushed its profit down; without that, it would have made more money. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Based on these factors, we think it's very unlikely that Tele2's statutory profits make it seem much weaker than it is. Obviously, we love to consider the historical data to inform our opinion of a company. But it can be really valuable to consider what other analysts are forecasting. At Simply Wall St, we have analyst estimates which you can view by clicking here.

Our examination of Tele2 has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:TEL2 B

Tele2

Provides fixed and mobile connectivity and entertainment services in Sweden, Lithuania, Latvia, and Estonia.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives