- Sweden

- /

- Wireless Telecom

- /

- OM:TEL2 B

Does Nicholas Högberg’s Appointment Signal a New Commercial Direction for Tele2 (OM:TEL2 B)?

Reviewed by Sasha Jovanovic

- Tele2 AB recently announced the appointment of Nicholas Högberg as Executive Vice President, Chief Commercial Officer, and Deputy CEO Sweden, effective December 1, 2025, following the departure of Petr Cermak.

- This marks a significant leadership transition for Tele2, as Högberg brings over 25 years of executive experience in telecommunications and technology, including board and CEO roles at major industry players.

- We will explore how Nicholas Högberg’s extensive telecom background could shape Tele2’s investment narrative and future commercial strategy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tele2 Investment Narrative Recap

For a Tele2 shareholder, conviction centers on the business's ability to convert ongoing network investments and digital transformation into sustainable revenue and earnings growth, despite fierce competition and margin pressures in Swedish broadband. The recent appointment of Nicholas Högberg as Executive Vice President and Deputy CEO Sweden is not expected to materially affect the biggest short-term catalyst, further commercial momentum in enterprise and IoT, nor does it immediately shift the largest risk, which remains aggressive pricing and slow regulatory progress dampening revenue potential.

Of Tele2’s many recent moves, the formation of a EUR 560 million Baltic tower company in partnership with Global Communications Infrastructure sharply aligns with the broader growth catalyst of disciplined capital allocation and unlocking infrastructure value. This development directly supports Tele2’s strategy to strengthen its balance sheet and redeploy resources into high-return opportunities, which may help buffer ongoing margin and revenue challenges discussed above.

In contrast, what investors may overlook is how competitive pricing risk in Swedish broadband and slow regulatory change could still...

Read the full narrative on Tele2 (it's free!)

Tele2's narrative projects SEK31.4 billion revenue and SEK5.6 billion earnings by 2028. This requires 2.0% yearly revenue growth and an earnings increase of SEK1.4 billion from SEK4.2 billion today.

Uncover how Tele2's forecasts yield a SEK161.02 fair value, a 7% upside to its current price.

Exploring Other Perspectives

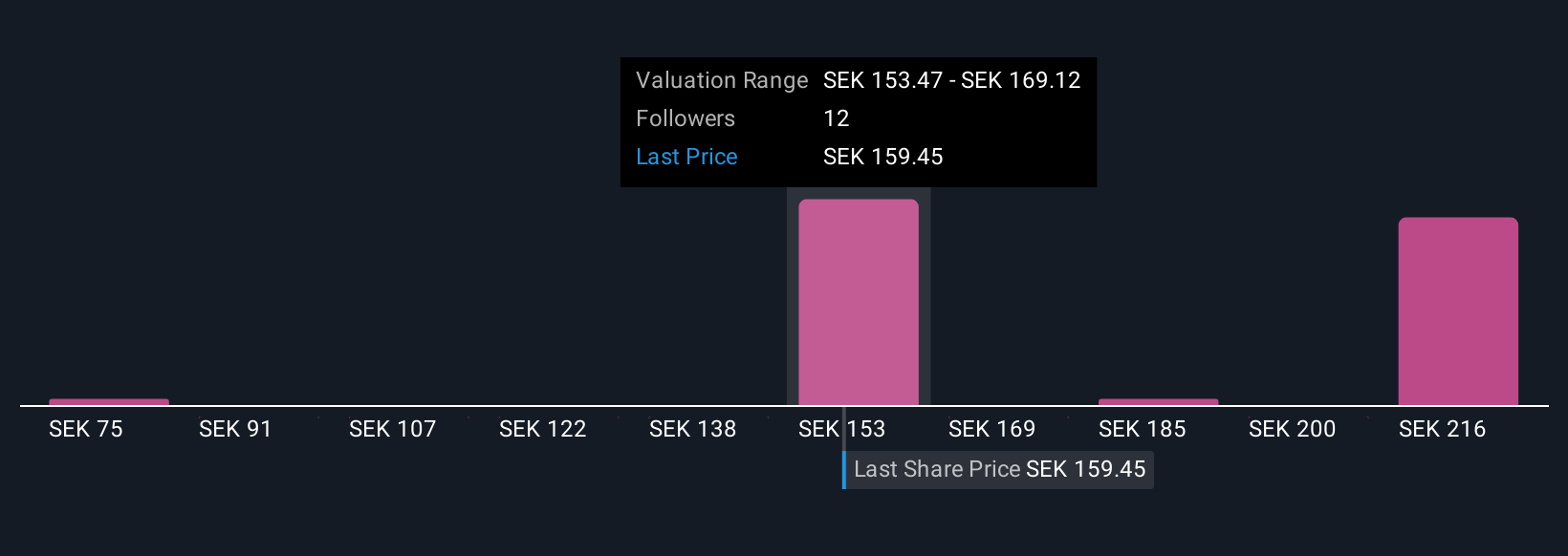

Four retail investors in the Simply Wall St Community provided fair value estimates for Tele2 ranging from SEK75.20 to SEK289.06 per share. These viewpoints sit against the backdrop of a business facing margin strain from intense competition and regulatory headwinds, highlighting why your own perspective matters.

Explore 4 other fair value estimates on Tele2 - why the stock might be worth less than half the current price!

Build Your Own Tele2 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tele2 research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tele2 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tele2's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tele2 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TEL2 B

Tele2

Provides fixed and mobile connectivity and entertainment services in Sweden, Lithuania, Latvia, and Estonia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives