- Sweden

- /

- Telecom Services and Carriers

- /

- OM:OVZON

After Leaping 158% Ovzon AB (publ) (STO:OVZON) Shares Are Not Flying Under The Radar

Ovzon AB (publ) (STO:OVZON) shareholders are no doubt pleased to see that the share price has bounced 158% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 71% share price drop in the last twelve months.

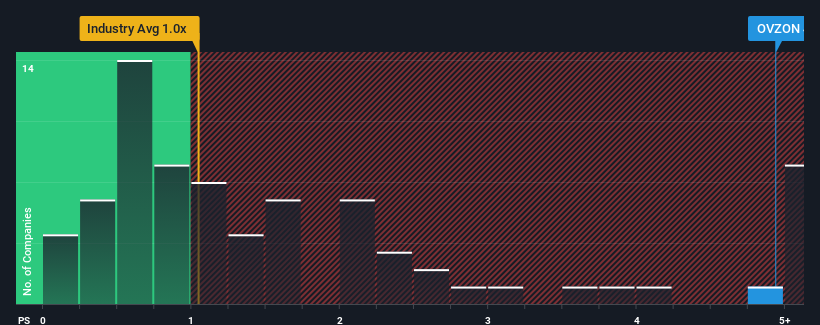

After such a large jump in price, when almost half of the companies in Sweden's Telecom industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Ovzon as a stock not worth researching with its 4.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Ovzon

What Does Ovzon's Recent Performance Look Like?

Ovzon hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Ovzon's future stacks up against the industry? In that case, our free report is a great place to start.How Is Ovzon's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ovzon's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.9%. Still, the latest three year period has seen an excellent 57% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 8.9% over the next year. With the industry only predicted to deliver 0.4%, the company is positioned for a stronger revenue result.

With this information, we can see why Ovzon is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has lead to Ovzon's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Ovzon shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Ovzon that you need to be mindful of.

If you're unsure about the strength of Ovzon's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OVZON

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives