- Italy

- /

- Electrical

- /

- BIT:CMB

Discover Cembre And 2 Hidden European Small Caps With Strong Potential

Reviewed by Simply Wall St

As European markets navigate through concerns about inflated AI stock valuations and shifting interest rate expectations, the pan-European STOXX Europe 600 Index has recently experienced a decline. Despite these challenges, early readings indicate steady business activity growth in the eurozone, suggesting potential opportunities within the small-cap segment. In this context, identifying stocks with strong fundamentals and resilience to broader market fluctuations becomes crucial for investors seeking promising prospects amid current conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.27% | 22.67% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Cembre (BIT:CMB)

Simply Wall St Value Rating: ★★★★★★

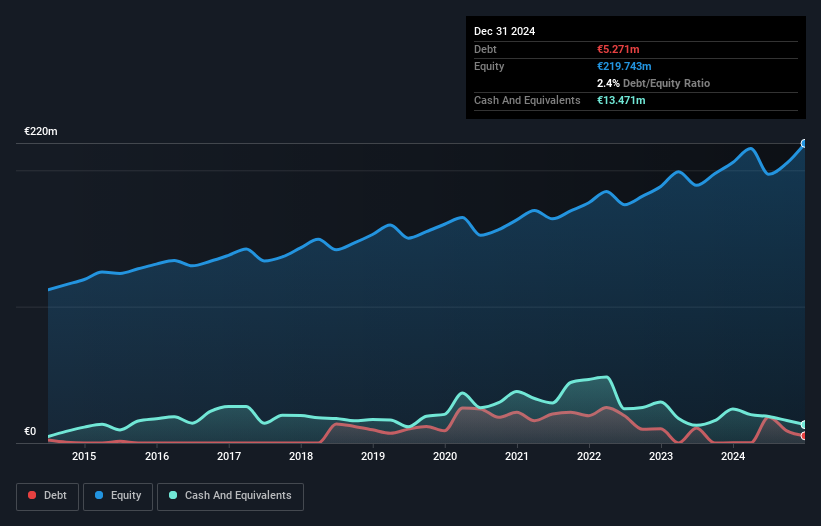

Overview: Cembre S.p.A. is a company that manufactures and sells electrical connectors, cable accessories, and tools across Italy, Europe, and internationally with a market capitalization of €1.10 billion.

Operations: The primary revenue stream for Cembre comes from the sale of electric connectors and related tools, amounting to €238.29 million.

Cembre, a small player in the electrical industry, has shown robust financial performance. Over the past year, earnings growth of 20.5% outpaced the industry's -7.1%. The company reported third-quarter sales of €55.6 million and net income of €9.54 million, compared to €51.78 million and €8.31 million last year respectively. For nine months ending September 2025, revenue reached €182.39 million with net income at €32.15 million against last year's figures of €172.64 million and €29.13 million respectively, indicating solid growth momentum despite market challenges.

- Take a closer look at Cembre's potential here in our health report.

Examine Cembre's past performance report to understand how it has performed in the past.

Atea (OB:ATEA)

Simply Wall St Value Rating: ★★★★☆☆

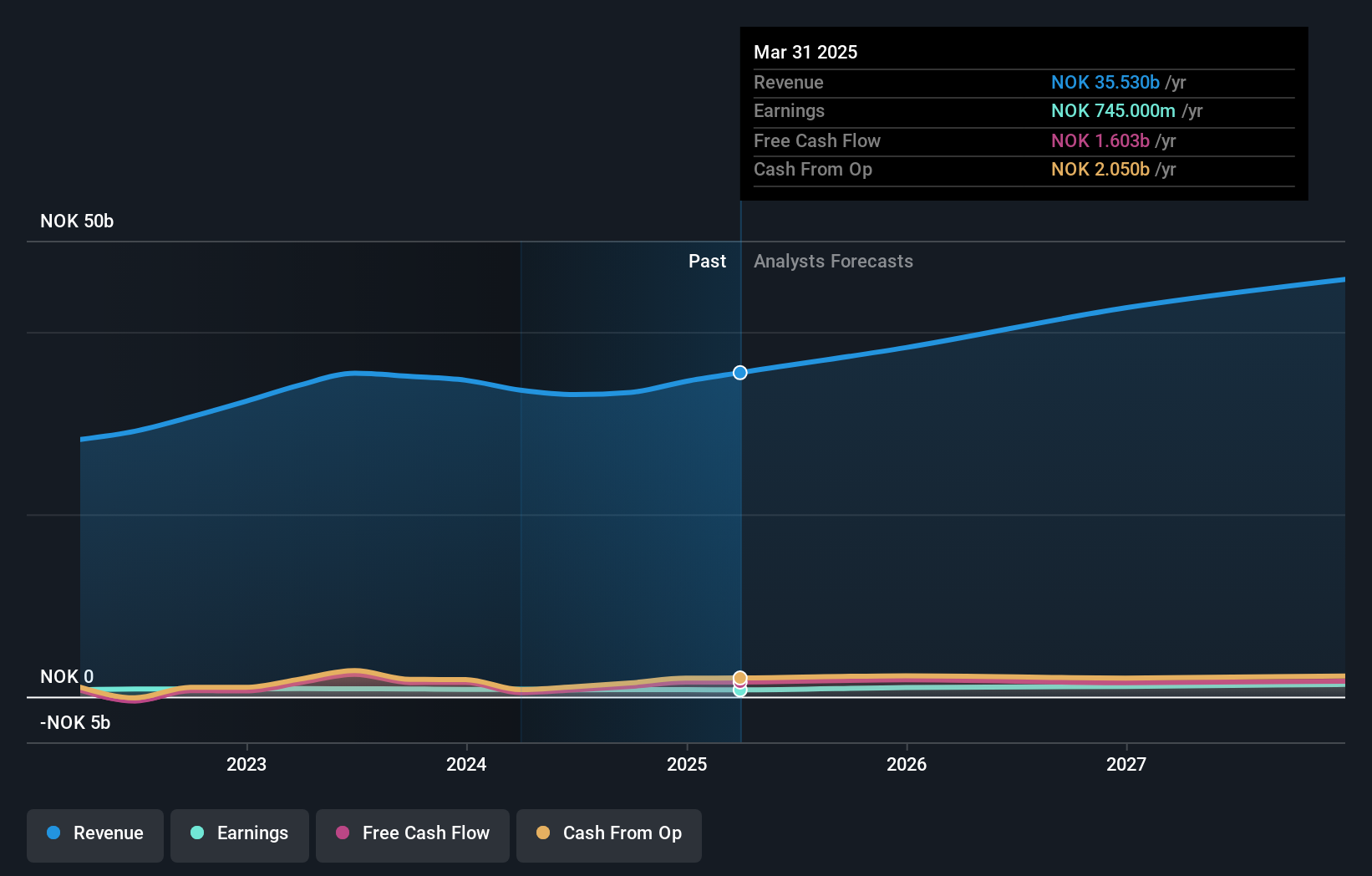

Overview: Atea ASA is a company that offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market capitalization of NOK 16.41 billion.

Operations: Atea generates revenue primarily from its operations in Norway (NOK 9.27 billion), Sweden (NOK 13.73 billion), and Denmark (NOK 8.56 billion). The company incurs a significant group cost of NOK -12.06 billion, while Group Shared Services contribute NOK 11.86 billion to the overall financial structure.

Atea, a key player in the Nordic and Baltic IT infrastructure market, is making waves with its strategic growth initiatives. The company’s net debt to equity ratio stands at a satisfactory 9.9%, highlighting strong financial management. With EBIT covering interest payments by eight times, Atea's financial health appears robust. Recent earnings show promising trends; Q3 sales reached NOK 8.43 billion from NOK 7.98 billion last year, while net income rose to NOK 226 million from NOK 192 million previously. A significant Euro 130 million contract with NATO further underscores Atea's expanding footprint and potential for sustained growth in the region.

Bahnhof (OM:BAHN B)

Simply Wall St Value Rating: ★★★★★★

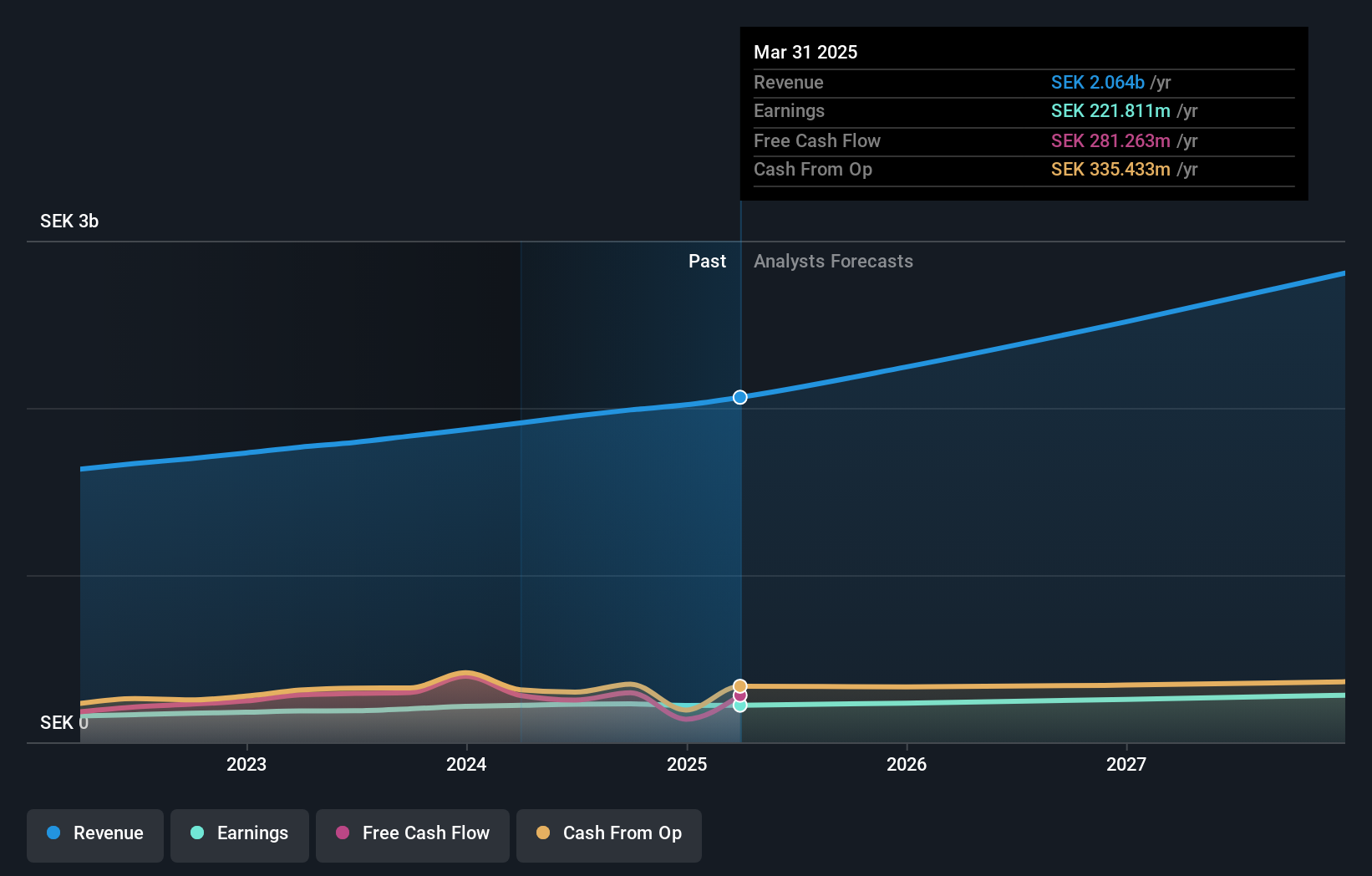

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK5.97 billion.

Operations: Bahnhof AB (publ) generates revenue primarily from its Internet and telecommunications services across Sweden and Europe. The company focuses on efficient cost management, which is reflected in its net profit margin of 14.5%.

Bahnhof, a nimble player in the telecom sector, shows both promise and challenges. Despite a negative earnings growth of 3.4% last year, its debt-free status is notable compared to five years ago when it had a debt-to-equity ratio of 0.08%. The company boasts high-quality earnings and forecasts suggest an annual earnings growth of 9.37%. Recent results reveal third-quarter sales at SEK 561 million, up from SEK 511 million the previous year, yet net income slightly dipped to SEK 56.91 million from SEK 60.05 million. This suggests robust revenue growth but highlights pressure on profitability margins amidst industry competition.

- Delve into the full analysis health report here for a deeper understanding of Bahnhof.

Understand Bahnhof's track record by examining our Past report.

Make It Happen

- Embark on your investment journey to our 313 European Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CMB

Cembre

Engages in the manufacture and sale of electrical connectors, cable accessories, and tools in Italy, the rest of Europe, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success