- Sweden

- /

- Communications

- /

- OM:WAYS

Market Cool On Waystream Holding AB (publ)'s (STO:WAYS) Revenues Pushing Shares 27% Lower

Waystream Holding AB (publ) (STO:WAYS) shares have had a horrible month, losing 27% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 76% loss during that time.

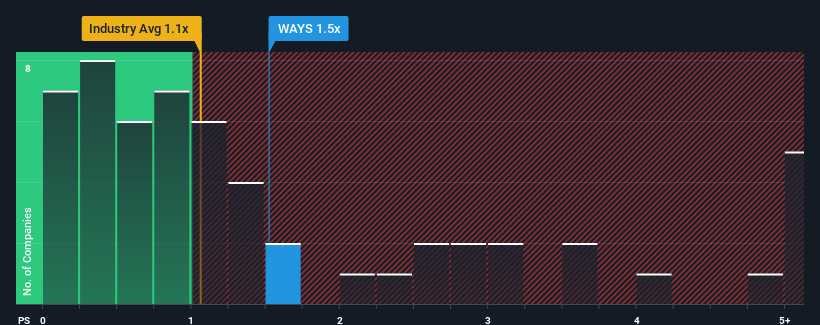

After such a large drop in price, Waystream Holding's price-to-sales (or "P/S") ratio of 1.5x might make it look like a buy right now compared to the Communications industry in Sweden, where around half of the companies have P/S ratios above 2.8x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Waystream Holding

What Does Waystream Holding's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Waystream Holding's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Waystream Holding will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Waystream Holding?

The only time you'd be truly comfortable seeing a P/S as low as Waystream Holding's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 23% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 3.0% during the coming year according to the one analyst following the company. Meanwhile, the broader industry is forecast to contract by 0.3%, which would indicate the company is doing better than the majority of its peers.

With this information, we find it very odd that Waystream Holding is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What Does Waystream Holding's P/S Mean For Investors?

Waystream Holding's recently weak share price has pulled its P/S back below other Communications companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Waystream Holding currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Waystream Holding.

If you're unsure about the strength of Waystream Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Waystream Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:WAYS

Waystream Holding

Provides routers and switches that are used in the fiber markets and peripherals in Sweden.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives