- Sweden

- /

- Tech Hardware

- /

- OM:TOBII

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Tobii AB (publ)'s (STO:TOBII) CEO For Now

Key Insights

- Tobii to hold its Annual General Meeting on 28th of May

- CEO Anand Srivatsa's total compensation includes salary of kr4.20m

- Total compensation is 137% above industry average

- Tobii's three-year loss to shareholders was 77% while its EPS grew by 9.4% over the past three years

Shareholders of Tobii AB (publ) (STO:TOBII) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 28th of May. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

View our latest analysis for Tobii

Comparing Tobii AB (publ)'s CEO Compensation With The Industry

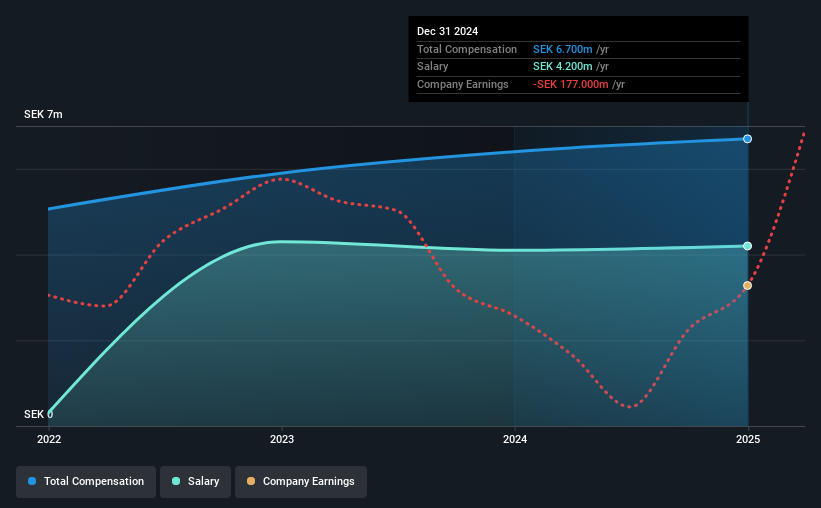

Our data indicates that Tobii AB (publ) has a market capitalization of kr780m, and total annual CEO compensation was reported as kr6.7m for the year to December 2024. That's a modest increase of 4.7% on the prior year. Notably, the salary which is kr4.20m, represents most of the total compensation being paid.

For comparison, other companies in the Sweden Tech industry with market capitalizations below kr1.9b, reported a median total CEO compensation of kr2.8m. Hence, we can conclude that Anand Srivatsa is remunerated higher than the industry median. Furthermore, Anand Srivatsa directly owns kr3.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr4.2m | kr4.1m | 63% |

| Other | kr2.5m | kr2.3m | 37% |

| Total Compensation | kr6.7m | kr6.4m | 100% |

Speaking on an industry level, nearly 47% of total compensation represents salary, while the remainder of 53% is other remuneration. According to our research, Tobii has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Tobii AB (publ)'s Growth

Tobii AB (publ)'s earnings per share (EPS) grew 9.4% per year over the last three years. In the last year, its revenue is up 19%.

We would argue that the modest growth in revenue is a notable positive. And the improvement in EPSis modest but respectable. Although we'll stop short of calling the stock a top performer, we think the company has potential. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Tobii AB (publ) Been A Good Investment?

The return of -77% over three years would not have pleased Tobii AB (publ) shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 3 warning signs for Tobii you should be aware of, and 1 of them is significant.

Important note: Tobii is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Tobii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TOBII

Tobii

Develops and sells eye-tracking technology and solutions in Sweden, Europe, Middle East, Africa, the United States, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.