- Sweden

- /

- Electronic Equipment and Components

- /

- OM:THUNDR

171% earnings growth over 1 year has not materialized into gains for Thunderful Group (STO:THUNDR) shareholders over that period

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Thunderful Group AB (STO:THUNDR) have tasted that bitter downside in the last year, as the share price dropped 47%. That's well below the market return of 15%. Because Thunderful Group hasn't been listed for many years, the market is still learning about how the business performs. The falls have accelerated recently, with the share price down 25% in the last three months.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Thunderful Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Thunderful Group share price fell, it actually saw its earnings per share (EPS) improve by 171%. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Thunderful Group managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

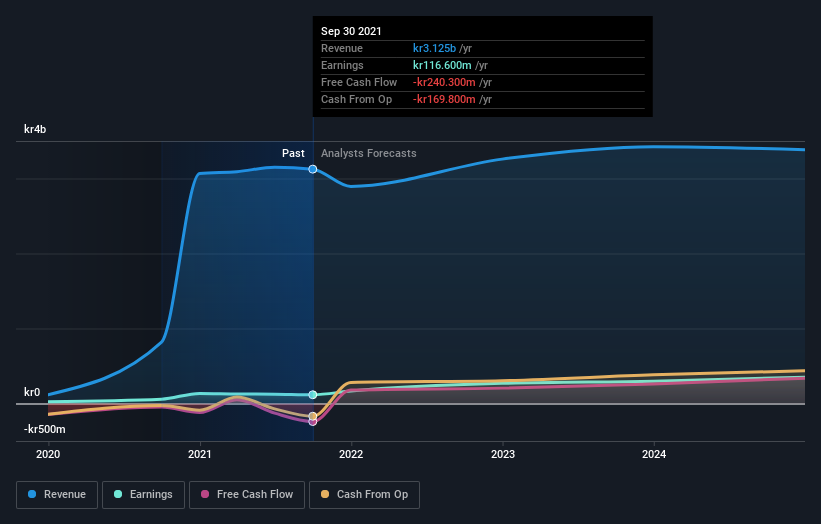

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Thunderful Group in this interactive graph of future profit estimates.

A Different Perspective

Given that the market gained 15% in the last year, Thunderful Group shareholders might be miffed that they lost 47%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 25% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Thunderful Group is showing 4 warning signs in our investment analysis , and 1 of those is potentially serious...

Thunderful Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Thunderful Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:THUNDR

Thunderful Group

Invests, develops, and publishes digital games primarily for PC and console platforms in Sweden.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives