Is Smart Eye (STO:SEYE) Using Debt In A Risky Way?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Smart Eye AB (publ) (STO:SEYE) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Smart Eye

What Is Smart Eye's Net Debt?

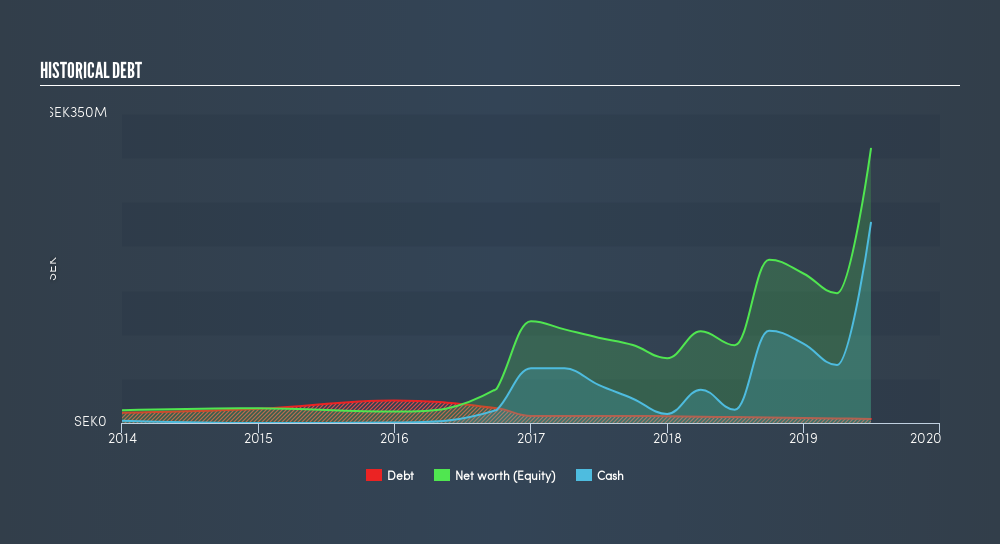

As you can see below, Smart Eye had kr4.67m of debt at June 2019, down from kr6.67m a year prior. However, it does have kr226.9m in cash offsetting this, leading to net cash of kr222.2m.

A Look At Smart Eye's Liabilities

The latest balance sheet data shows that Smart Eye had liabilities of kr35.9m due within a year, and liabilities of kr2.67m falling due after that. Offsetting this, it had kr226.9m in cash and kr10.3m in receivables that were due within 12 months. So it can boast kr198.6m more liquid assets than total liabilities.

This surplus suggests that Smart Eye has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Smart Eye has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Smart Eye's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Smart Eye reported revenue of kr77m, which is a gain of 23%. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Smart Eye?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Smart Eye had negative earnings before interest and tax (EBIT), truth be told. And over the same period it saw negative free cash outflow of kr81m and booked a kr73m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of kr222.2m. That kitty means the company can keep spending for growth for at least two years, at current rates. With very solid revenue growth in the last year, Smart Eye may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. For riskier companies like Smart Eye I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OM:SEYE

Smart Eye

Develops human insight artificial intelligence (AI) technology solutions that understand, support, and predict human behavior in the Nordics countries, the rest of Europe, North America, Asia, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion