Update: Sensys Gatso Group (STO:SENS) Stock Gained 35% In The Last Five Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Sensys Gatso Group AB (publ) (STO:SENS) shareholders might be concerned after seeing the share price drop 22% in the last quarter. On the bright side the share price is up over the last half decade. However we are not very impressed because the share price is only up 35%, less than the market return of 50%.

See our latest analysis for Sensys Gatso Group

We don't think that Sensys Gatso Group's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For the last half decade, Sensys Gatso Group can boast revenue growth at a rate of 15% per year. That's a pretty good long term growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 6.2% full reflects the underlying business growth. If revenue growth can maintain for long enough, it's likely profits will flow. There's no doubt that it can be difficult to value pre-profit companies.

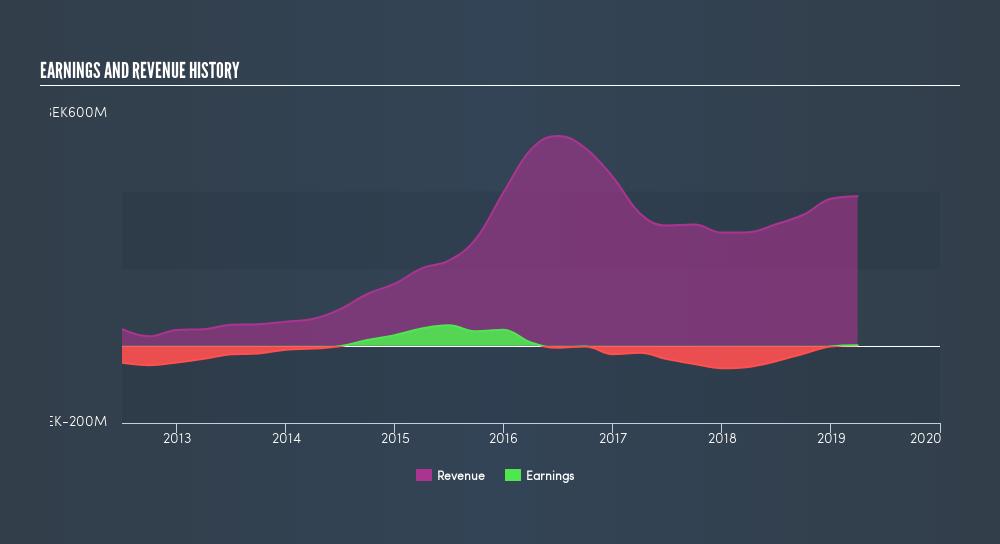

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We know that Sensys Gatso Group has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Sensys Gatso Group

What about the Total Shareholder Return (TSR)?

We've already covered Sensys Gatso Group's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Sensys Gatso Group hasn't been paying dividends, but its TSR of 40% exceeds its share price return of 35%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Sensys Gatso Group shareholders have received a total shareholder return of 13% over one year. That's better than the annualised return of 7.0% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You could get a better understanding of Sensys Gatso Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges. We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OM:SGG

Sensys Gatso Group

Designs, develops, owns, operates, markets, and sells traffic management and enforcement solutions to nations, cities, and fleet owners in Sweden and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives