In the wake of a "red sweep" in the U.S. elections, global markets have responded with optimism, pushing major indices like the S&P 500 to near-record highs as investors anticipate favorable economic policies. Amidst this backdrop of market enthusiasm and economic speculation, companies with high insider ownership often stand out as promising growth opportunities due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 32% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

NOTE (OM:NOTE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NOTE AB (publ) offers electronics manufacturing services across Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally with a market cap of approximately SEK3.76 billion.

Operations: The company's revenue segments include SEK988.44 million from the Rest of World and SEK3.02 billion from Western Europe.

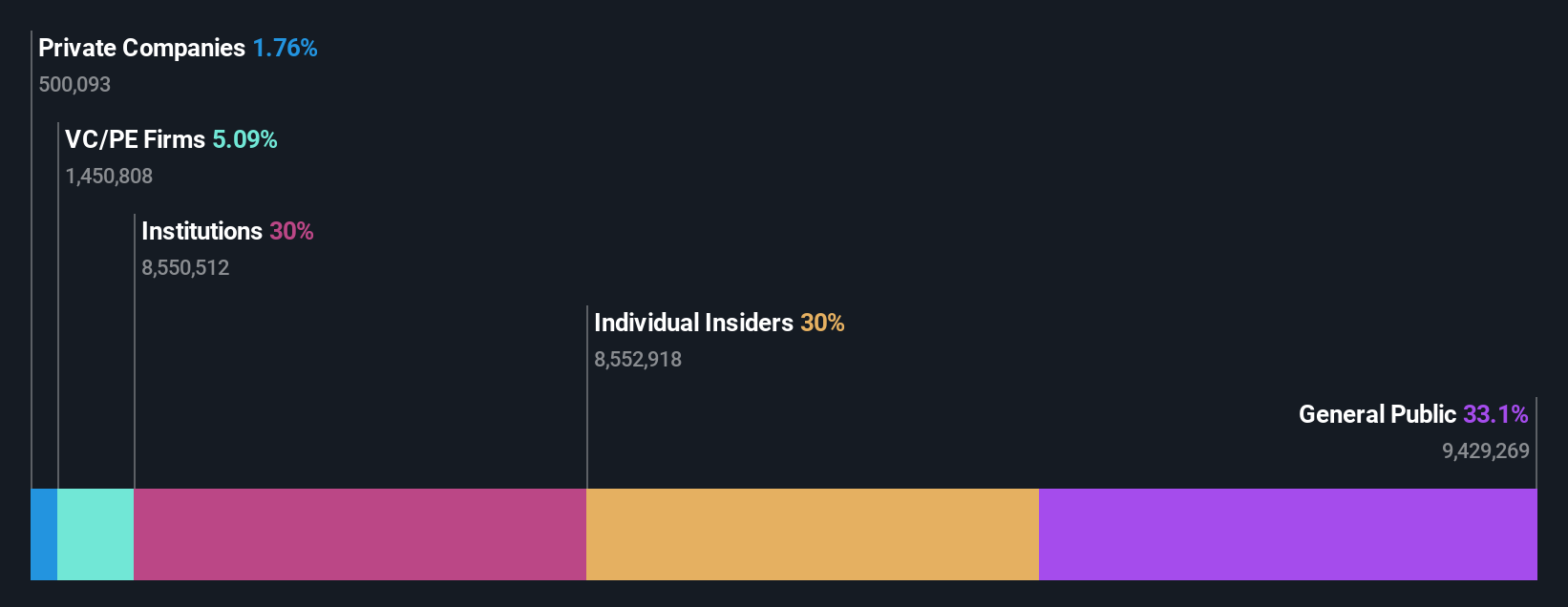

Insider Ownership: 25.6%

NOTE is trading at a good value, 27.3% below its estimated fair value, with earnings forecasted to grow significantly at 20% annually, outpacing the Swedish market. However, recent financial results showed a decline in sales and net income for Q3 and the first nine months of 2024 compared to the previous year. Despite high insider ownership typically indicating confidence, significant insider selling was observed over the past quarter.

- Take a closer look at NOTE's potential here in our earnings growth report.

- Our valuation report here indicates NOTE may be undervalued.

Shenzhen WOTE Advanced MaterialsLtd (SZSE:002886)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen WOTE Advanced Materials Co., Ltd specializes in the research, development, production, and sale of polymer materials and engineering plastic products both in China and internationally, with a market cap of CN¥4.14 billion.

Operations: The company generates revenue of CN¥1.72 billion from its New Material Industry segment.

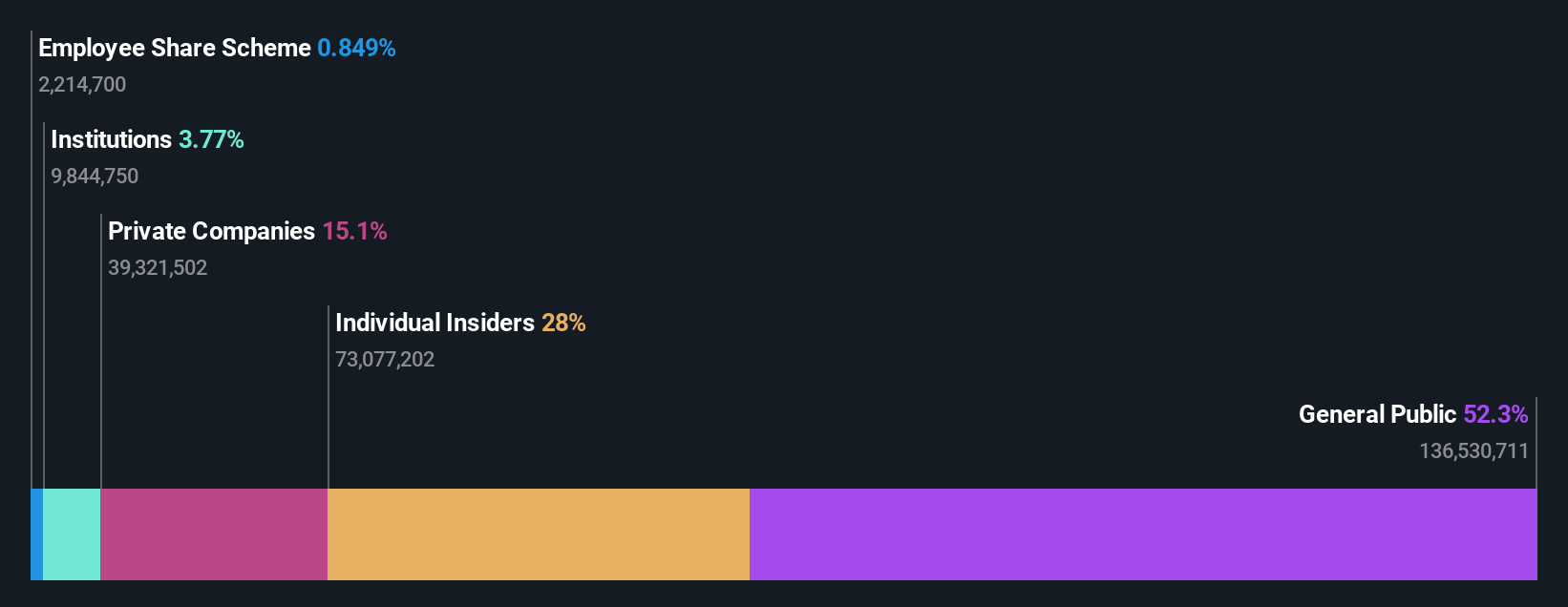

Insider Ownership: 28.6%

Shenzhen WOTE Advanced Materials reported strong earnings growth of 77.5% over the past year, with net income rising to CNY 25.07 million for the nine months ended September 2024. Revenue increased to CNY 1.29 billion from CNY 1.11 billion a year ago, reflecting robust business expansion. Despite high insider ownership suggesting confidence, future earnings and revenue are forecasted to grow significantly above market averages, though interest payments remain a concern due to limited coverage by earnings.

- Dive into the specifics of Shenzhen WOTE Advanced MaterialsLtd here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Shenzhen WOTE Advanced MaterialsLtd's share price might be too optimistic.

Msscorps (TWSE:6830)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Msscorps Co., Ltd. specializes in the testing and analysis of electronic materials across Asia, the United States, and internationally, with a market capitalization of approximately NT$9.40 billion.

Operations: The company's revenue is primarily derived from its Testing and Analysis Service segment, which generated NT$1.91 billion.

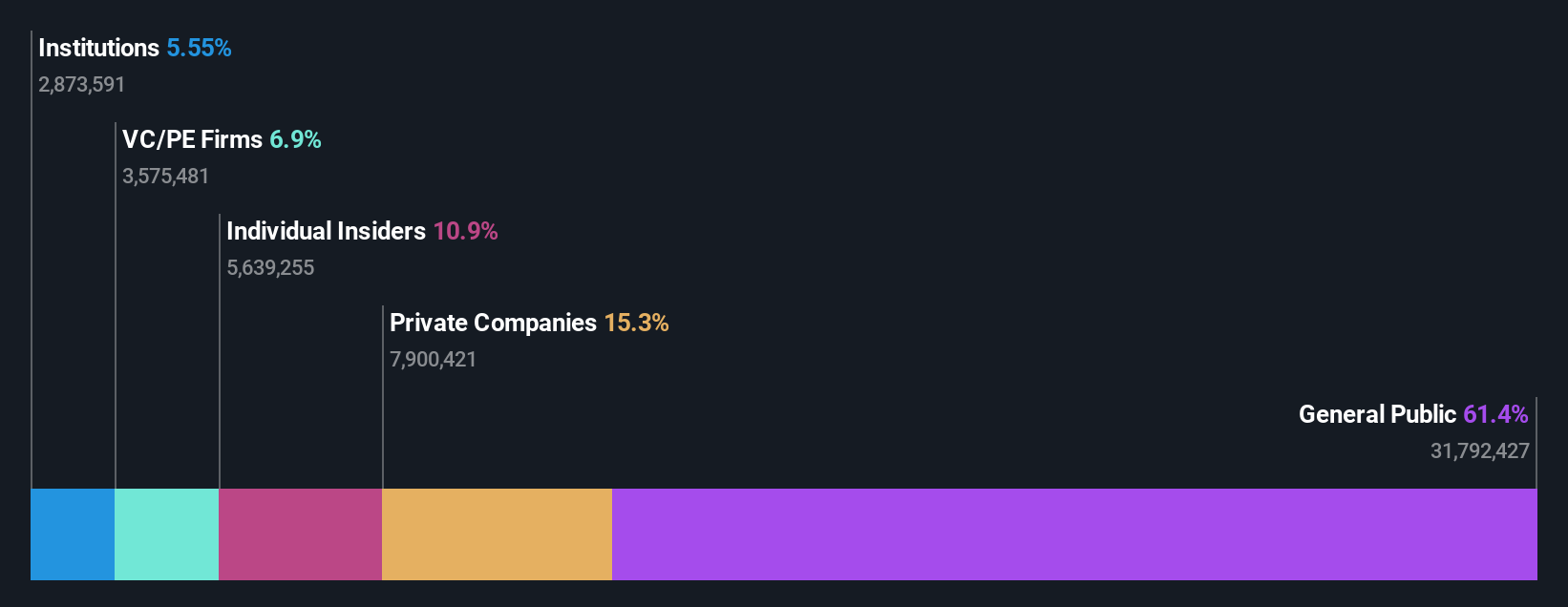

Insider Ownership: 10.9%

Msscorps shows promising growth potential, with earnings expected to rise significantly at 34.8% annually, outpacing the TW market. However, profit margins have decreased from 16.5% to 9.2%, and the dividend yield of 2.54% is not well covered by earnings or free cash flow. Despite high revenue forecasts of US$15 billion annually growing faster than the market, share price volatility and past shareholder dilution present challenges for investors considering insider ownership confidence.

- Navigate through the intricacies of Msscorps with our comprehensive analyst estimates report here.

- The analysis detailed in our Msscorps valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Unlock our comprehensive list of 1522 Fast Growing Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NOTE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOTE

NOTE

Provides electronics manufacturing services in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives