3 Value Stock Picks Including Fnac Darty That May Offer Growth Opportunities

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with rate cuts in Europe and expectations of a U.S. Federal Reserve cut, investors are keenly observing the performance of major indices like the Nasdaq Composite, which recently reached new heights. In this environment, where growth stocks have outpaced value stocks for several weeks, identifying undervalued opportunities becomes crucial for those looking to capitalize on potential market shifts. A good stock pick in such conditions often involves finding companies that offer solid fundamentals at attractive valuations, potentially providing growth opportunities as broader market dynamics evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥26.21 | CN¥52.08 | 49.7% |

| UMB Financial (NasdaqGS:UMBF) | US$122.18 | US$244.23 | 50% |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.9% |

| GlobalData (AIM:DATA) | £1.88 | £3.73 | 49.6% |

| Equity Bancshares (NYSE:EQBK) | US$46.49 | US$92.69 | 49.8% |

| Wetteri Oyj (HLSE:WETTERI) | €0.298 | €0.59 | 49.7% |

| Ingenia Communities Group (ASX:INA) | A$4.60 | A$9.14 | 49.7% |

| Equifax (NYSE:EFX) | US$265.81 | US$530.33 | 49.9% |

| QD Laser (TSE:6613) | ¥297.00 | ¥591.10 | 49.8% |

| Cellnex Telecom (BME:CLNX) | €32.32 | €64.59 | 50% |

Here's a peek at a few of the choices from the screener.

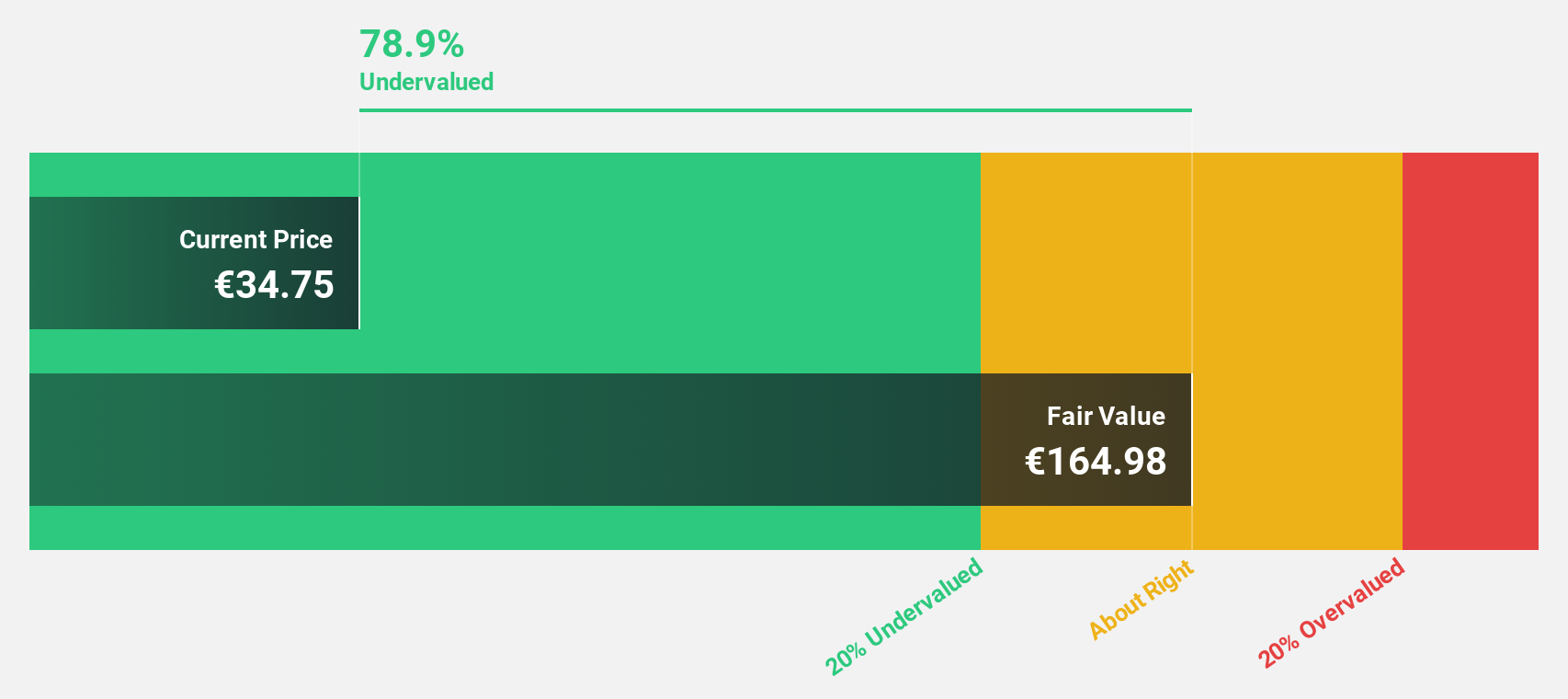

Fnac Darty (ENXTPA:FNAC)

Overview: Fnac Darty SA is a retailer of entertainment and leisure products, consumer electronics, and domestic appliances operating in France, Switzerland, Belgium, Luxembourg, and the Iberian Peninsula with a market cap of €859.68 million.

Operations: The company generates revenue from its retail segment, specifically in electronics, amounting to €7.92 billion.

Estimated Discount To Fair Value: 49.3%

Fnac Darty is trading at €29.75, significantly undervalued compared to its estimated fair value of €58.67, suggesting it may be a good value based on discounted cash flow analysis. The company has raised its 2024 earnings guidance, expecting current operating income to exceed €180 million. Despite large one-off items affecting financial results and low forecasted return on equity, earnings are projected to grow substantially at 46.1% annually over the next three years.

- Our growth report here indicates Fnac Darty may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Fnac Darty stock in this financial health report.

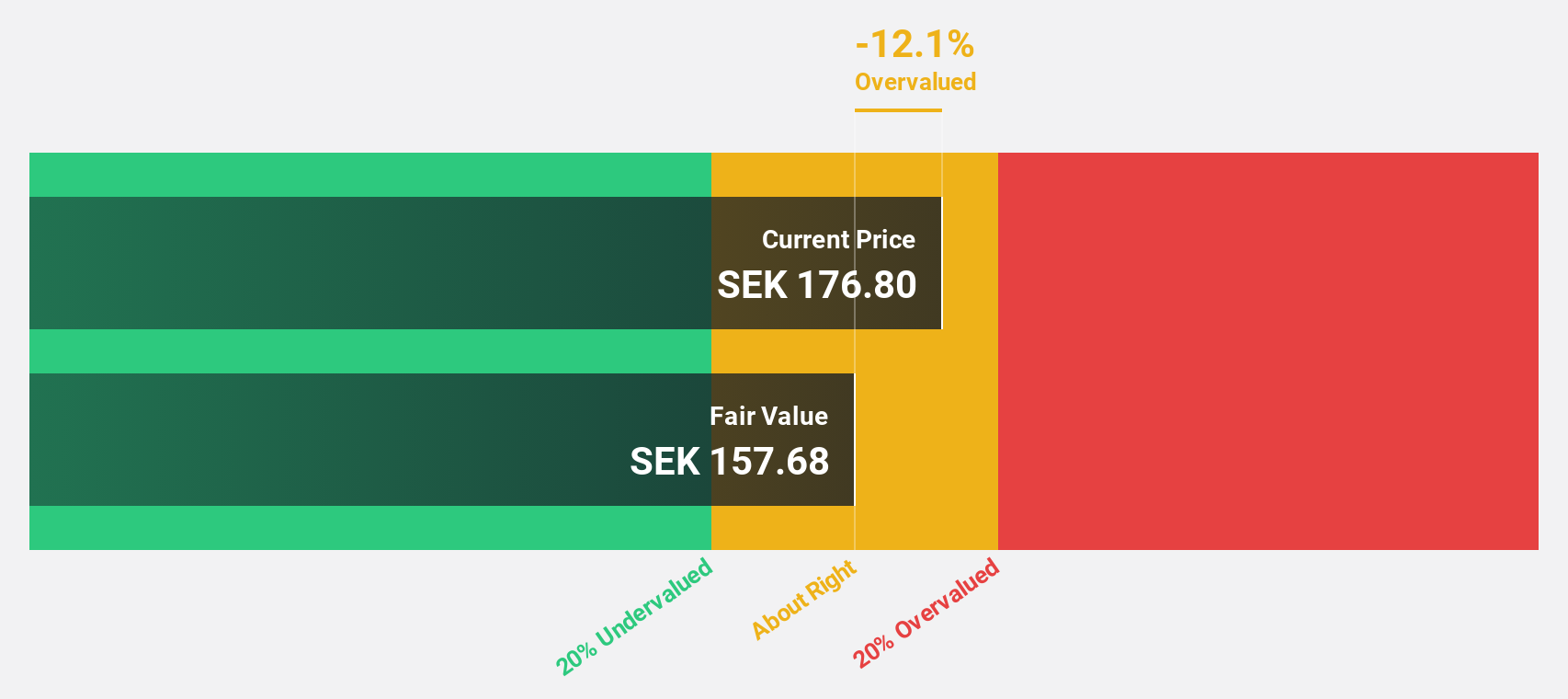

NOTE (OM:NOTE)

Overview: NOTE AB (publ) is a company that offers electronics manufacturing services across Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally with a market cap of SEK4.25 billion.

Operations: The company's revenue is primarily generated from Western Europe, contributing SEK3.02 billion, and the Rest of World segment, which accounts for SEK988.44 million.

Estimated Discount To Fair Value: 18.4%

NOTE is trading at SEK146.5, below its estimated fair value of SEK179.52, indicating potential undervaluation based on cash flows. Despite a forecasted low return on equity of 18.3% in three years, earnings are expected to grow significantly at 20% annually, outpacing the Swedish market's growth rate. Recent earnings showed declines with Q3 sales at SEK809 million and net income at SEK43 million compared to last year’s figures of SEK1,034 million and SEK65 million respectively.

- Our comprehensive growth report raises the possibility that NOTE is poised for substantial financial growth.

- Get an in-depth perspective on NOTE's balance sheet by reading our health report here.

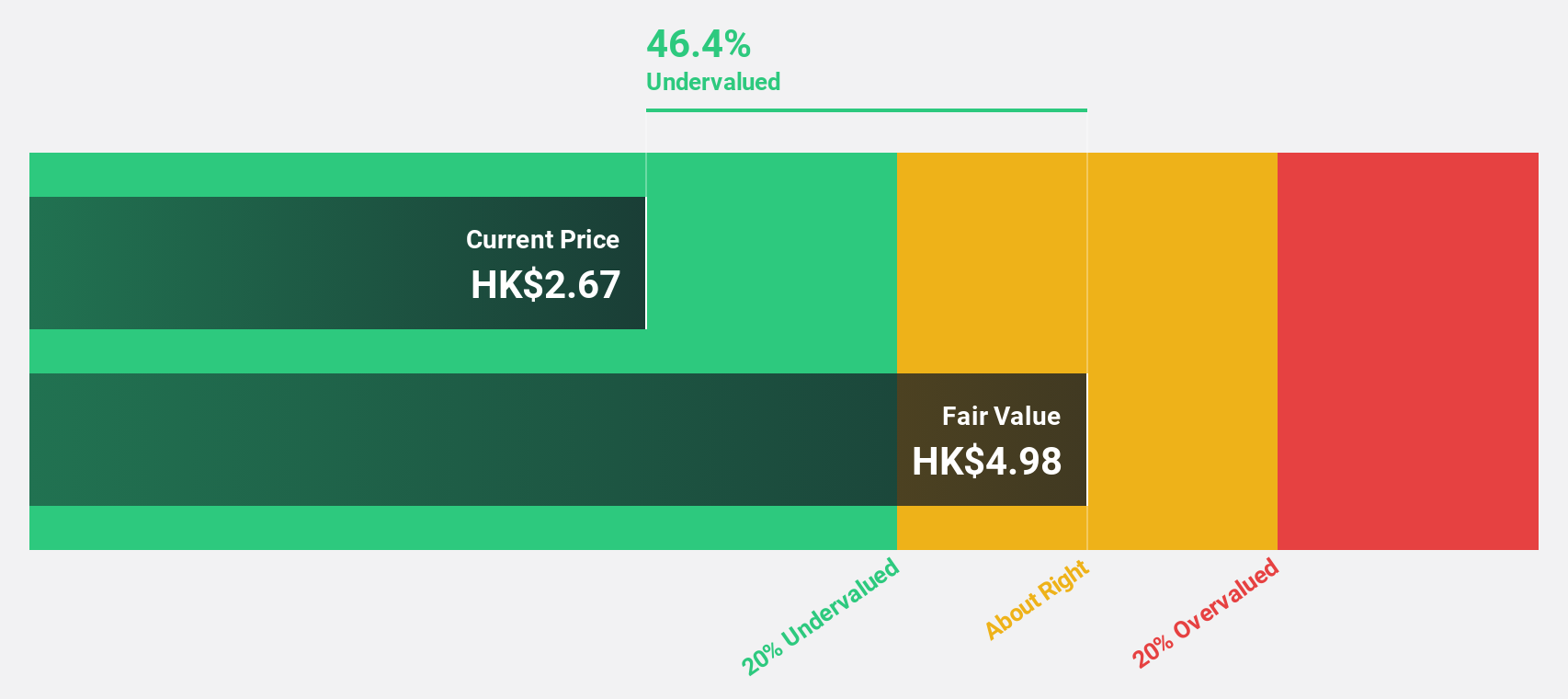

Best Pacific International Holdings (SEHK:2111)

Overview: Best Pacific International Holdings Limited, along with its subsidiaries, is engaged in the manufacturing, trading, and selling of elastic fabric, elastic webbing, and lace with a market capitalization of approximately HK$3.21 billion.

Operations: The company's revenue is primarily derived from the manufacturing and trading of elastic fabric and lace, amounting to HK$3.76 billion, and elastic webbing, contributing HK$915.53 million.

Estimated Discount To Fair Value: 42.7%

Best Pacific International Holdings, trading at HK$3.09, is significantly undervalued based on cash flows with a fair value estimate of HK$5.4. Despite its unstable dividend track record and a forecasted low return on equity of 19.6% in three years, earnings are projected to grow at 21.43% annually over the next three years, surpassing the Hong Kong market's growth rate of 11.4%. Revenue growth is expected at 13.1% per year.

- Insights from our recent growth report point to a promising forecast for Best Pacific International Holdings' business outlook.

- Click to explore a detailed breakdown of our findings in Best Pacific International Holdings' balance sheet health report.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 906 more companies for you to explore.Click here to unveil our expertly curated list of 909 Undervalued Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOTE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOTE

NOTE

Provides electronics manufacturing services in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives