- Sweden

- /

- Communications

- /

- OM:LUMEN

Some Confidence Is Lacking In LumenRadio AB (publ) (STO:LUMEN) As Shares Slide 26%

To the annoyance of some shareholders, LumenRadio AB (publ) (STO:LUMEN) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Longer-term, the stock has been solid despite a difficult 30 days, gaining 17% in the last year.

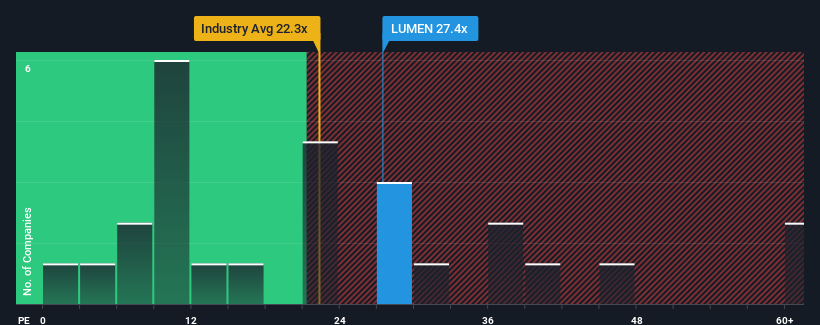

Although its price has dipped substantially, given around half the companies in Sweden have price-to-earnings ratios (or "P/E's") below 21x, you may still consider LumenRadio as a stock to potentially avoid with its 27.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

The earnings growth achieved at LumenRadio over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for LumenRadio

How Is LumenRadio's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as LumenRadio's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 28% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that LumenRadio is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Despite the recent share price weakness, LumenRadio's P/E remains higher than most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of LumenRadio revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for LumenRadio with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LUMEN

LumenRadio

A technology company, develops and sells wireless product-to-product connections in Sweden.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion