Investors Continue Waiting On Sidelines For Nordic LEVEL Group AB (publ.) (STO:LEVEL)

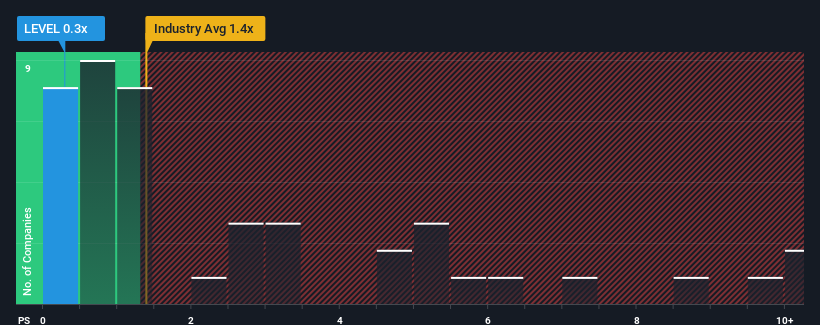

With a price-to-sales (or "P/S") ratio of 0.3x Nordic LEVEL Group AB (publ.) (STO:LEVEL) may be sending bullish signals at the moment, given that almost half of all the Electronic companies in Sweden have P/S ratios greater than 1.4x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Nordic LEVEL Group AB (publ.)

What Does Nordic LEVEL Group AB (publ.)'s Recent Performance Look Like?

The revenue growth achieved at Nordic LEVEL Group AB (publ.) over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Nordic LEVEL Group AB (publ.), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Nordic LEVEL Group AB (publ.)'s Revenue Growth Trending?

In order to justify its P/S ratio, Nordic LEVEL Group AB (publ.) would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 6.6%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Nordic LEVEL Group AB (publ.)'s P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Nordic LEVEL Group AB (publ.)'s P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see Nordic LEVEL Group AB (publ.) currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

You need to take note of risks, for example - Nordic LEVEL Group AB (publ.) has 5 warning signs (and 3 which are concerning) we think you should know about.

If these risks are making you reconsider your opinion on Nordic LEVEL Group AB (publ.), explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nordic LEVEL Group AB (publ.) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LEVEL

Nordic LEVEL Group AB (publ.)

Provides safety and security solutions primarily in Sweden.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026