Amidst a backdrop of rising inflation and volatile treasury yields, global stock markets have seen significant movements with U.S. indices like the Nasdaq Composite nearing record highs, driven by strong performances in growth stocks despite small-cap stocks lagging behind. In such an environment, identifying high-growth tech stocks becomes crucial as these companies often demonstrate resilience through innovation and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| AVITA Medical | 30.43% | 54.08% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1213 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lagercrantz Group (OM:LAGR B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lagercrantz Group AB (publ) is a technology company operating through its subsidiaries across various regions including Sweden, Denmark, Norway, Finland, Germany, the United Kingdom, Benelux, Poland, and other international markets with a market cap of approximately SEK49.50 billion.

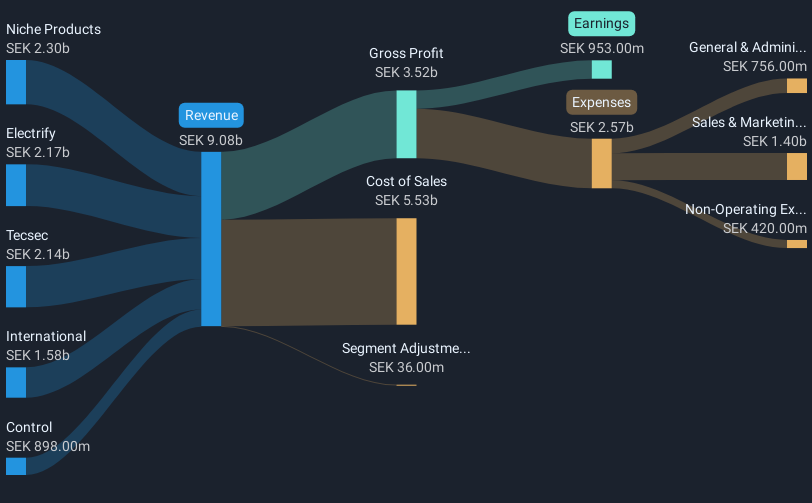

Operations: Lagercrantz Group generates revenue through its diverse segments, including Tecsec (SEK2.14 billion), Control (SEK898 million), Electrify (SEK2.17 billion), International (SEK1.58 billion), and Niche Products (SEK2.30 billion). The company's business model focuses on providing specialized technology solutions across multiple geographical markets, leveraging its subsidiaries to cater to regional demands effectively.

Lagercrantz Group's recent performance underscores its potential in the high-growth tech sector, with a notable 11.8% annual revenue increase, outpacing the Swedish market's growth of 1.1%. This growth is complemented by an earnings forecast to rise by 15.1% annually, significantly above Sweden's average of 10.7%. Despite not exceeding the electronic industry’s growth rate last year, Lagercrantz has demonstrated robust financial health with high-quality earnings and a strong return on equity projected at 25% in three years. The company’s latest quarterly results showed a surge in sales to SEK 2,462 million and net income rising to SEK 267 million, indicating solid operational execution and resilience amidst market challenges.

- Get an in-depth perspective on Lagercrantz Group's performance by reading our health report here.

Assess Lagercrantz Group's past performance with our detailed historical performance reports.

Shanghai Film (SHSE:601595)

Simply Wall St Growth Rating: ★★★★★☆

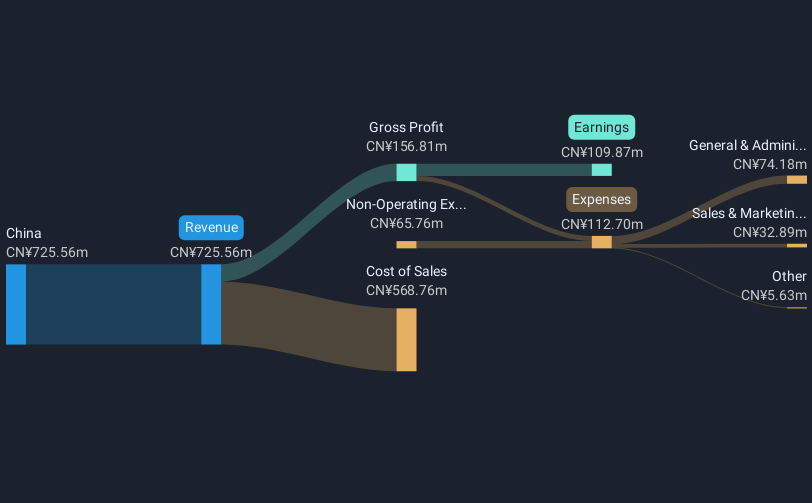

Overview: Shanghai Film Co., Ltd. is involved in film distribution and screening activities within China, with a market capitalization of CN¥12.29 billion.

Operations: Shanghai Film Co., Ltd. generates revenue primarily through its film distribution and screening services across China. The company's operations focus on leveraging its network to deliver a diverse range of films to audiences, contributing significantly to its financial performance.

Shanghai Film has emerged as a dynamic contender in the tech-driven entertainment sector, with its revenue forecast to surge by 28.5% annually, significantly outpacing the Chinese market's growth of 13.3%. This robust expansion is supported by an impressive projected annual earnings increase of 53.6%, dwarfing the market average of 25.1%. The company's commitment to innovation is evident from its R&D spending trends, positioning it well for sustained growth amidst evolving industry demands. With recent financials revealing a transition to profitability and a strategic focus on high-tech enhancements in film production, Shanghai Film is poised to capitalize on increasing digital consumption trends, although its Return on Equity is expected to remain modest at 16% over three years.

- Click to explore a detailed breakdown of our findings in Shanghai Film's health report.

Review our historical performance report to gain insights into Shanghai Film's's past performance.

HIVE Digital Technologies (TSXV:HIVE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HIVE Digital Technologies Ltd. is involved in the mining and sale of digital currencies across Canada, Sweden, and Iceland, with a market capitalization of CA$623.16 million.

Operations: HIVE Digital Technologies Ltd. generates revenue primarily through the mining and sale of digital currencies, with reported earnings of $120.99 million. The company's operations span Canada, Sweden, and Iceland.

HIVE Digital Technologies, amidst a transformative phase, reported a significant turnaround with its Q3 earnings showing net income of $1.27 million compared to a net loss of $6.95 million the previous year. This recovery is underpinned by robust annual revenue growth projections of 48.8%, outstripping the Canadian market's average of 5.4%. The firm's strategic acquisition of the Yguazú Bitcoin mining facility in Paraguay for $56 million highlights its aggressive expansion and commitment to green energy, expected to boost its hashrate capacity significantly by September 2025. This move not only enhances HIVE's operational scale but also aligns with sustainable energy practices, positioning it as a leader in eco-friendly Bitcoin mining operations globally.

- Navigate through the intricacies of HIVE Digital Technologies with our comprehensive health report here.

Understand HIVE Digital Technologies' track record by examining our Past report.

Next Steps

- Gain an insight into the universe of 1213 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HIVE Digital Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HIVE

HIVE Digital Technologies

A technology company, engages in the building and operating data centers powered by green energy in Bermuda.

Flawless balance sheet with medium-low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>