- Sweden

- /

- Communications

- /

- OM:INCOAX

Founder Helge Tiainen Just Bought 9.7% More Shares In InCoax Networks AB (publ) (STO:INCOAX)

Whilst it may not be a huge deal, we thought it was good to see that the InCoax Networks AB (publ) (STO:INCOAX) Founder, Helge Tiainen, recently bought kr61k worth of stock, for kr6.12 per share. Although the purchase is not a big one, increasing their shareholding by only 9.7%, it can be interpreted as a good sign.

View our latest analysis for InCoax Networks

InCoax Networks Insider Transactions Over The Last Year

Founder Helge Tiainen previously made an even bigger purchase of kr93k worth of shares at a price of kr7.30 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being kr6.28). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We always take careful note of the price insiders pay when purchasing shares. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels. We note that Helge Tiainen was also the biggest seller.

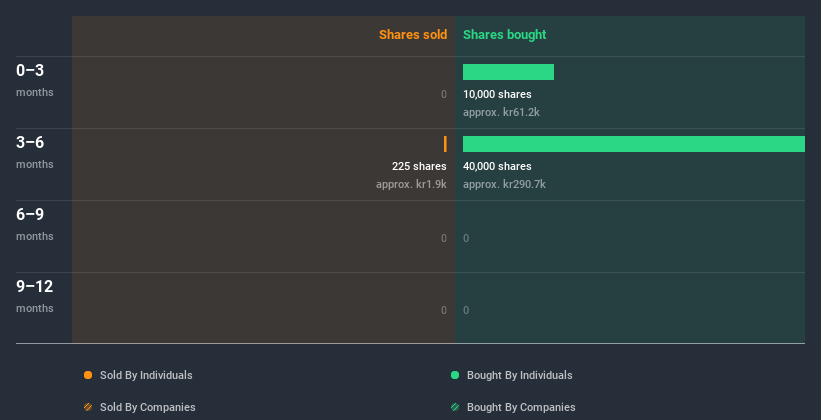

Over the last year, we can see that insiders have bought 50.00k shares worth kr350k. But they sold 225.00 shares for kr1.9k. In the last twelve months there was more buying than selling by InCoax Networks insiders. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

InCoax Networks is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. InCoax Networks insiders own about kr56m worth of shares (which is 47% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About InCoax Networks Insiders?

It is good to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about InCoax Networks. Nice! So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To that end, you should learn about the 5 warning signs we've spotted with InCoax Networks (including 3 which are significant).

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading InCoax Networks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:INCOAX

InCoax Networks

InCoax Networks AB (publ) re-purposes existing property coaxial networks in fiber and fixed wireless access extension deployments for communication service providers in the European Union, North America, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion