- Hong Kong

- /

- Entertainment

- /

- SEHK:3888

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a complex landscape shaped by the Federal Reserve's cautious approach to interest rate cuts and looming political uncertainties in the U.S., which have contributed to a broad-based decline in stock indices, particularly impacting smaller-cap stocks. Amid these challenges, investors are keenly observing high-growth tech stocks that possess strong fundamentals and innovative potential, essential qualities for weathering economic fluctuations and capitalizing on opportunities within a shifting market environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

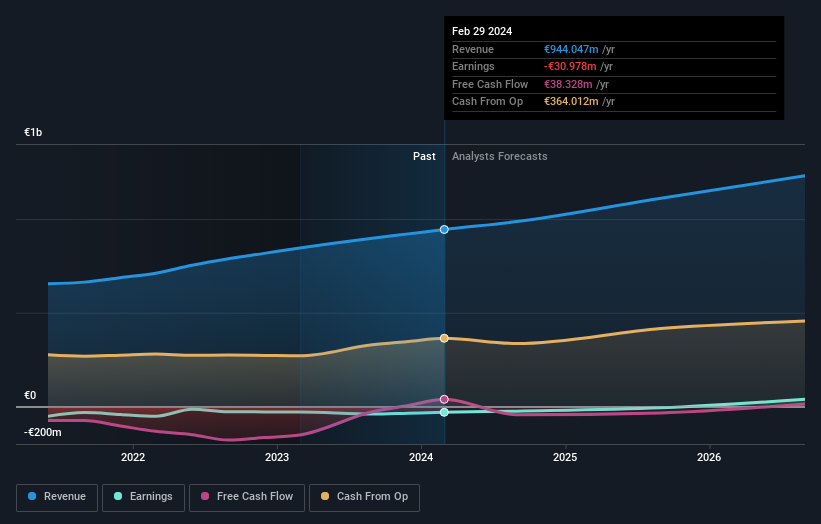

Overview: OVH Groupe S.A. offers a range of cloud services including public and private cloud, shared hosting, and dedicated servers on a global scale, with a market capitalization of approximately €1.62 billion.

Operations: OVH Groupe generates revenue primarily from its private cloud segment, which accounts for €623.53 million, followed by public cloud and web cloud services at €182.82 million and €186.71 million respectively.

OVH Groupe's recent strategic moves, including the launch of third-generation Bare Metal game servers and managed MongoDB services, underscore its commitment to enhancing cloud solutions and infrastructure. These innovations are critical as they cater to real-time, data-heavy applications essential for modern businesses, reflecting a 9.6% annual revenue growth which surpasses the French market average of 5.5%. Moreover, with a significant reduction in net loss from EUR 40.32 million to EUR 10.3 million year-over-year and an anticipated profitability within three years, OVH is positioning itself strongly in the tech sector. The partnership with Digital Realty to integrate OVHcloud into ServiceFabric further amplifies its market presence by offering secure and high-performance cloud solutions vital for digital transformation across Europe.

- Click to explore a detailed breakdown of our findings in OVH Groupe's health report.

Explore historical data to track OVH Groupe's performance over time in our Past section.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

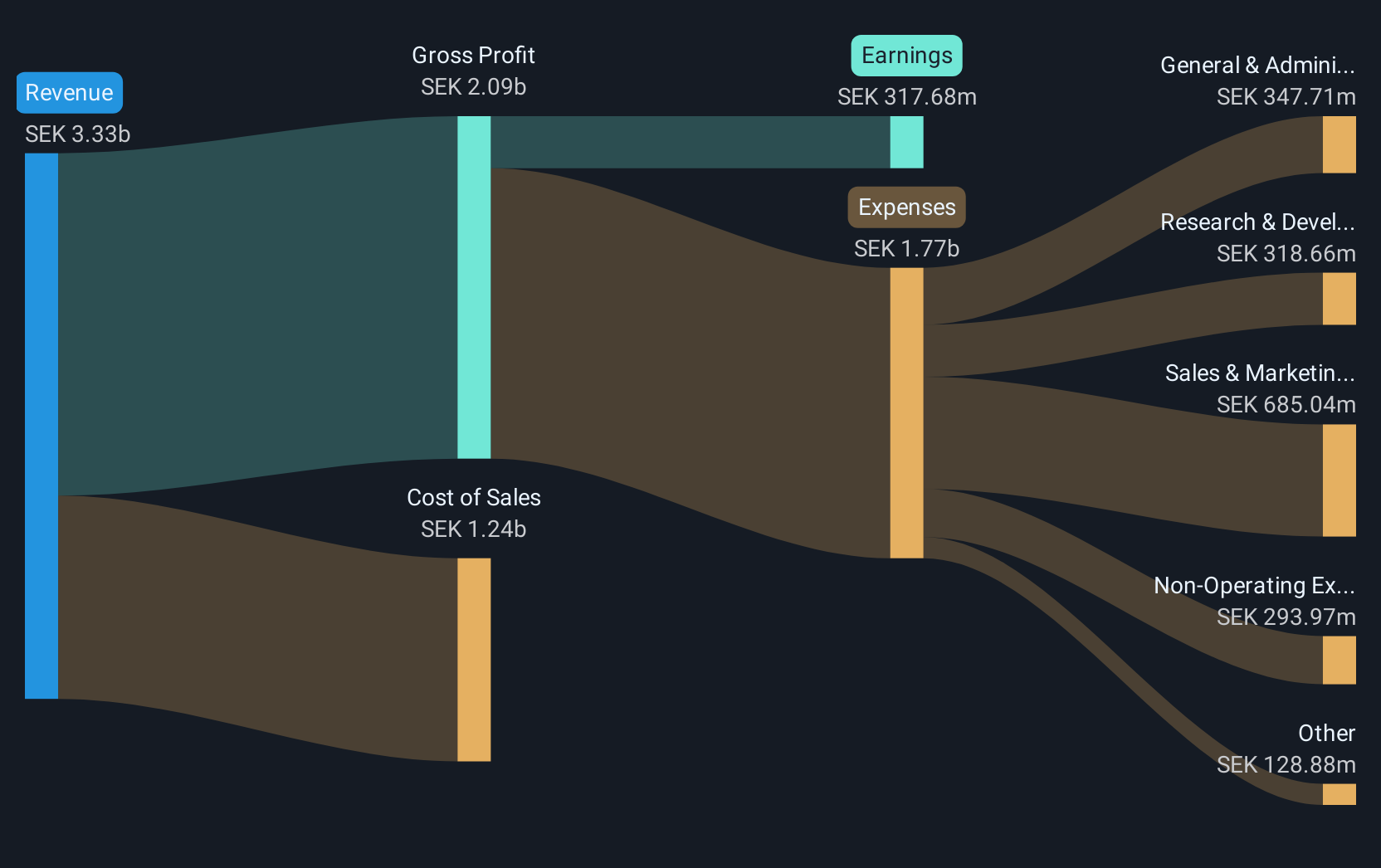

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK22.04 billion.

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, amounting to SEK3.01 billion.

Amidst a challenging landscape, HMS Networks has showcased resilience with its strategic reorganization into three focused divisions, aiming to enhance service delivery and technological synergies across varied industrial sectors. This move is expected to streamline operations and result in significant savings of SEK 40 million annually starting from 2025. Despite a recent dip in earnings, where net income fell to SEK 95 million from SEK 172 million year-over-year for the third quarter, the company's robust annual revenue growth of 17.8% and earnings growth forecast at an impressive 42% per annum highlight its potential in outpacing the broader Swedish market's growth rates. The firm’s commitment to innovation is evident from its R&D investments, aligning with industry shifts towards more integrated and efficient industrial communication solutions.

- Click here and access our complete health analysis report to understand the dynamics of HMS Networks.

Examine HMS Networks' past performance report to understand how it has performed in the past.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

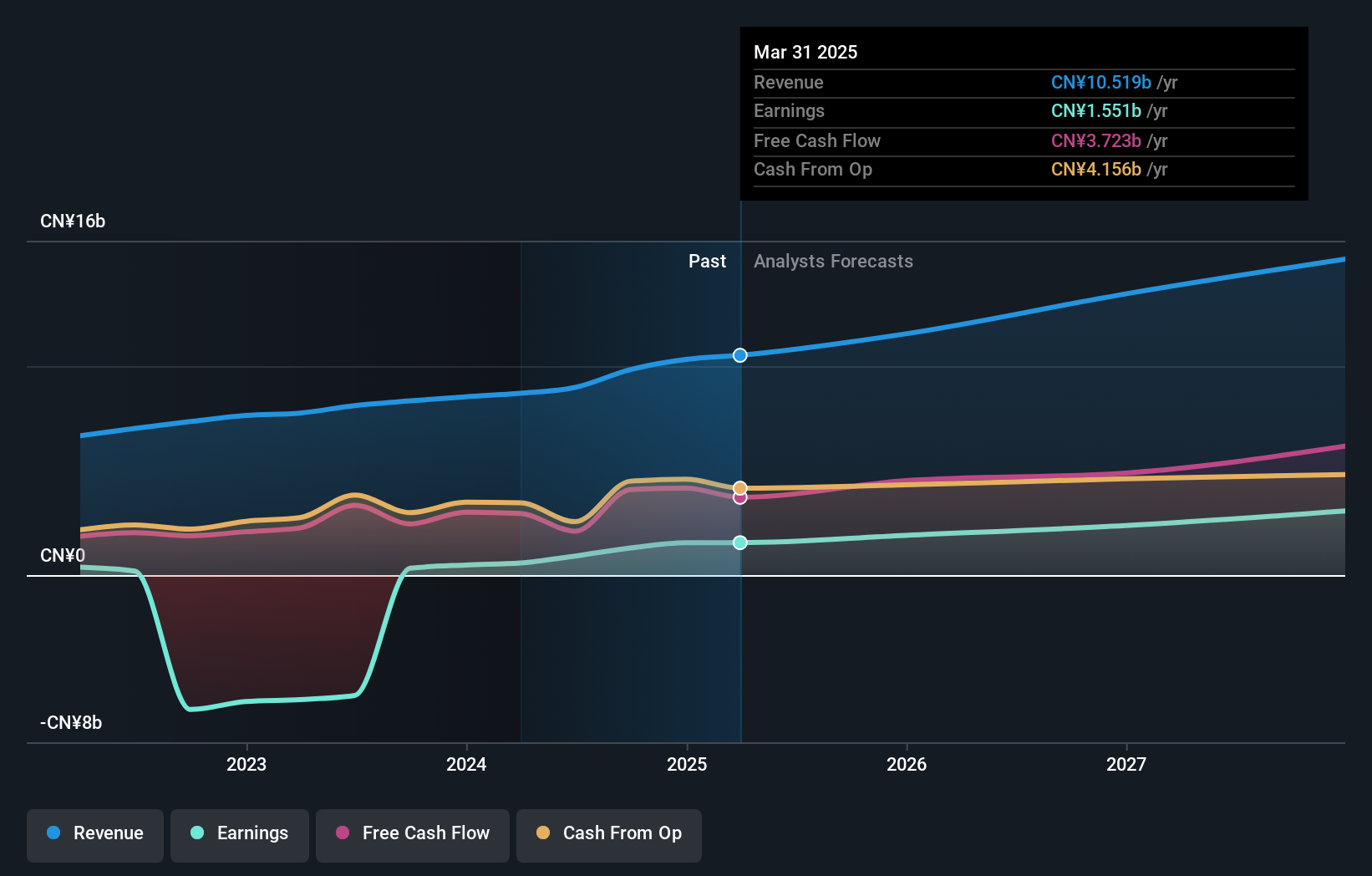

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market capitalization of approximately HK$44.78 billion.

Operations: Kingsoft Corporation Limited generates revenue primarily from its online games and office software and services segments, with both contributing nearly equally to the company's income, at CN¥4.93 billion and CN¥4.91 billion respectively.

Kingsoft's recent earnings surge, with net income skyrocketing to CNY 413.45 million from CNY 28.49 million year-over-year in Q3 2024, underscores its robust growth trajectory in the tech sector. This performance is bolstered by a substantial annualized earnings growth rate of 21.3%, positioning it well above the industry norm. The company's commitment to innovation is reflected in its significant R&D investments, which are crucial for maintaining competitive edge and fueling future expansions. With earnings growing at a pace that outstrips many peers and a strategic focus on enhancing product offerings, Kingsoft appears well-equipped to capitalize on expanding market opportunities while adapting to dynamic technological advancements.

- Navigate through the intricacies of Kingsoft with our comprehensive health report here.

Gain insights into Kingsoft's past trends and performance with our Past report.

Taking Advantage

- Unlock our comprehensive list of 1271 High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3888

Kingsoft

Engages in the entertainment and office software and services businesses in Mainland China, Hong Kong, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives