Amid recent trade uncertainties and economic shifts, European markets have seen a positive upswing, with the STOXX Europe 600 Index rising by nearly 4% as investor sentiment was buoyed by the European Central Bank's rate cuts. In this environment of cautious optimism and policy adjustments, identifying undervalued stocks can be particularly appealing for investors seeking opportunities that might not yet reflect their full potential in market pricing.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK49.265 | SEK96.49 | 48.9% |

| LPP (WSE:LPP) | PLN15695.00 | PLN30654.82 | 48.8% |

| Pharma Mar (BME:PHM) | €80.80 | €158.16 | 48.9% |

| Lindab International (OM:LIAB) | SEK190.30 | SEK372.38 | 48.9% |

| TF Bank (OM:TFBANK) | SEK347.50 | SEK683.01 | 49.1% |

| Mo-BRUK (WSE:MBR) | PLN316.50 | PLN621.01 | 49% |

| LINK Mobility Group Holding (OB:LINK) | NOK22.70 | NOK44.01 | 48.4% |

| Jerónimo Martins SGPS (ENXTLS:JMT) | €21.40 | €42.22 | 49.3% |

| MedinCell (ENXTPA:MEDCL) | €14.70 | €28.62 | 48.6% |

| Longino & Cardenal (BIT:LON) | €1.36 | €2.71 | 49.8% |

Let's dive into some prime choices out of the screener.

Pharma Mar (BME:PHM)

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology across various international markets, with a market cap of €1.42 billion.

Operations: The company's revenue is primarily derived from its Oncology segment, which generated €174.59 million, and a minor contribution from RNA Interference (RNAi) amounting to €0.26 million.

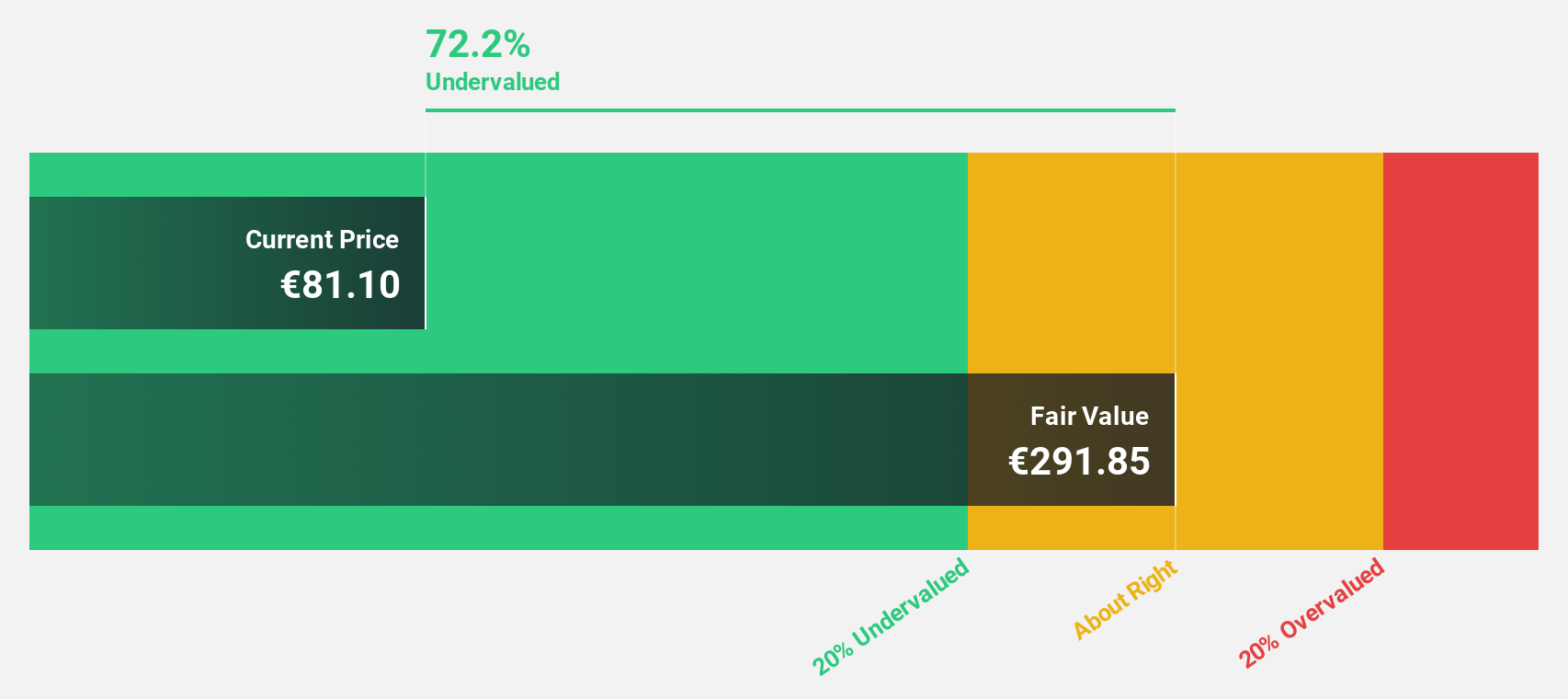

Estimated Discount To Fair Value: 48.9%

Pharma Mar's stock is trading at €80.8, significantly below its estimated fair value of €158.16, suggesting it may be undervalued based on cash flows. Despite a volatile share price, earnings are forecast to grow by 40.07% annually, outpacing the Spanish market's growth rate of 5.8%. Recent financials show revenue growth from €158.15 million to €174.86 million and net income surging from €1.14 million to €26.13 million year-over-year.

- According our earnings growth report, there's an indication that Pharma Mar might be ready to expand.

- Unlock comprehensive insights into our analysis of Pharma Mar stock in this financial health report.

ASML Holding (ENXTAM:ASML)

Overview: ASML Holding N.V. specializes in lithography solutions for the semiconductor industry, encompassing development, production, marketing, sales, upgrading, and servicing of advanced equipment systems with a market cap of approximately €228.46 billion.

Operations: ASML's revenue primarily comes from its Semiconductor Equipment and Services segment, which generated €30.71 billion.

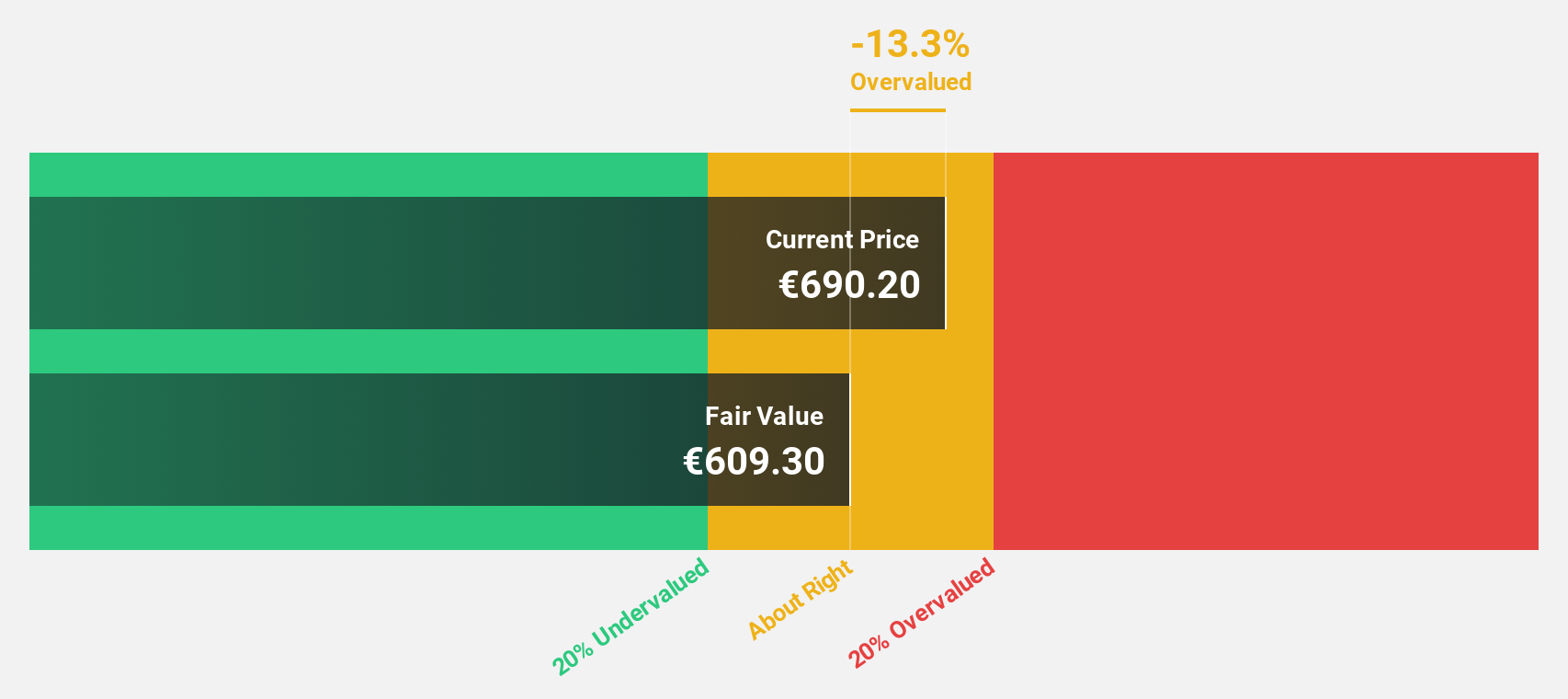

Estimated Discount To Fair Value: 11.6%

ASML Holding is trading at €580.9, below its estimated fair value of €657.3, indicating potential undervaluation based on cash flows. The company's earnings rose by 22.3% over the past year and are projected to grow annually by 12.5%, surpassing the Dutch market's average growth rate of 11%. Recent earnings reported a net income increase to €2.36 billion from €1.22 billion year-over-year, reflecting strong financial performance despite insider selling activity recently observed.

- Our earnings growth report unveils the potential for significant increases in ASML Holding's future results.

- Click to explore a detailed breakdown of our findings in ASML Holding's balance sheet health report.

HMS Networks (OM:HMS)

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK20.71 billion.

Operations: HMS Networks generates revenue through its products that enable communication and information sharing for industrial equipment worldwide.

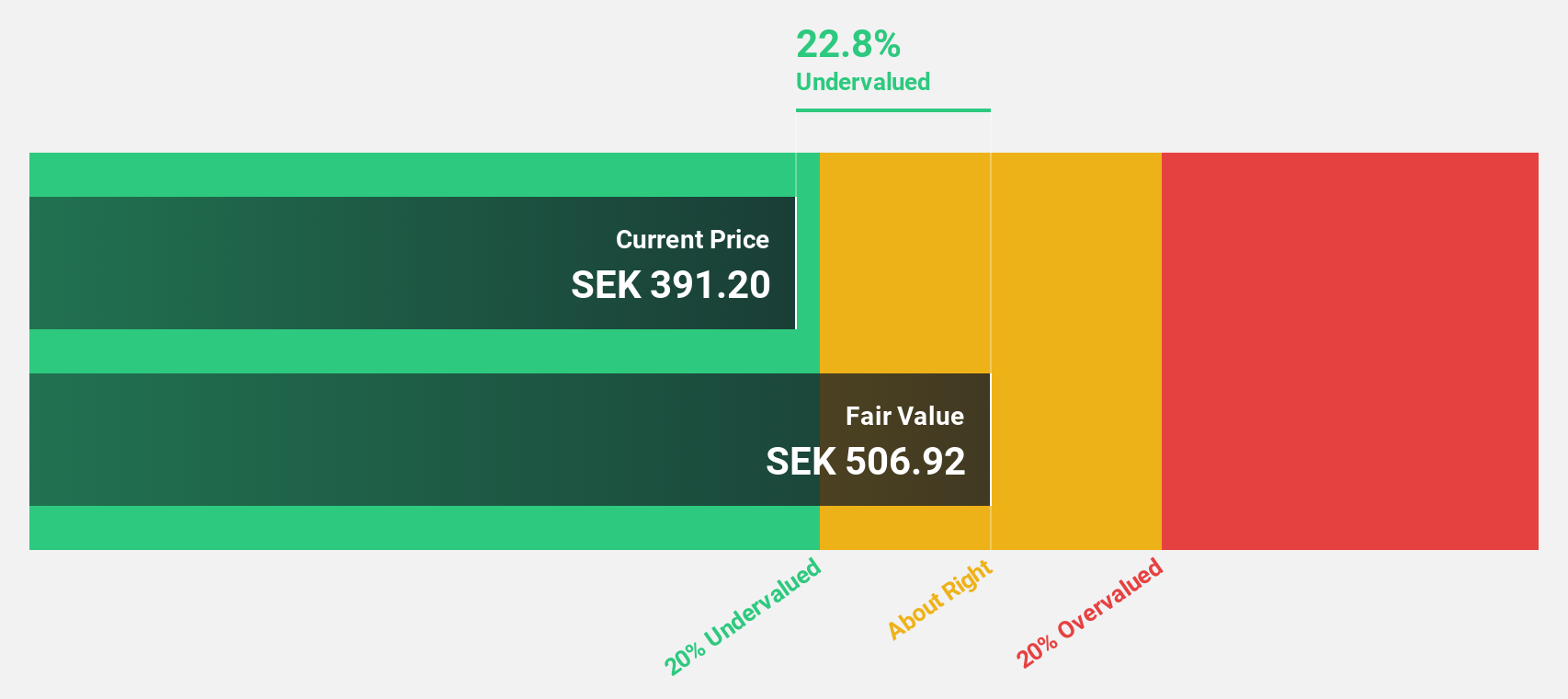

Estimated Discount To Fair Value: 23.3%

HMS Networks, trading at SEK412.8, is undervalued with an estimated fair value of SEK538.36, offering potential based on cash flow analysis. Despite a decrease in net profit margin from 17.6% to 9.5%, earnings are projected to grow significantly at 33.4% annually over the next three years, outpacing the Swedish market's growth of 13.1%. Recent Q1 sales rose to SEK890 million from SEK616 million year-over-year, indicating robust revenue performance amidst strategic acquisitions and no dividend payout this year.

- Insights from our recent growth report point to a promising forecast for HMS Networks' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of HMS Networks.

Summing It All Up

- Gain an insight into the universe of 177 Undervalued European Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PHM

Pharma Mar

A biopharmaceutical company, focuses on the research, development, production, and commercialization of bio-active principles for the use in oncology in Spain, China, Germany, Ireland, France, rest of the European Union, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives