- Sweden

- /

- Aerospace & Defense

- /

- OM:MILDEF

European Growth Companies With High Insider Ownership For June 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of global tensions and economic uncertainties, reflected in the recent declines of major indices such as the STOXX Europe 600 and Germany's DAX, investors are increasingly focusing on companies with strong insider ownership. In such a climate, growth companies with high insider stakes can offer potential resilience and alignment of interests between management and shareholders, making them an attractive consideration for those seeking stability amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| VusionGroup (ENXTPA:VU) | 13.4% | 71.2% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 130.8% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Diamyd Medical (OM:DMYD B) | 11.9% | 93% |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 58.6% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Here's a peek at a few of the choices from the screener.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. provides digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €4.20 billion.

Operations: The company's revenue is primarily derived from installing and maintaining electronic shelf labels, amounting to €954.71 million.

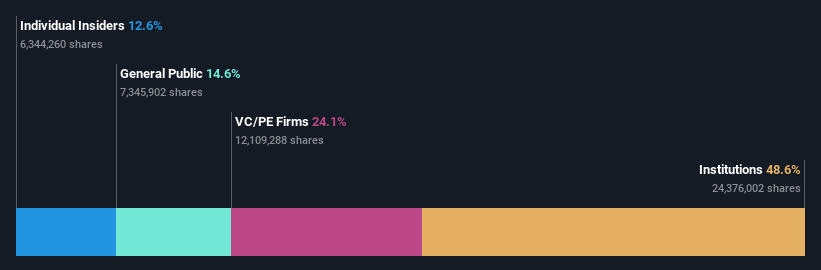

Insider Ownership: 13.4%

Revenue Growth Forecast: 20.4% p.a.

VusionGroup is experiencing robust growth, with revenue projected to increase by 20.4% annually, outpacing the French market. The company anticipates profitability within three years and a high return on equity of 35%. A recent strategic alliance with Carrefour aims to revolutionize retail through advanced technologies like EdgeSense and Captana, enhancing store operations and customer experience. Despite no significant insider trading activity recently, insider ownership remains substantial post-private placement adjustments.

- Navigate through the intricacies of VusionGroup with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that VusionGroup's current price could be inflated.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK19.78 billion.

Operations: HMS Networks generates revenue through its diverse range of products designed to enable communication and information exchange for industrial equipment on a global scale.

Insider Ownership: 24.5%

Revenue Growth Forecast: 14.8% p.a.

HMS Networks is experiencing significant earnings growth, projected at 34.3% annually, outpacing the Swedish market. Revenue growth is strong at 14.8% per year, though below the 20% mark often seen in high-growth companies. Despite a recent decision to forgo dividends, insiders have shown confidence by purchasing shares recently. However, profit margins have declined from last year and the company carries a high debt level. Analysts predict a stock price increase of 34.4%.

- Click here to discover the nuances of HMS Networks with our detailed analytical future growth report.

- Our valuation report here indicates HMS Networks may be undervalued.

MilDef Group (OM:MILDEF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions across several countries including Sweden, Norway, and the United States, with a market cap of approximately SEK9.29 billion.

Operations: The company's revenue segment primarily consists of Computer Hardware, generating SEK1.31 billion.

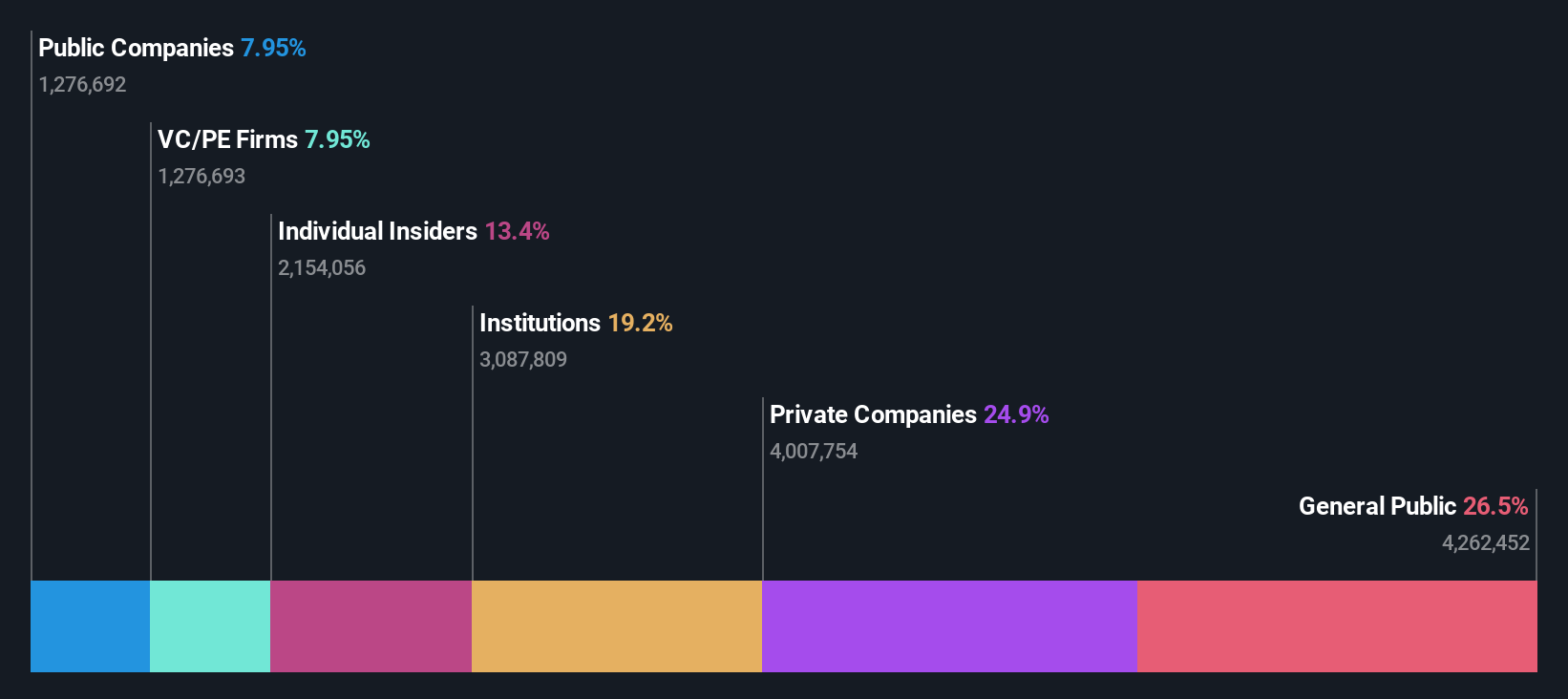

Insider Ownership: 13.7%

Revenue Growth Forecast: 30.6% p.a.

MilDef Group is set for robust revenue growth of 30.6% annually, surpassing the Swedish market's average. Despite recent insider selling, the stock trades 38.7% below estimated fair value with analysts predicting a 32.7% price increase. The company reported Q1 sales of SEK 339.5 million and a reduced net loss compared to last year, supported by significant orders from the Swedish Defence Materiel Administration worth SEK 126 million for IT equipment upgrades in 2025.

- Click to explore a detailed breakdown of our findings in MilDef Group's earnings growth report.

- According our valuation report, there's an indication that MilDef Group's share price might be on the cheaper side.

Seize The Opportunity

- Reveal the 205 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Want To Explore Some Alternatives? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MILDEF

MilDef Group

Develops, manufactures, and sells rugged IT solutions in Sweden, Norway, Finland, Denmark, the United Kingdom, Germany, Switzerland, the United States, Australia, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives