- Sweden

- /

- Specialty Stores

- /

- OM:HM B

Undervalued Swedish Stocks You Might Be Overlooking In October 2024

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts fuel optimism in the region, Sweden's stock market is garnering attention for its potential opportunities amid a shifting economic landscape. In this context, identifying undervalued stocks can be crucial for investors looking to capitalize on discrepancies between a company's intrinsic value and its current market price.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK45.96 | SEK88.90 | 48.3% |

| Husqvarna (OM:HUSQ B) | SEK67.42 | SEK124.43 | 45.8% |

| Lindab International (OM:LIAB) | SEK264.00 | SEK524.69 | 49.7% |

| TF Bank (OM:TFBANK) | SEK311.00 | SEK612.84 | 49.3% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK89.26 | SEK174.93 | 49% |

| Wall to Wall Group (OM:WTW A) | SEK52.80 | SEK103.39 | 48.9% |

| Nolato (OM:NOLA B) | SEK52.65 | SEK102.64 | 48.7% |

| Securitas (OM:SECU B) | SEK131.05 | SEK260.34 | 49.7% |

| BHG Group (OM:BHG) | SEK14.62 | SEK26.80 | 45.4% |

| Bactiguard Holding (OM:BACTI B) | SEK44.90 | SEK85.65 | 47.6% |

Let's dive into some prime choices out of the screener.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Overview: Telefonaktiebolaget LM Ericsson, along with its subsidiaries, offers mobile connectivity solutions to telecom operators and enterprise customers across multiple regions including North America, Europe, Latin America, the Middle East, Africa, and Asia; it has a market cap of approximately SEK297.38 billion.

Operations: The company's revenue segments include Networks at SEK156.41 billion, Cloud Software and Services at SEK62.74 billion, and Enterprise at SEK25.47 billion.

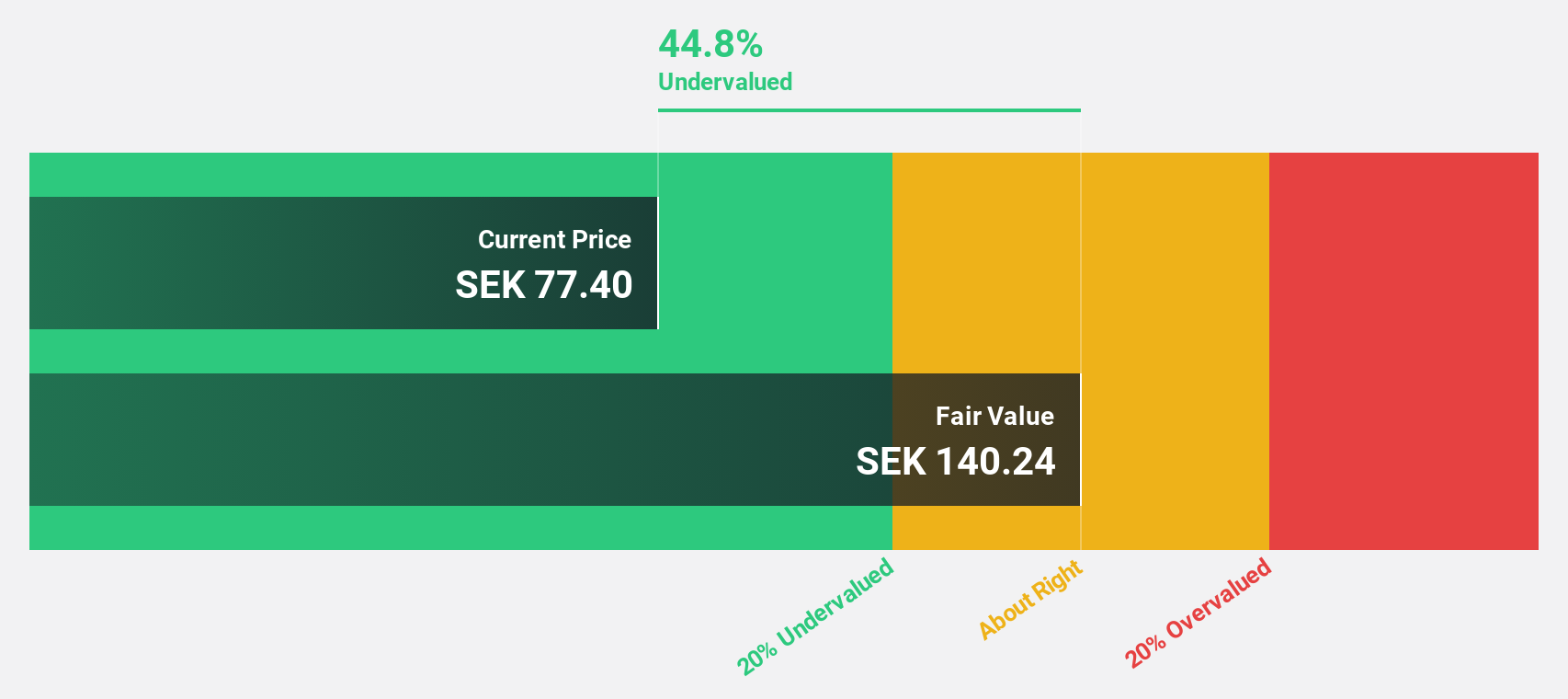

Estimated Discount To Fair Value: 49%

Telefonaktiebolaget LM Ericsson is trading at SEK 89.26, significantly below its estimated fair value of SEK 174.93, suggesting it may be undervalued based on discounted cash flow analysis. Despite a recent decline in sales to SEK 61.79 billion for Q3 2024, the company reported a net income turnaround from a substantial loss last year. However, the dividend yield of 3.02% is not well covered by earnings, indicating potential sustainability concerns for investors focused on cash flow valuation metrics.

- Our expertly prepared growth report on Telefonaktiebolaget LM Ericsson implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Telefonaktiebolaget LM Ericsson here with our thorough financial health report.

H & M Hennes & Mauritz (OM:HM B)

Overview: H & M Hennes & Mauritz AB (publ) is a global retailer offering clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children with a market cap of SEK281.32 billion.

Operations: The company's revenue primarily comes from its apparel segment, which generated SEK234.94 billion.

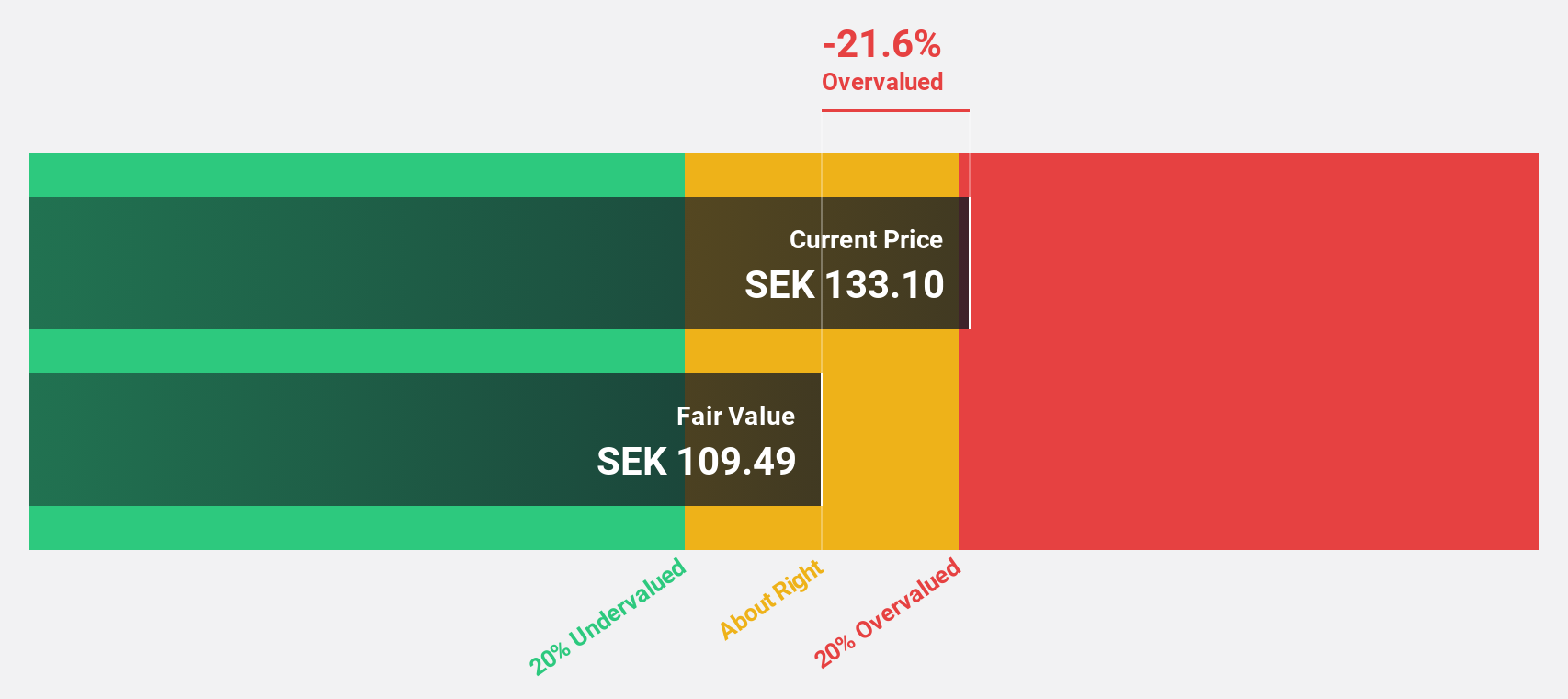

Estimated Discount To Fair Value: 14.5%

H & M Hennes & Mauritz is trading at SEK 174.85, below its estimated fair value of SEK 204.39, showing potential undervaluation based on cash flows. Despite a dip in Q3 sales to SEK 59.01 billion from last year, net income for the nine months rose to SEK 8.54 billion. The company initiated a share buyback program and launched a new menswear collection, Atelier, which may influence future cash flow dynamics positively amidst moderate earnings growth forecasts.

- The analysis detailed in our H & M Hennes & Mauritz growth report hints at robust future financial performance.

- Navigate through the intricacies of H & M Hennes & Mauritz with our comprehensive financial health report here.

Munters Group (OM:MTRS)

Overview: Munters Group AB (publ) offers climate solutions both in Sweden and internationally, with a market cap of SEK35.38 billion.

Operations: The company generates revenue through its Air Tech segment at SEK8.05 billion, Food Tech at SEK2.63 billion, and Data Center Technologies at SEK3.94 billion.

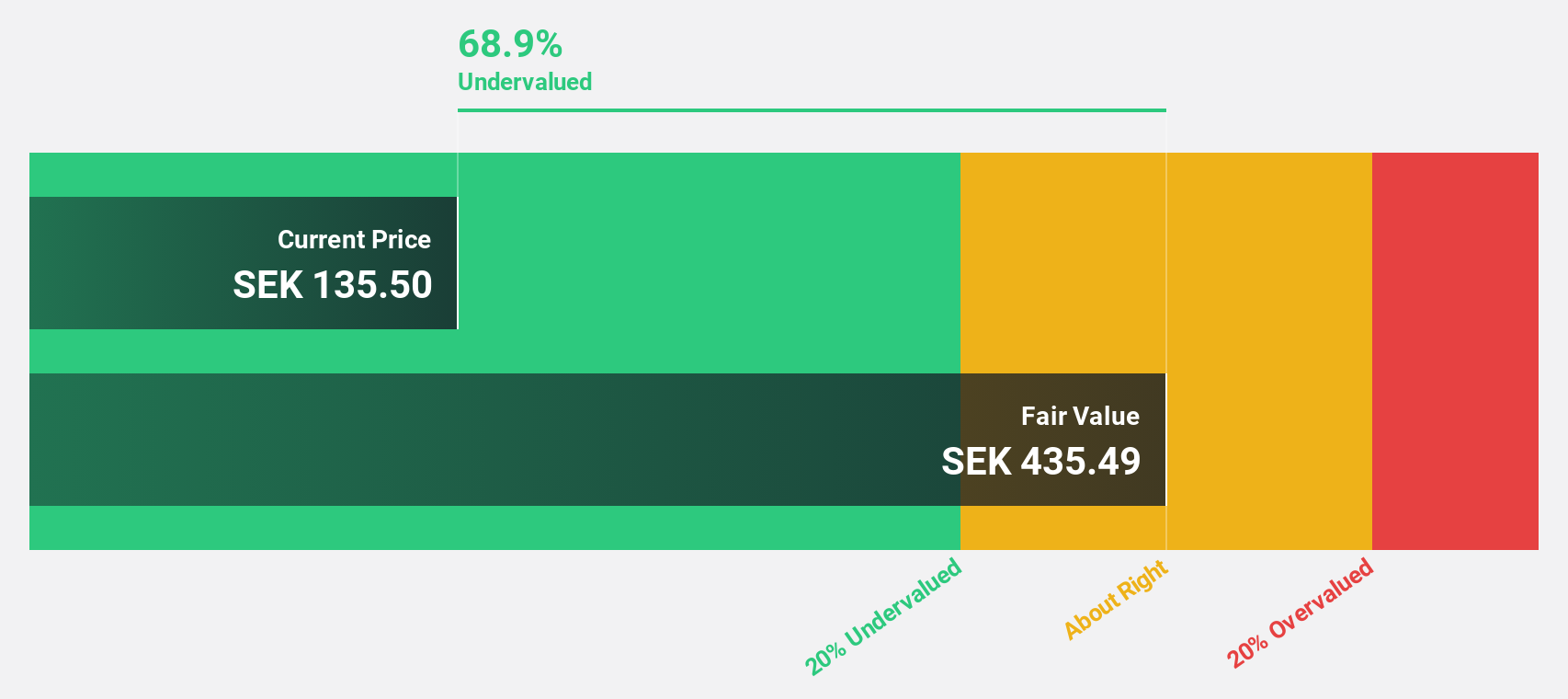

Estimated Discount To Fair Value: 10.9%

Munters Group's stock, priced at SEK 193.8, is trading below its estimated fair value of SEK 217.56, suggesting undervaluation based on cash flows. Recent strategic alliances aim to enhance cooling efficiency for AI applications, potentially boosting future revenue growth forecasted at 10.9% annually—outpacing the Swedish market average. Despite high debt levels, earnings are expected to grow significantly at 27.3% per year over the next three years, supported by recent profit growth of 11.5%.

- The growth report we've compiled suggests that Munters Group's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Munters Group stock in this financial health report.

Summing It All Up

- Gain an insight into the universe of 46 Undervalued Swedish Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H & M Hennes & Mauritz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HM B

H & M Hennes & Mauritz

Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives