In March 2025, the European market is navigating a complex landscape characterized by concerns over U.S. trade tariffs, economic growth uncertainties, and fluctuating monetary policies. Despite these challenges, high growth tech stocks in Europe continue to attract attention as investors seek opportunities that align with resilient business models and innovative capabilities capable of weathering broader market volatility.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| CD Projekt | 30.55% | 39.06% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Devyser Diagnostics | 26.50% | 94.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Oryzon Genomics (BME:ORY)

Simply Wall St Growth Rating: ★★★★★☆

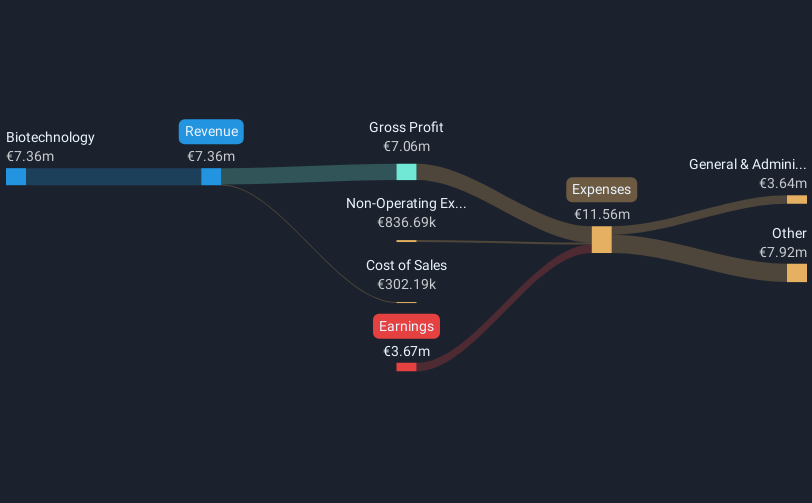

Overview: Oryzon Genomics S.A. is a clinical stage biopharmaceutical company focused on developing epigenetics-based therapeutics for cancer and CNS disorders, with a market cap of €228.43 million.

Operations: Oryzon Genomics focuses on the discovery and development of epigenetics-based therapeutics targeting cancer and CNS disorders. As a clinical stage biopharmaceutical company, it does not currently report revenue from product sales.

Oryzon Genomics is making significant strides in the biotech sector, particularly in precision medicine for psychiatric and neurodevelopmental disorders. Recently, Oryzon announced positive outcomes from Phase IIa trials of vafidemstat in various psychiatric conditions and is advancing this promising drug into a Phase III trial for Borderline Personality Disorder, with FDA discussions set for the first half of 2025. This progression underscores Oryzon's commitment to addressing unmet medical needs through innovative therapies. Furthermore, the company's recent presentation at BIO-Europe Spring and its continuous R&D efforts highlight its potential to impact future treatments significantly. With an annual revenue growth forecast at 52% and earnings expected to surge by approximately 54%, Oryzon exemplifies a dynamic player within Europe’s high-growth tech landscape.

- Navigate through the intricacies of Oryzon Genomics with our comprehensive health report here.

Gain insights into Oryzon Genomics' past trends and performance with our Past report.

BioGaia (OM:BIOG B)

Simply Wall St Growth Rating: ★★★★☆☆

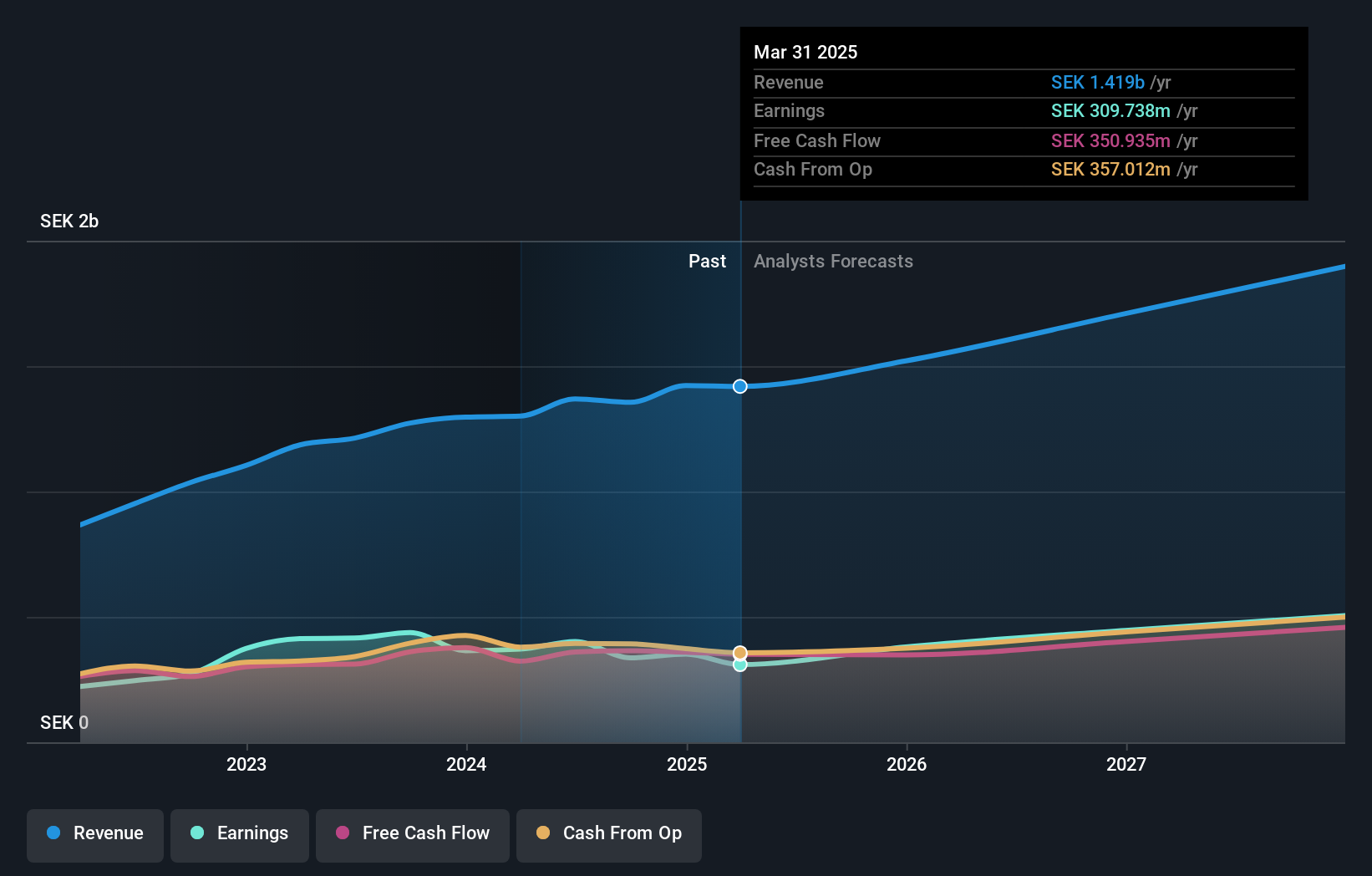

Overview: BioGaia AB (publ) is a healthcare company that develops and sells probiotic products globally, with a market capitalization of SEK11.83 billion.

Operations: The company generates revenue primarily from its Pediatrics segment, contributing SEK 1.09 billion, followed by the Adult Health segment at SEK 321.29 million.

BioGaia, a Swedish biotech firm, has recently demonstrated robust financial performance with its Q4 sales surging by 23% to SEK 365 million and operating profit increasing by 28% to SEK 103 million. This growth is underpinned by an annual revenue increase of 10.9% and earnings growth forecasted at 15% per year, outpacing the Swedish market averages significantly. The company's strategic move to directly manage its operations in France reflects a proactive approach in tapping into the growing health-conscious consumer base there, leveraging its reputation for high-quality probiotics. These developments suggest BioGaia is effectively capitalizing on niche market trends while maintaining strong financial health.

- Click here to discover the nuances of BioGaia with our detailed analytical health report.

Assess BioGaia's past performance with our detailed historical performance reports.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★☆☆

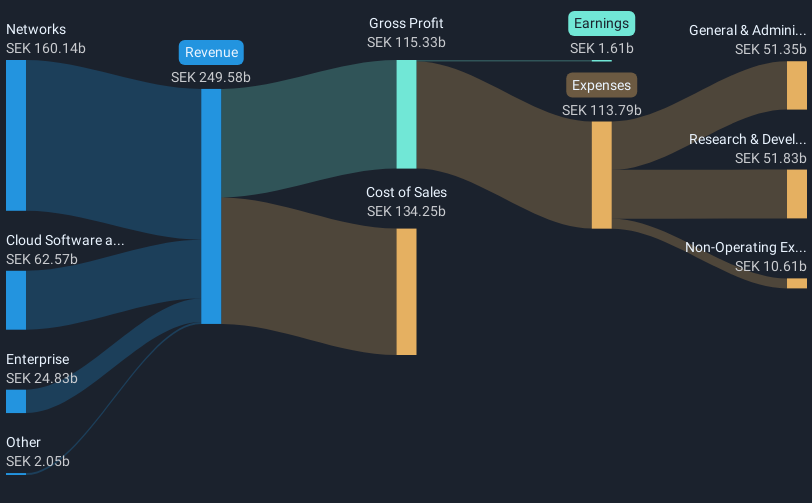

Overview: Telefonaktiebolaget LM Ericsson (publ) is a company that offers mobile connectivity solutions to communications service providers, enterprises, and the public sector, with a market capitalization of approximately SEK278.13 billion.

Operations: Ericsson generates revenue primarily from its Networks segment, which accounts for SEK158.21 billion, followed by Cloud Software and Services at SEK62.64 billion, and Enterprise at SEK24.86 billion. The company's business model focuses on providing mobile connectivity solutions to various sectors including communications service providers and enterprises.

Telefonaktiebolaget LM Ericsson, a stalwart in telecommunications, is making significant strides in leveraging advanced technologies like AI and 5G. With its recent strategic alliances, including a notable partnership with Volvo Group and Bharti Airtel to explore Extended Reality and Digital Twin technologies, Ericsson is at the forefront of industrial digital transformation. This collaboration aims to enhance manufacturing processes and workforce training through the integration of 5G's ultra-low latency capabilities. Financially, Ericsson has demonstrated robust growth with a notable increase in earnings forecasted at an impressive 47% annually. Despite moderate revenue growth projections at 1.9% per year, the company's commitment to R&D remains strong, ensuring sustained innovation and competitiveness in the high-tech industry landscape.

Key Takeaways

- Click here to access our complete index of 243 European High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ORY

Oryzon Genomics

A clinical stage biopharmaceutical company, engages in the discovery and development of epigenetics-based therapeutics for patients with cancer and CNS (central nervous system) disorders.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives