Exploring Three High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a degree of volatility, with U.S. stocks giving back some gains amid uncertainties surrounding the incoming Trump administration's policies and their potential impact on corporate earnings, as well as shifts in inflation expectations and interest rates. As investors navigate these complex market dynamics, identifying high-growth tech stocks that demonstrate strong fundamentals and resilience can be an essential strategy for enhancing portfolio potential in such uncertain times.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.90% | 42.65% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.75% | 72.43% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1309 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★★☆

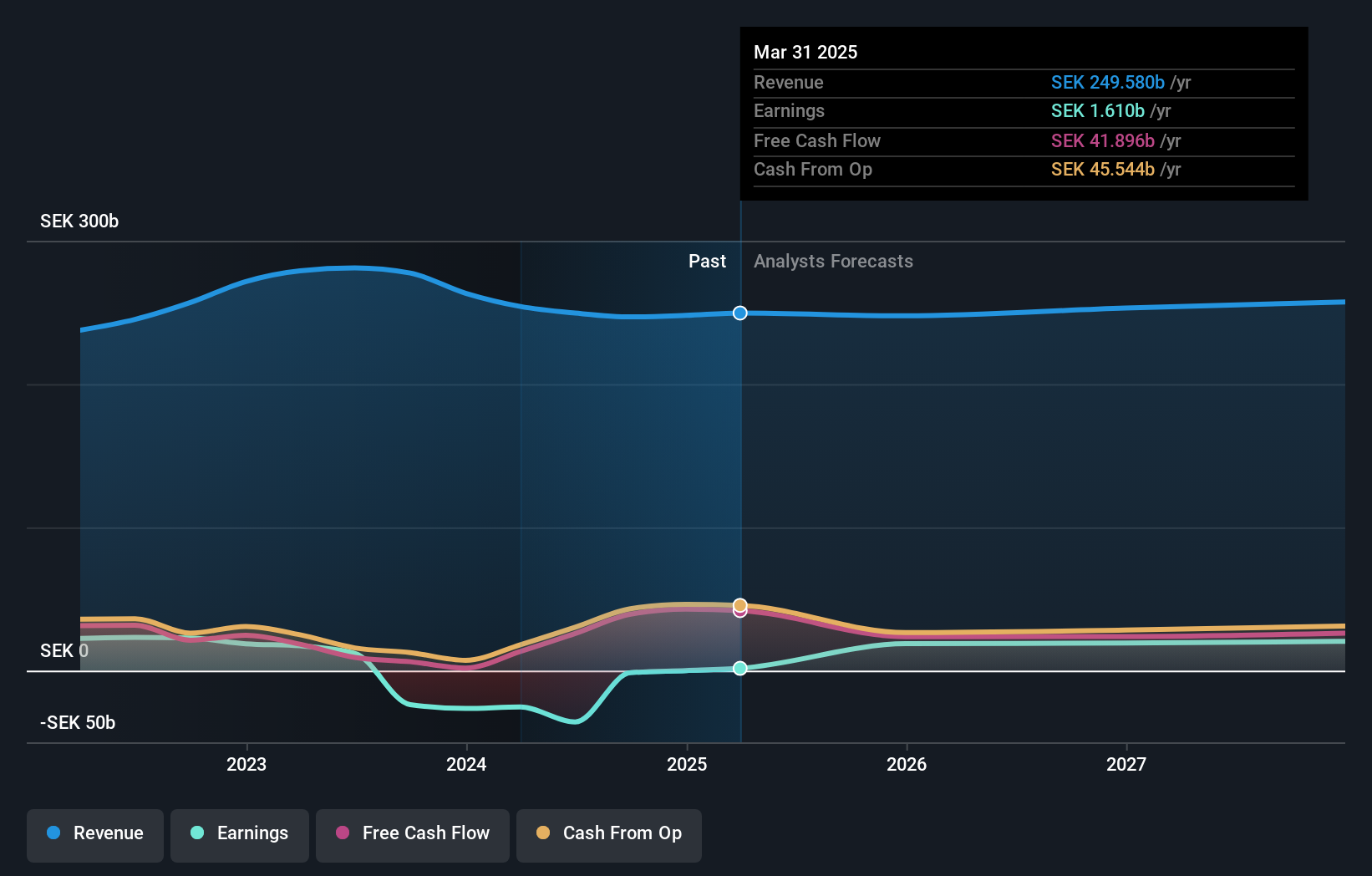

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions for telecom operators and enterprise customers across multiple regions worldwide, with a market cap of approximately SEK295.20 billion.

Operations: Ericsson generates revenue primarily from its Networks segment, which accounts for SEK156.41 billion, followed by Cloud Software and Services at SEK62.74 billion, and Enterprise at SEK25.47 billion. The company serves telecom operators and enterprise clients across diverse global regions including North America, Europe, Latin America, the Middle East, Africa, Asia-Pacific regions such as North East Asia and South East Asia as well as Oceania and India.

Telefonaktiebolaget LM Ericsson's recent strides in 5G technology underscore its robust commitment to innovation, particularly with the launch of seven 5G Advanced software products aimed at enhancing network performance and user experience. These developments are pivotal as they not only promise to boost CSPs' operational efficiencies but also align with evolving market demands for more dynamic and programmable networks. Moreover, Ericsson's involvement in T-Mobile’s record-breaking 5G SA test using New Radio Dual Connectivity, which achieved unprecedented uplink speeds of 2.2 Gbps, further cements its role in pushing the boundaries of mobile technology. This technological prowess is critical as it supports burgeoning data demands and complex applications like extended reality and live event streaming, ensuring Ericsson remains a key player in the global tech landscape despite a modest revenue growth forecast of 2.1% per year.

Easy Click Worldwide Network Technology (SZSE:301171)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Easy Click Worldwide Network Technology Co., Ltd. operates in the digital advertising and promotion sector with a market cap of CN¥15.35 billion.

Operations: The company generates revenue primarily through its Advertising and Promotion Services, amounting to CN¥2.31 billion.

Easy Click Worldwide Network Technology has demonstrated a notable capacity for growth with a 14.4% annual revenue increase, outpacing the broader Chinese market's expansion. This growth is supported by robust R&D investments, which have surged to represent 25.9% of its revenue, underscoring a deep commitment to innovation and development in tech spaces like AI and software solutions. Additionally, the company's recent earnings report shows a solid performance with net income rising to CNY 194.98 million from CNY 180.79 million year-over-year, reflecting effective operational execution and strategic market positioning despite industry challenges.

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

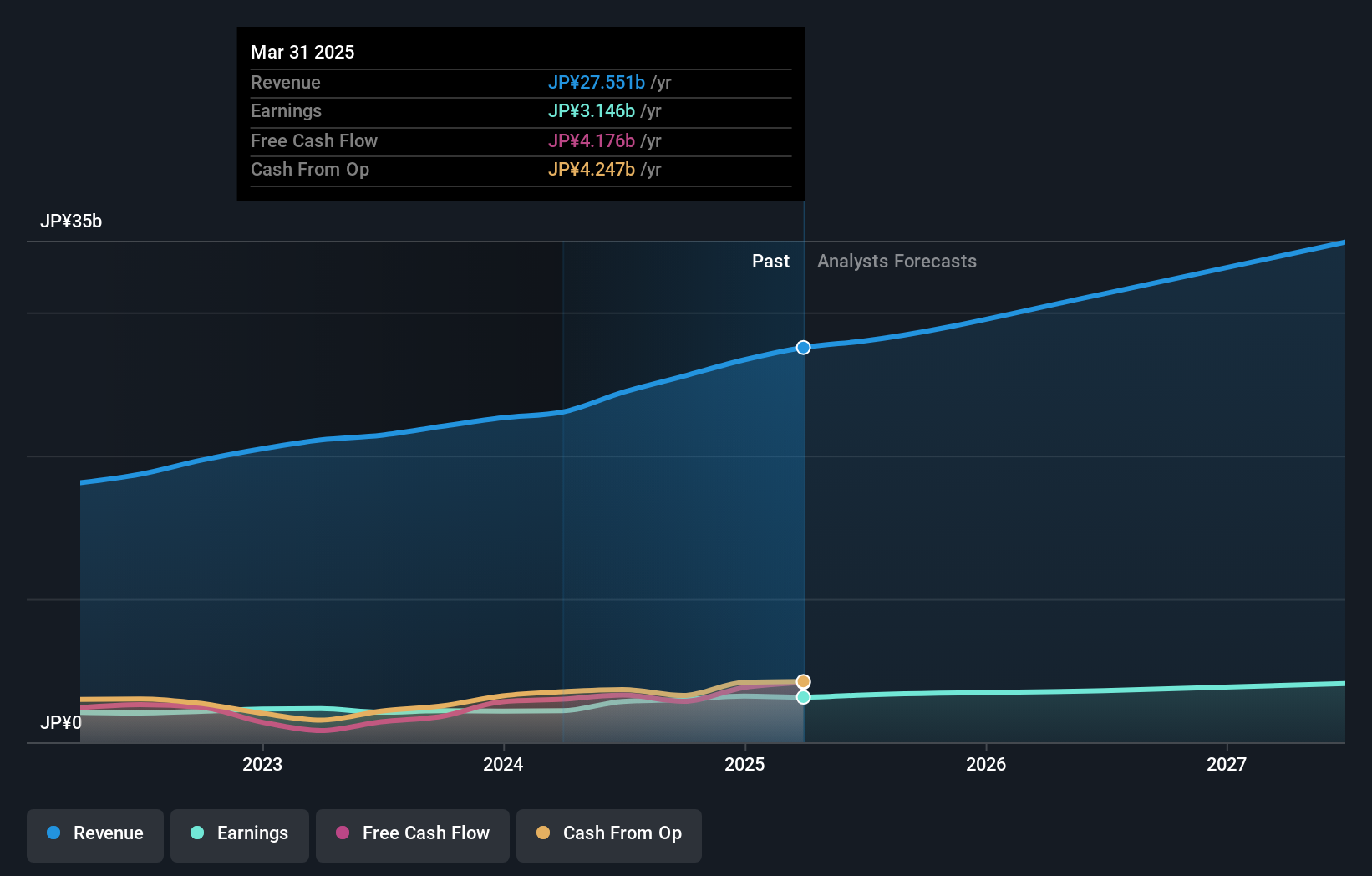

Overview: Avant Group Corporation, with a market capitalization of ¥76.29 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: The company generates revenue primarily through its subsidiaries by offering services in accounting, business intelligence, and outsourcing. Operating within these segments, it leverages specialized expertise to cater to diverse client needs.

Avant Group is capturing attention with its strategic focus on R&D, allocating 18.1% of its revenue to these efforts, a move that not only underscores its commitment to innovation but also positions it well within the competitive tech landscape. This investment has catalyzed a revenue growth forecast at 15.8% annually, outstripping the Japanese market's average of 4.2%. Moreover, recent share repurchases totaling ¥828.93 million reflect a strong confidence in future prospects, further evidenced by an anticipated earnings growth of 18.1% per year. These financial maneuvers are set against a backdrop where Avant has also recently announced an upcoming earnings release for Q1 2025, signaling continued operational momentum and transparency in its fiscal health and strategy execution.

- Dive into the specifics of Avant Group here with our thorough health report.

Examine Avant Group's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Access the full spectrum of 1309 High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Easy Click Worldwide Network Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301171

Easy Click Worldwide Network Technology

Easy Click Worldwide Network Technology Co., Ltd.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives