Exploring High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets experience fluctuations with U.S. stock indexes nearing record highs and inflation data influencing interest rate expectations, small-cap stocks have notably lagged behind larger indices like the S&P 500. In this dynamic environment, investors often seek high growth tech stocks that demonstrate strong potential for portfolio enhancement by capitalizing on technological advancements and market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| AVITA Medical | 30.43% | 54.08% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.81% | 58.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1213 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Telefonaktiebolaget LM Ericsson (OM:ERIC B)

Simply Wall St Growth Rating: ★★★★☆☆

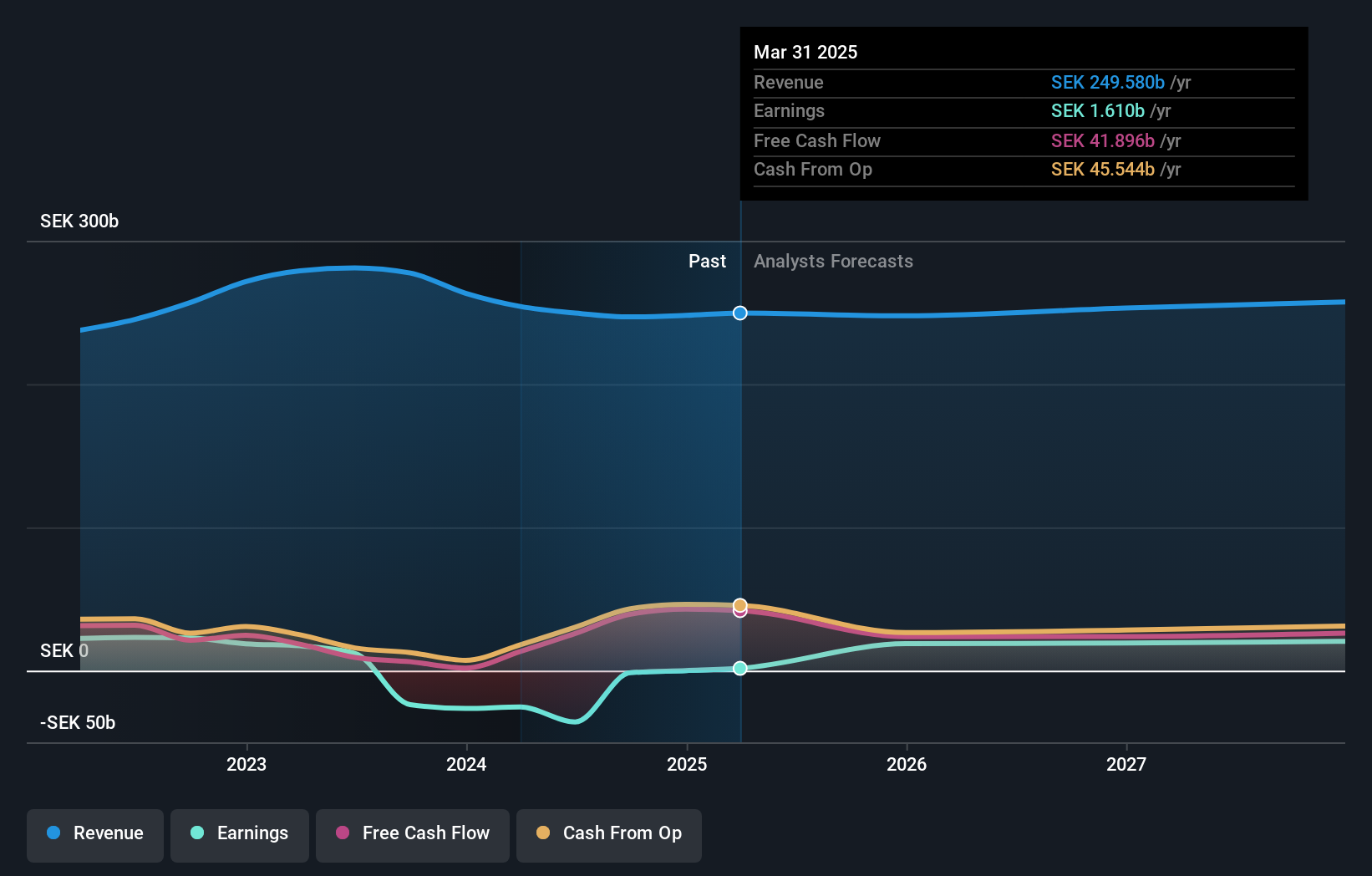

Overview: Telefonaktiebolaget LM Ericsson (publ) offers mobile connectivity solutions to telecom operators and enterprise customers across multiple regions including North America, Europe, Latin America, and Asia, with a market cap of approximately SEK283.19 billion.

Operations: Ericsson generates revenue primarily from its Networks segment, which accounts for SEK158.21 billion, followed by Cloud Software and Services at SEK62.64 billion, and Enterprise at SEK24.86 billion. The company focuses on providing mobile connectivity solutions to telecom operators and enterprise customers across various regions globally.

Ericsson's recent strides in technology, particularly with their expansive rollout of 130 new radio products aimed at open and programmable networks, underscore its aggressive pursuit of innovation in the communications sector. These offerings are set to constitute over two-thirds of their deliveries this year, highlighting a strategic emphasis on adaptable and energy-efficient solutions. Notably, the AIR 3266 model exemplifies this push with significant reductions in energy use and carbon footprint, enhancing both spectral efficiency and uplink performance. Furthermore, Ericsson's introduction of RAN Connect solutions like the 6682 model supports large-scale deployments with impressive throughput capabilities up to 1.2 Tbps. This suite of advancements not only reinforces Ericsson’s commitment to leading next-generation network evolution but also positions it strongly within an increasingly competitive tech landscape where sustainability and efficiency are paramount.

- Navigate through the intricacies of Telefonaktiebolaget LM Ericsson with our comprehensive health report here.

Understand Telefonaktiebolaget LM Ericsson's track record by examining our Past report.

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

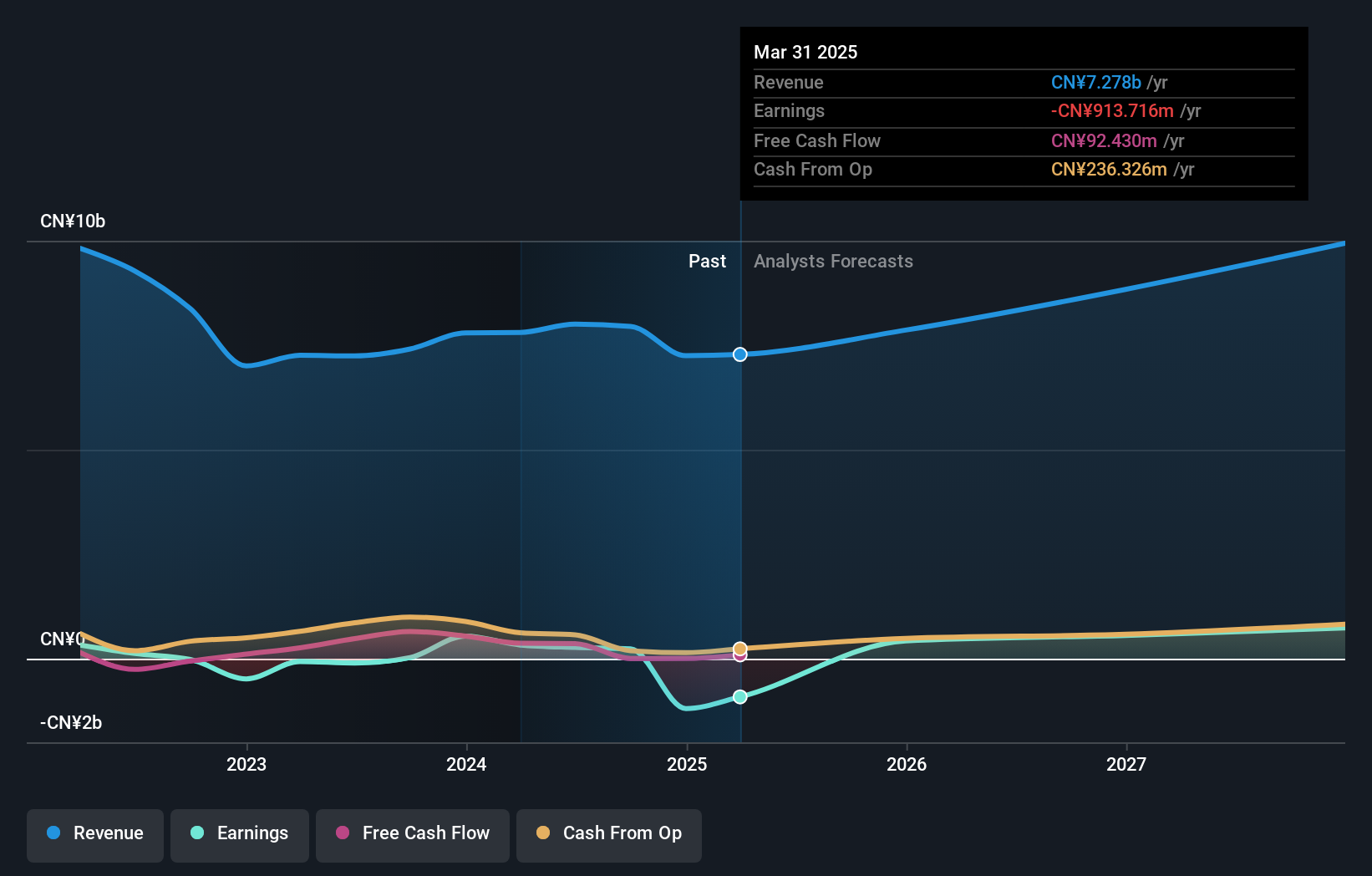

Overview: China Transinfo Technology Co., Ltd. operates in the transportation, Internet of Things, big data, and artificial intelligence sectors with a market capitalization of CN¥17.13 billion.

Operations: The company focuses on providing solutions across transportation, IoT, big data, and AI sectors. It leverages these technologies to enhance operational efficiencies and optimize infrastructure management.

China Transinfo Technology has demonstrated a robust trajectory in the tech sector, with earnings forecasted to burgeon by an impressive 58.1% annually. This growth rate notably surpasses the broader Chinese market's average of 25.1%, positioning it favorably against its peers. The firm's commitment to innovation is evident in its R&D spending, which has been strategically increased to foster further technological advancements, though specific figures were not provided. Moreover, with a revenue increase of 14.7% per year, China Transinfo outpaces the market growth rate of 13.3%, underscoring its effective expansion strategies and operational efficiency in a competitive landscape.

Hytera Communications (SZSE:002583)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hytera Communications Corporation Limited offers communications technologies and solutions globally under the Hytera brand, with a market cap of CN¥25.91 billion.

Operations: Hytera Communications focuses on providing communications technologies and solutions both in China and internationally. The company's revenue streams are primarily derived from its range of communication products and services, catering to various sectors.

Hytera Communications has been actively expanding its technological portfolio, as evidenced by its recent showcase at MWC25 and the launch of the DS-6250S base station, signaling robust product innovation. Despite facing legal challenges with a guilty plea for misappropriating trade secrets from Motorola Solutions, Hytera's commitment to advancing communication technologies remains evident. The company's R&D focus is particularly notable in its development of mission-critical devices and digital evidence management solutions tailored for public safety and industrial sectors. This strategic emphasis on high-demand tech segments could potentially offset some of the reputational risks posed by ongoing legal proceedings.

- Unlock comprehensive insights into our analysis of Hytera Communications stock in this health report.

Gain insights into Hytera Communications' past trends and performance with our Past report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1213 companies within our High Growth Tech and AI Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002373

China Transinfo Technology

Engages in the transportation, Internet of Things, big data, and artificial intelligence businesses.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives