- Sweden

- /

- Communications

- /

- OM:ERIC B

Ericsson (OM:ERIC B): Valuation in Focus Following Major 5G Network Expansion Deal with Telia

Reviewed by Simply Wall St

Telefonaktiebolaget LM Ericsson (OM:ERIC B) just secured a new four-year agreement with Telia Company to extend its Radio Access Network partnership throughout Sweden, Norway, Lithuania, and Estonia. This move strengthens Ericsson's leadership in mobile network technology and advances the rollout of next-generation communications infrastructure.

See our latest analysis for Telefonaktiebolaget LM Ericsson.

Momentum appears to be picking up for Telefonaktiebolaget LM Ericsson, with the stock notching up a 25.7% gain in share price over the past 90 days, and its total shareholder return climbing 10.2% for the year. Recent moves, including a leadership transition on the executive team, ongoing presentations at high-profile tech conferences, and the Telia partnership extension, are fueling perceptions that Ericsson is positioning itself for longer-term growth.

If major telecom deals spark your interest, it could be time to see what other innovative players are out there. Explore See the full list for free..

With shares climbing and major strategic wins secured, investors now face a crucial question: is Ericsson trading at a discount to its potential, or is the market already factoring in the company’s future growth trajectory?

Most Popular Narrative: 6.6% Overvalued

Telefonaktiebolaget LM Ericsson's most widely followed narrative suggests that the stock's fair value sits slightly below its most recent close, which could be a red flag for bargain hunters seeking a major upside. The market appears to be weighing both margin improvements and muted growth projections. This creates an opportunity to take a closer look at what drives this valuation call.

Expansion of AI-powered applications and edge compute is expected to significantly boost network data traffic, requiring further buildout and modernization of telecom infrastructure where Ericsson has strong product and R&D positioning. This provides a long-term tailwind to both revenues and gross margins. Ongoing digital transformation across multiple sectors (including defense, mission-critical services, and industrial automation) is opening high-margin enterprise and private network opportunities for Ericsson, which should improve revenue diversification and margin profiles over time.

Want to know the growth blueprint behind this value call? The narrative centers on a future profit strategy tied to margin strength and technology shifts. Curious how bullish financial assumptions tip the scales in this popular outlook? Click through and see the exact numbers hidden behind the headline commentary.

Result: Fair Value of $87.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including intensifying geopolitical tensions and competition, which could pressure Ericsson’s margins and put revenue growth targets at risk.

Find out about the key risks to this Telefonaktiebolaget LM Ericsson narrative.

Another View: What Do the Numbers Say?

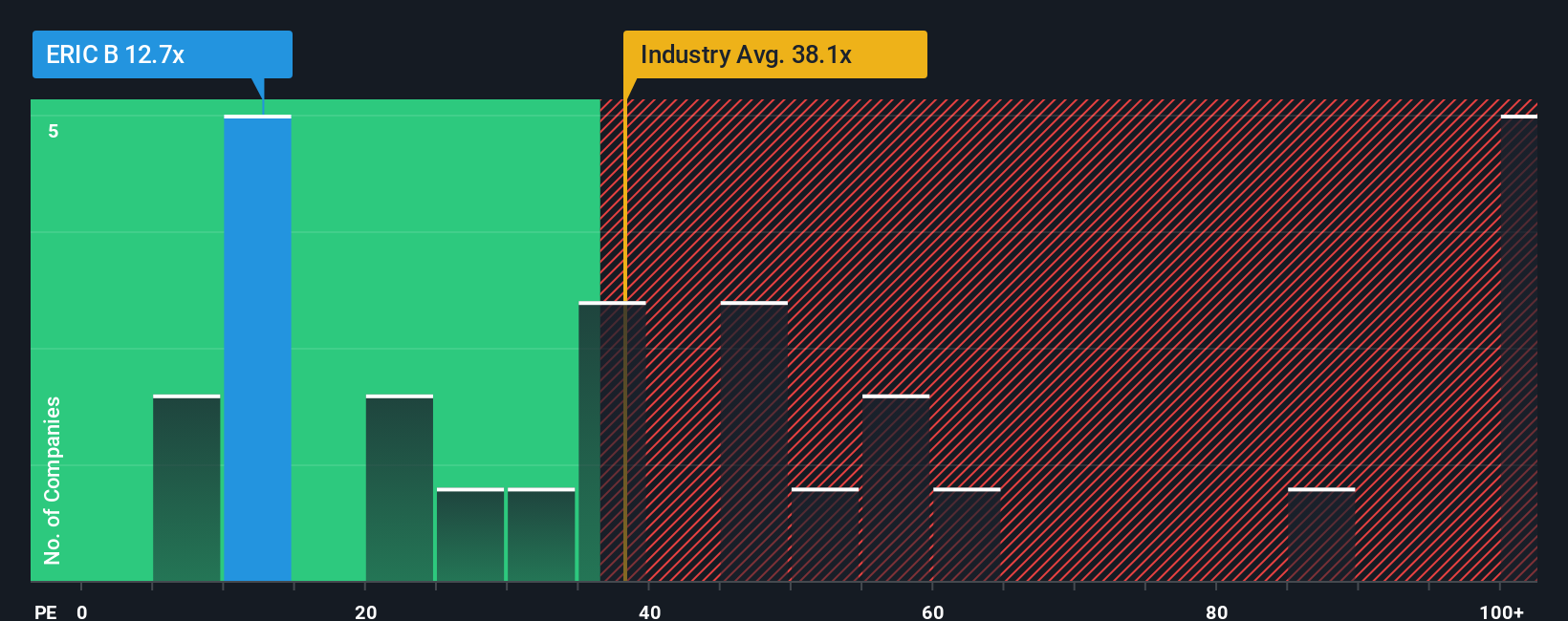

Looking at Ericsson through traditional price-to-earnings lenses, the stock appears inexpensive. Its P/E ratio stands at 12.6x, which is far below both the European sector average of 38.7x and the peer average of 43.5x. The market’s fair ratio estimate is 24.4x. Is the current low valuation a signal of overlooked opportunity or a warning about possible risks ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Telefonaktiebolaget LM Ericsson Narrative

If you see the story differently or want to dig into the details yourself, you can shape your own perspective in just a few minutes, Do it your way.

A great starting point for your Telefonaktiebolaget LM Ericsson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself the advantage by expanding your portfolio and targeting fresh themes and high-impact opportunities. Don’t let the next big winner pass you by.

- Boost your income by selecting companies with impressive yields using these 16 dividend stocks with yields > 3%, focusing on those that prioritize strong and consistent dividend payments.

- Capitalize on emerging tech by exploring these 25 AI penny stocks driving breakthroughs in automation, data intelligence, and digital transformation.

- Seize opportunities in breakthrough sectors with these 26 quantum computing stocks, revealing businesses that are advancing the boundaries of computing and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telefonaktiebolaget LM Ericsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ERIC B

Telefonaktiebolaget LM Ericsson

Provides mobile connectivity solutions to communications service providers, enterprises, and the public sector.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives