- France

- /

- Entertainment

- /

- ENXTPA:UBI

High Growth Tech Stocks In Europe Featuring Ubisoft Entertainment And Two Others

Reviewed by Simply Wall St

Amidst a backdrop of mixed performance in European markets, with the STOXX Europe 600 Index declining by 1.54% due to geopolitical tensions and economic uncertainties, investors are increasingly focused on identifying high-growth opportunities within the tech sector. In this environment, a good stock is often characterized by its ability to innovate and adapt swiftly to changing market conditions, making it well-positioned to capitalize on emerging trends despite broader market challenges.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| argenx | 21.69% | 26.77% | ★★★★★★ |

| Bonesupport Holding | 29.17% | 58.57% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Ubisoft Entertainment (ENXTPA:UBI)

Simply Wall St Growth Rating: ★★★★☆☆

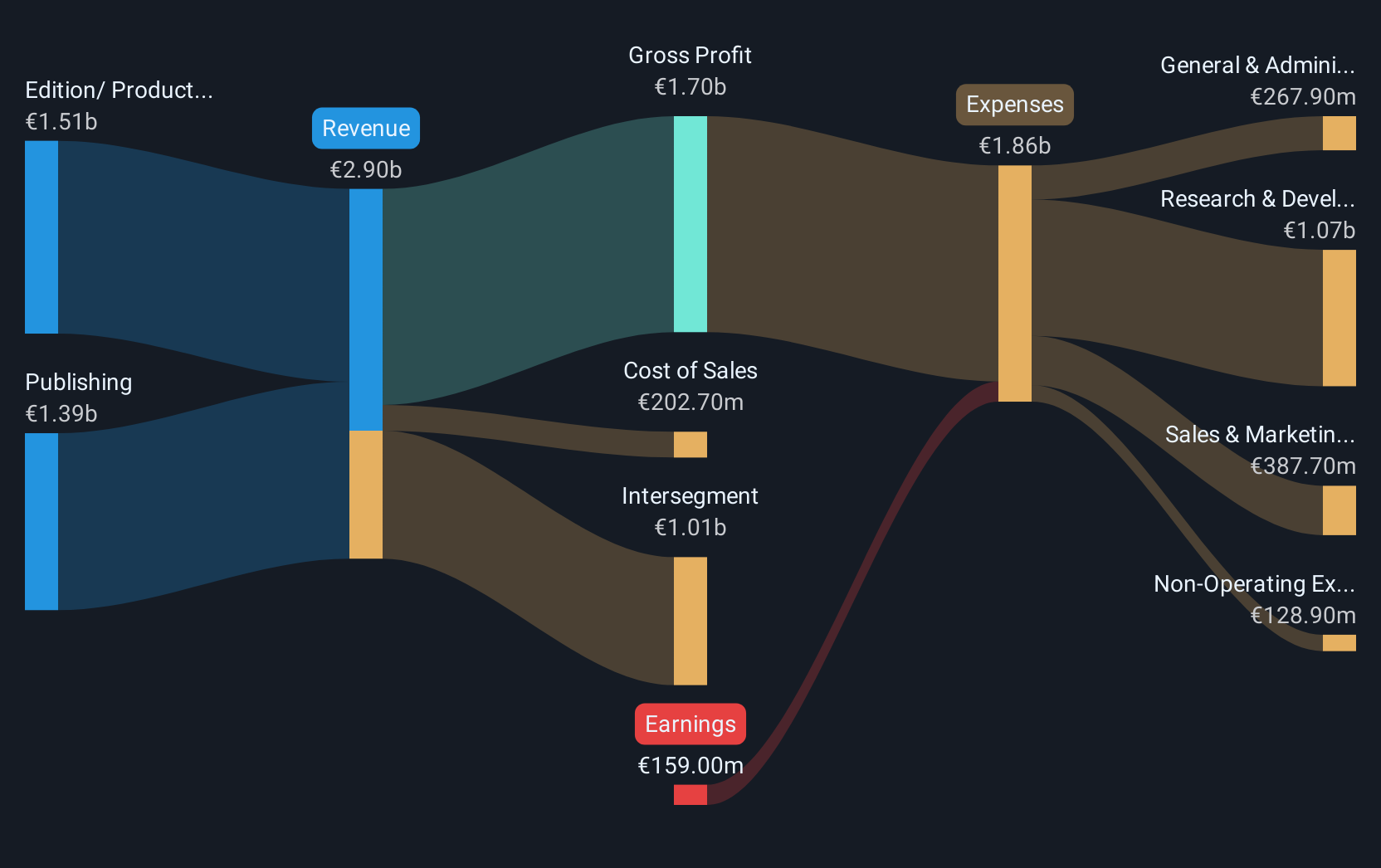

Overview: Ubisoft Entertainment SA is a company that produces, publishes, and distributes video games across various platforms including consoles, PC, smartphones, and tablets in both physical and digital formats globally, with a market cap of approximately €1.23 billion.

Operations: Ubisoft generates revenue primarily from publishing (€1.39 billion) and cloud gaming production (€1.51 billion).

Ubisoft Entertainment SA faces challenges with a net loss of €159 million this year, contrasting sharply with last year's net income of €157.8 million. Despite these hurdles, the company is poised for recovery, forecasting an impressive earnings growth rate of 63.73% annually. This optimism is bolstered by strategic moves like the recent creation of a subsidiary valued at approximately €4 billion, involving major titles such as Assassin’s Creed and Far Cry, with Tencent acquiring a 25% stake for €1.16 billion. This partnership not only injects capital but also potentially expands Ubisoft's market reach in Asia, indicating promising future prospects despite current financial volatility.

- Navigate through the intricacies of Ubisoft Entertainment with our comprehensive health report here.

Gain insights into Ubisoft Entertainment's past trends and performance with our Past report.

Ependion (OM:EPEN)

Simply Wall St Growth Rating: ★★★★☆☆

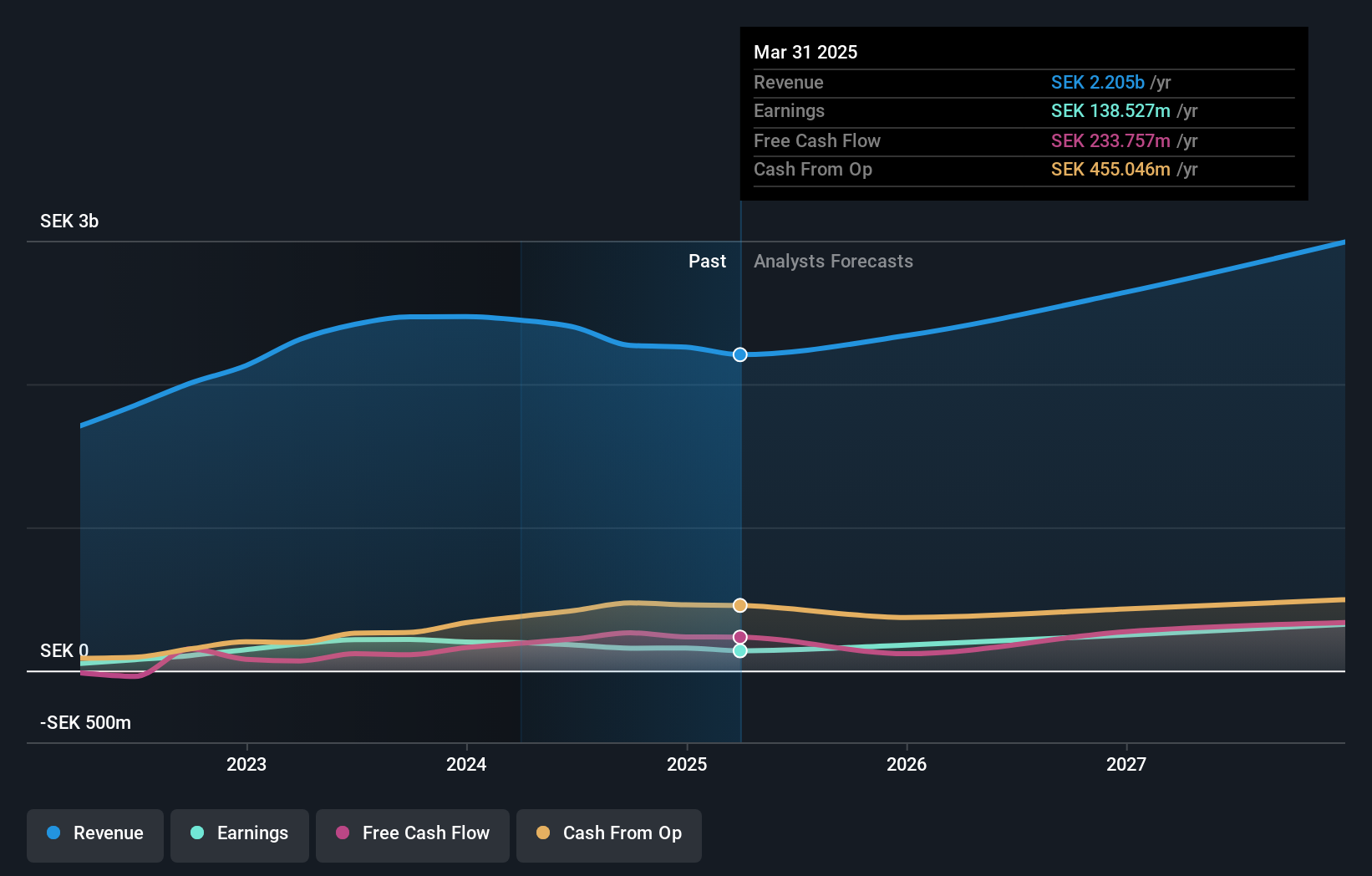

Overview: Ependion AB, with a market cap of SEK3.47 billion, offers digital solutions for secure control, management, visualization, and data communication in industrial applications through its subsidiaries.

Operations: Westermo and Beijer Electronics, including Korenix, are the primary revenue segments for Ependion AB, contributing SEK1.27 billion and SEK935.64 million respectively.

Ependion AB, navigating through a challenging landscape with a recent 9% dip in quarterly sales to SEK 545.06 million, still shows promise with strategic maneuvers such as the acquisition of Welotec and a robust follow-on equity offering raising SEK 300 million. Despite a downturn in net income to SEK 32.01 million from last year's SEK 51.49 million, the firm is poised for significant growth with earnings expected to surge by an annual rate of 30.2%. This optimism is underpinned by Ependion's strong revenue projections growing at an annualized rate of 11.2%, outpacing the Swedish market's growth of 4.2%. With these initiatives, Ependion not only aims to bolster its financial standing but also solidify its position in the high-growth tech sector in Europe.

- Click to explore a detailed breakdown of our findings in Ependion's health report.

Understand Ependion's track record by examining our Past report.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★☆☆

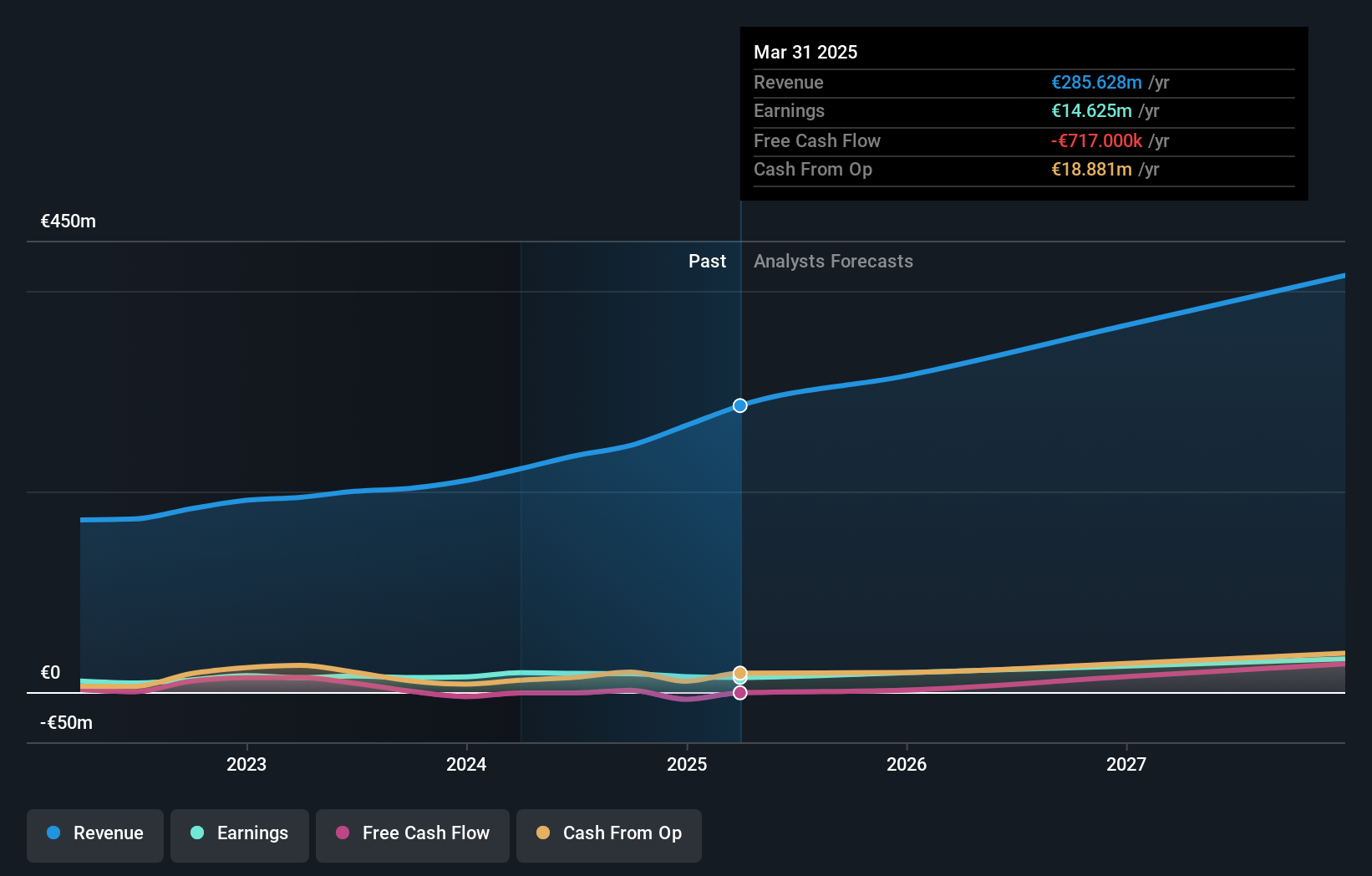

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of approximately €384.18 million.

Operations: The company primarily generates revenue through its wireless communications equipment segment, which accounts for €285.63 million.

Init innovation in traffic systems SE has demonstrated robust growth, with a significant increase in first-quarter sales to €70.41 million from €50.45 million year-over-year, reflecting a 39.5% surge. This performance is underscored by their confirmed financial guidance for 2025, projecting revenues between €300 million and €330 million and EBIT from €30 million to €33 million. Despite a slight dip in net income to €1.56 million from the previous year's €2.4 million, the company's strategic presentations at major international forums such as the ITS Asia Pacific Forum and UITP Global Public Transport Summit highlight its proactive engagement in global markets, potentially bolstering future growth prospects in high-tech European sectors.

Key Takeaways

- Reveal the 228 hidden gems among our European High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:UBI

Ubisoft Entertainment

Produces, publishes, distributes, and operates video games for consoles, PC, smartphones, and tablets in both physical and digital formats in Europe, North America, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives