- Sweden

- /

- Electronic Equipment and Components

- /

- OM:LAGR B

Exploring High Growth Tech Stocks In Europe March 2025

Reviewed by Simply Wall St

Amid ongoing concerns about U.S. trade tariffs and the European Central Bank's cautious stance on interest rates, the pan-European STOXX Europe 600 Index recently faced a decline of 1.23%, reflecting broader market uncertainties and economic growth challenges across the region. In this environment, identifying high-growth tech stocks in Europe involves focusing on companies that demonstrate resilience through innovation, adaptability to changing regulations, and sustainable business models that can thrive despite external pressures.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Bonesupport Holding | 30.48% | 50.17% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| Devyser Diagnostics | 26.50% | 94.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

LINK Mobility Group Holding (OB:LINK)

Simply Wall St Growth Rating: ★★★★☆☆

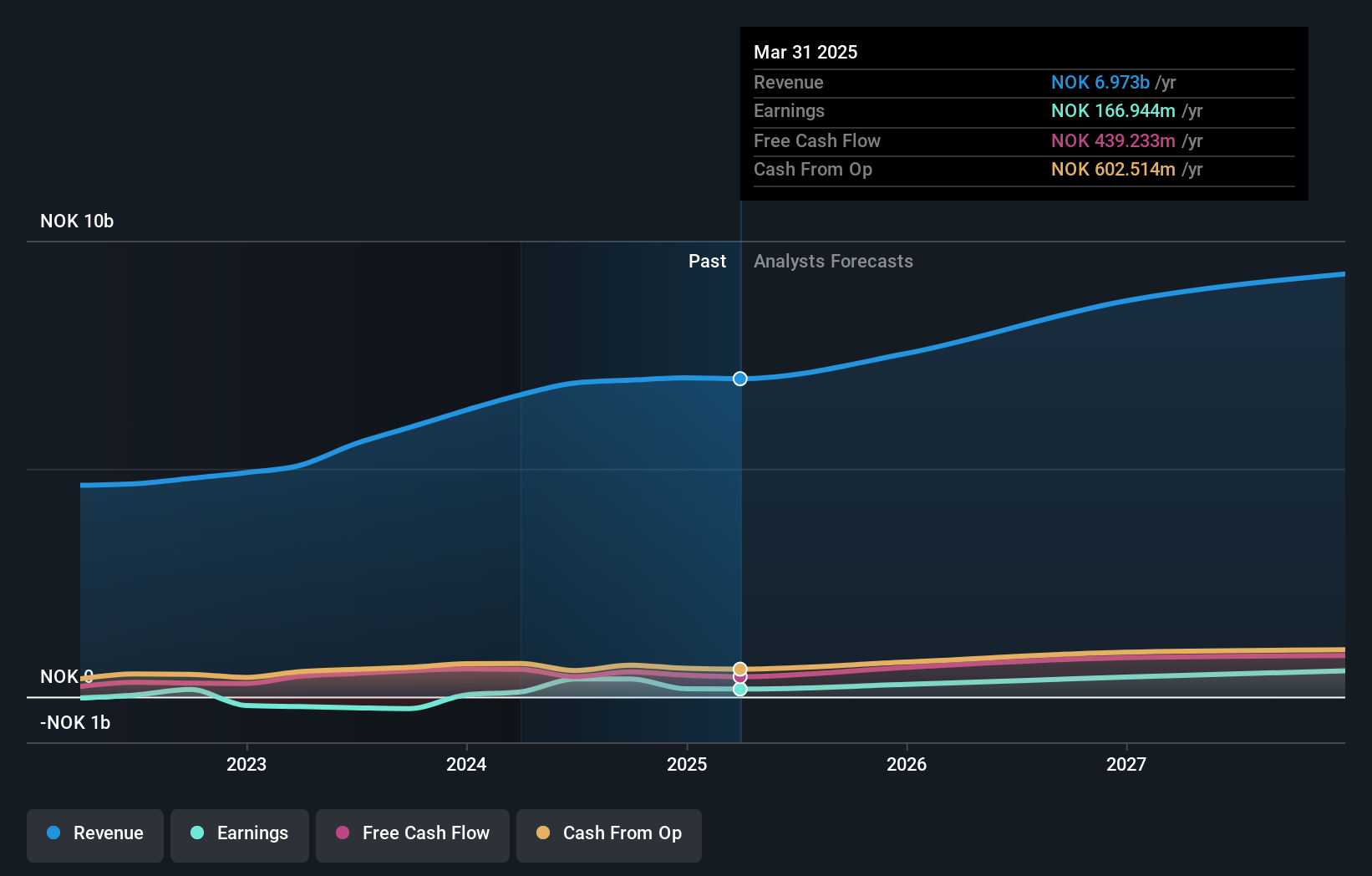

Overview: LINK Mobility Group Holding ASA, with a market cap of NOK6.12 billion, offers mobile and communication-platform-as-a-service solutions through its subsidiaries.

Operations: The company generates revenue from distinct geographical segments, with Western Europe contributing NOK2.11 billion, Central Europe NOK1.69 billion, Northern Europe NOK1.54 billion, and Global Messaging NOK1.66 billion. The diverse geographical presence highlights its strategic focus on providing communication solutions across various regions.

LINK Mobility Group Holding ASA has demonstrated robust performance with a 347% surge in earnings over the past year, significantly outpacing the software industry's growth of 18.6%. This Norwegian tech firm is not just advancing in earnings; its revenue growth forecast at 8.1% annually also exceeds the national market average of 3.3%. Despite facing challenges like a one-off loss of NOK 119.3 million last year, LINK continues to innovate and expand its market presence, evidenced by substantial increases in both sales and net income reported for the full year ended December 31, 2024. With such dynamic financial health and strategic market positioning, LINK is poised to maintain its trajectory amid Europe's competitive tech landscape.

Ependion (OM:EPEN)

Simply Wall St Growth Rating: ★★★★☆☆

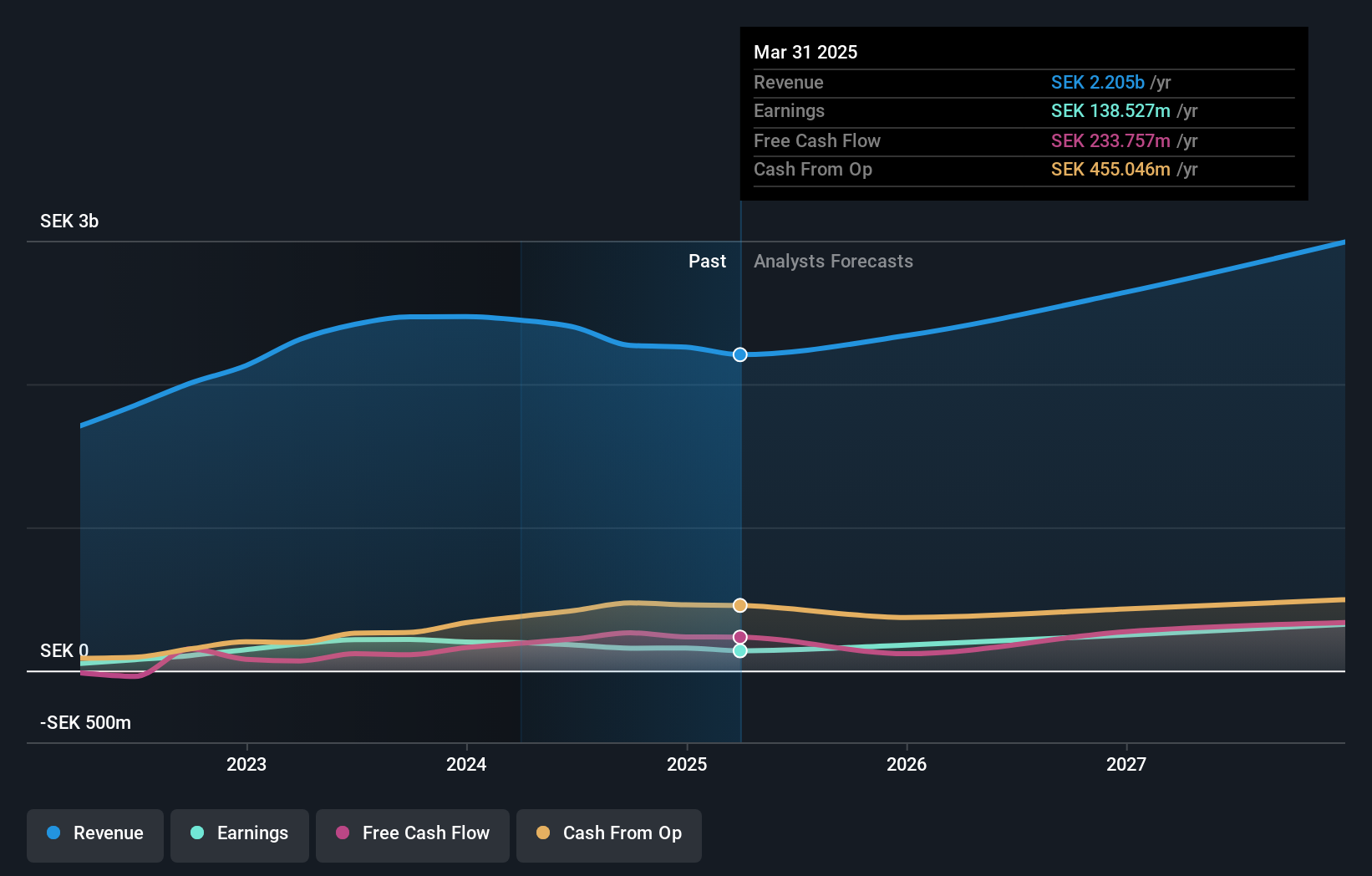

Overview: Ependion AB, with a market cap of SEK3.74 billion, offers digital solutions for secure control, management, visualization, and data communication tailored for industrial applications.

Operations: Westermo and Beijer Electronics, including Korenix, are the primary revenue segments for Ependion AB, contributing SEK1.32 billion and SEK946.32 million respectively.

Ependion AB, a Swedish tech firm, is navigating a complex landscape with its revenue growth forecast at 9.4% annually, outpacing the local market's 0.9%, yet underperforming against broader high-growth benchmarks. Despite a recent dip in earnings by 21.2% last year, the company's earnings are projected to surge by an impressive 24.2% annually over the next three years, signaling potential recovery and robust profit growth ahead. Contributing to this optimistic outlook is Ependion’s strategic focus on R&D investments which align with industry shifts towards more innovative and technologically advanced solutions, ensuring it remains competitive in Europe's tech arena.

- Take a closer look at Ependion's potential here in our health report.

Assess Ependion's past performance with our detailed historical performance reports.

Lagercrantz Group (OM:LAGR B)

Simply Wall St Growth Rating: ★★★★☆☆

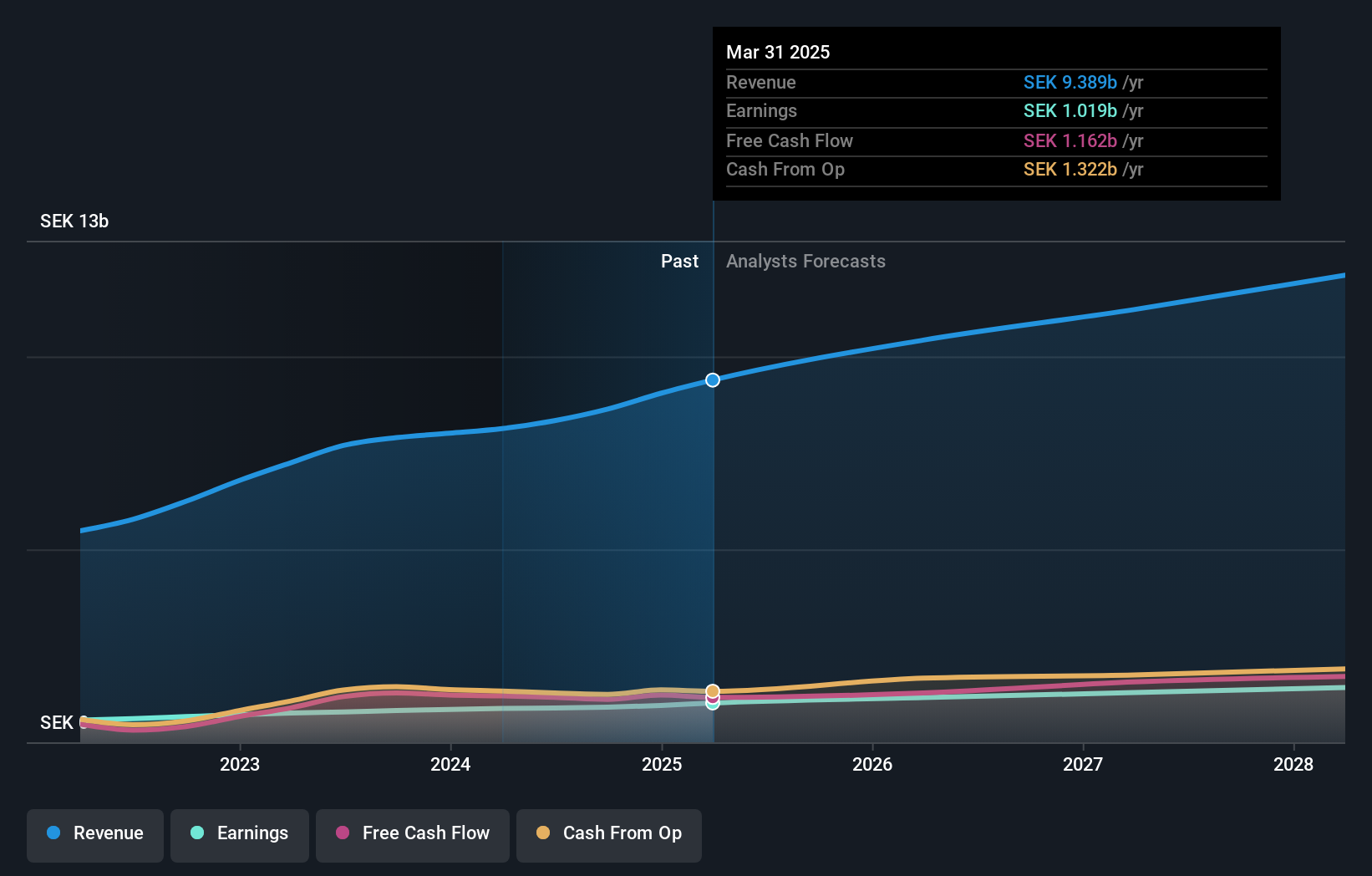

Overview: Lagercrantz Group AB is a technology company that operates through its subsidiaries across Europe, North America, Asia, and internationally, with a market cap of approximately SEK45.09 billion.

Operations: The company's revenue streams are diversified across several segments, with Niche Products contributing SEK2.30 billion and Electrify generating SEK2.17 billion. Tecsec and International segments also play significant roles, bringing in SEK2.14 billion and SEK1.58 billion, respectively, while the Control segment adds SEK898 million to the total revenue mix.

Lagercrantz Group has demonstrated robust financial performance with a significant uptick in sales, escalating from SEK 2,054 million to SEK 2,462 million in the recent quarter and reaching SEK 6,887 million over nine months—an impressive year-over-year growth. This surge is mirrored in net income which rose from SEK 225 million to SEK 267 million quarterly and from SEK 637 million to SEK 713 million over nine months. With earnings per share also increasing from SEK 1.09 to SEK 1.3, Lagercrantz is not only outpacing the Swedish market's modest growth of 0.9% but also exceeding its industry's earnings growth rate of 4.9%. This trajectory suggests Lagercrantz is effectively leveraging its market position and R&D strategies to foster innovation and drive financial success amidst Europe's competitive tech landscape.

- Click here to discover the nuances of Lagercrantz Group with our detailed analytical health report.

Explore historical data to track Lagercrantz Group's performance over time in our Past section.

Turning Ideas Into Actions

- Unlock our comprehensive list of 244 European High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LAGR B

Lagercrantz Group

Operates as a technology company in Sweden, Denmark, Norway, Finland, Germany, the United Kingdom, Benelux, Poland, rest of Europe, North America, Asia, and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives