- Sweden

- /

- Electronic Equipment and Components

- /

- OM:BERNER B

Berner Industrier (STO:BERNER B) jumps 13% this week, though earnings growth is still tracking behind three-year shareholder returns

Generally speaking, investors are inspired to be stock pickers by the potential to find the big winners. Not every pick can be a winner, but when you pick the right stock, you can win big. Take, for example, the Berner Industrier AB (STO:BERNER B) share price, which skyrocketed 317% over three years. It's also good to see the share price up 14% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

Since it's been a strong week for Berner Industrier shareholders, let's have a look at trend of the longer term fundamentals.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

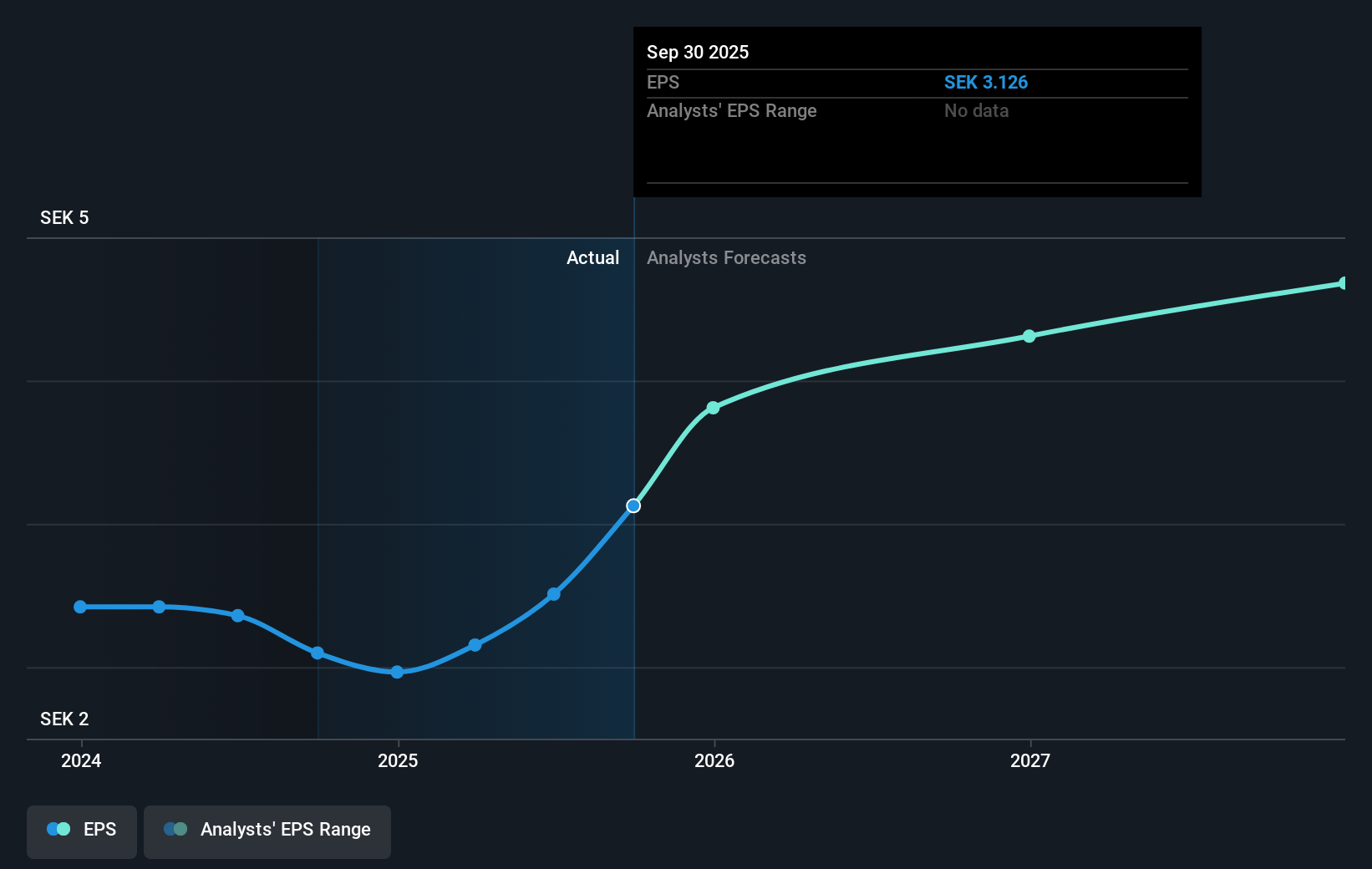

During three years of share price growth, Berner Industrier achieved compound earnings per share growth of 50% per year. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 61% average annual increase in the share price. This suggests that sentiment and expectations have not changed drastically. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Berner Industrier has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Berner Industrier the TSR over the last 3 years was 348%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Berner Industrier has rewarded shareholders with a total shareholder return of 165% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 30% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Berner Industrier better, we need to consider many other factors. Take risks, for example - Berner Industrier has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Berner Industrier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BERNER B

Berner Industrier

Engages in the technology distribution, and energy and environment business in Sweden, Norway, Finland, and Denmark.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success