While Acconeer (STO:ACCON) shareholders have made 230% in 3 years, increasing losses might now be front of mind as stock sheds 11% this week

It's been a soft week for Acconeer AB (publ) (STO:ACCON) shares, which are down 11%. But that doesn't change the fact that the returns over the last three years have been very strong. In fact, the share price is up a full 222% compared to three years ago. To some, the recent share price pullback wouldn't be surprising after such a good run. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

Check out our latest analysis for Acconeer

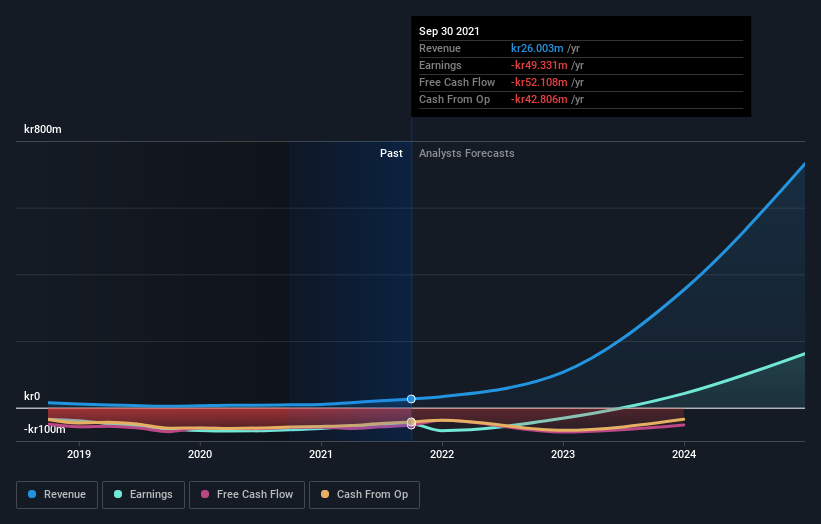

Because Acconeer made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years Acconeer has grown its revenue at 33% annually. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 48% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. Nonetheless, we'd say Acconeer is still worth investigating - successful businesses can often keep growing for long periods.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We've already covered Acconeer's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Acconeer's TSR, at 230% is higher than its share price return of 222%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Acconeer shareholders have gained 145% (in total) over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 49%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Acconeer better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Acconeer (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ACCON

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives