European Growth Stocks With High Insider Ownership Expecting Up To 53% Earnings Growth

Reviewed by Simply Wall St

The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising for a fourth consecutive week amidst hopes of easing trade tensions between China and the U.S. As investors navigate these evolving economic landscapes, stocks with high insider ownership can offer a unique perspective on potential growth opportunities, particularly when insiders are confident enough to maintain significant stakes in their companies.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.4% | 66.1% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 52.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.1% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Ortoma (OM:ORT B) | 27.7% | 69.2% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

We're going to check out a few of the best picks from our screener tool.

ID Logistics Group (ENXTPA:IDL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ID Logistics Group SA offers contract logistics services both in France and internationally, with a market cap of €2.63 billion.

Operations: The company generates revenue from its transportation and trucking segment, amounting to €3.27 billion.

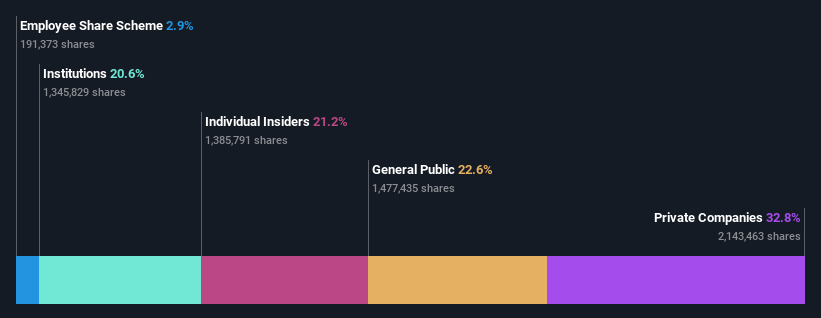

Insider Ownership: 21.2%

Earnings Growth Forecast: 21.7% p.a.

ID Logistics Group shows promising growth potential with expected annual earnings growth of 21.7%, outpacing the French market's 12%. The recent Q1 2025 revenue increase to €867.8 million from €736.3 million last year underscores its upward trajectory. Despite low forecasted return on equity at 12.8%, insider ownership remains a positive factor, though no substantial insider trading occurred recently. Revenue is projected to grow at a steady rate of 8.1% annually, surpassing the market average.

- Click to explore a detailed breakdown of our findings in ID Logistics Group's earnings growth report.

- Our valuation report unveils the possibility ID Logistics Group's shares may be trading at a premium.

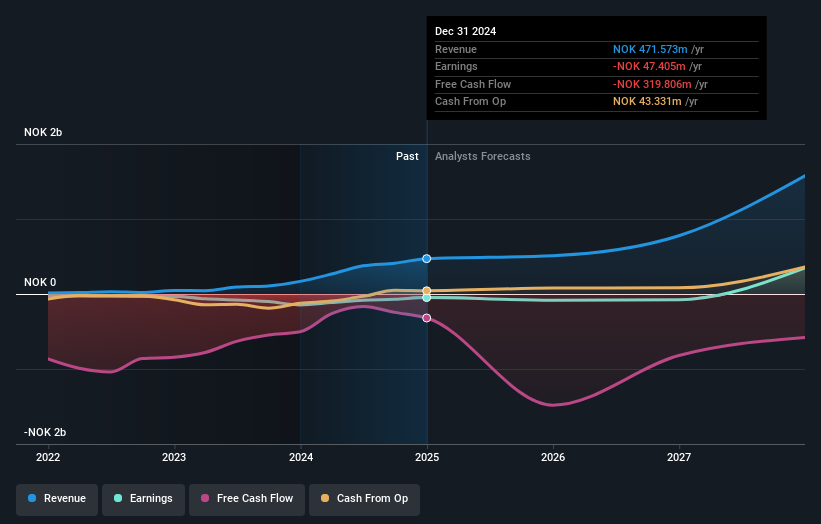

Salmon Evolution (OB:SALME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Salmon Evolution ASA operates as a land-based salmon farming company in Norway and internationally, with a market cap of NOK2.88 billion.

Operations: The company's revenue is primarily derived from its Farming Norway segment, which generated NOK467.74 million.

Insider Ownership: 17%

Earnings Growth Forecast: 53.1% p.a.

Salmon Evolution is poised for significant growth, with revenue projected to expand by 35.4% annually, outpacing the Norwegian market's modest 2.1% growth rate. Analysts anticipate a stock price increase of 44.5%, and the company is expected to achieve profitability within three years, surpassing average market growth rates. Despite a limited cash runway of less than one year and low forecasted return on equity at 12%, insider ownership remains strong with no recent substantial insider trading activity reported.

- Dive into the specifics of Salmon Evolution here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Salmon Evolution is priced higher than what may be justified by its financials.

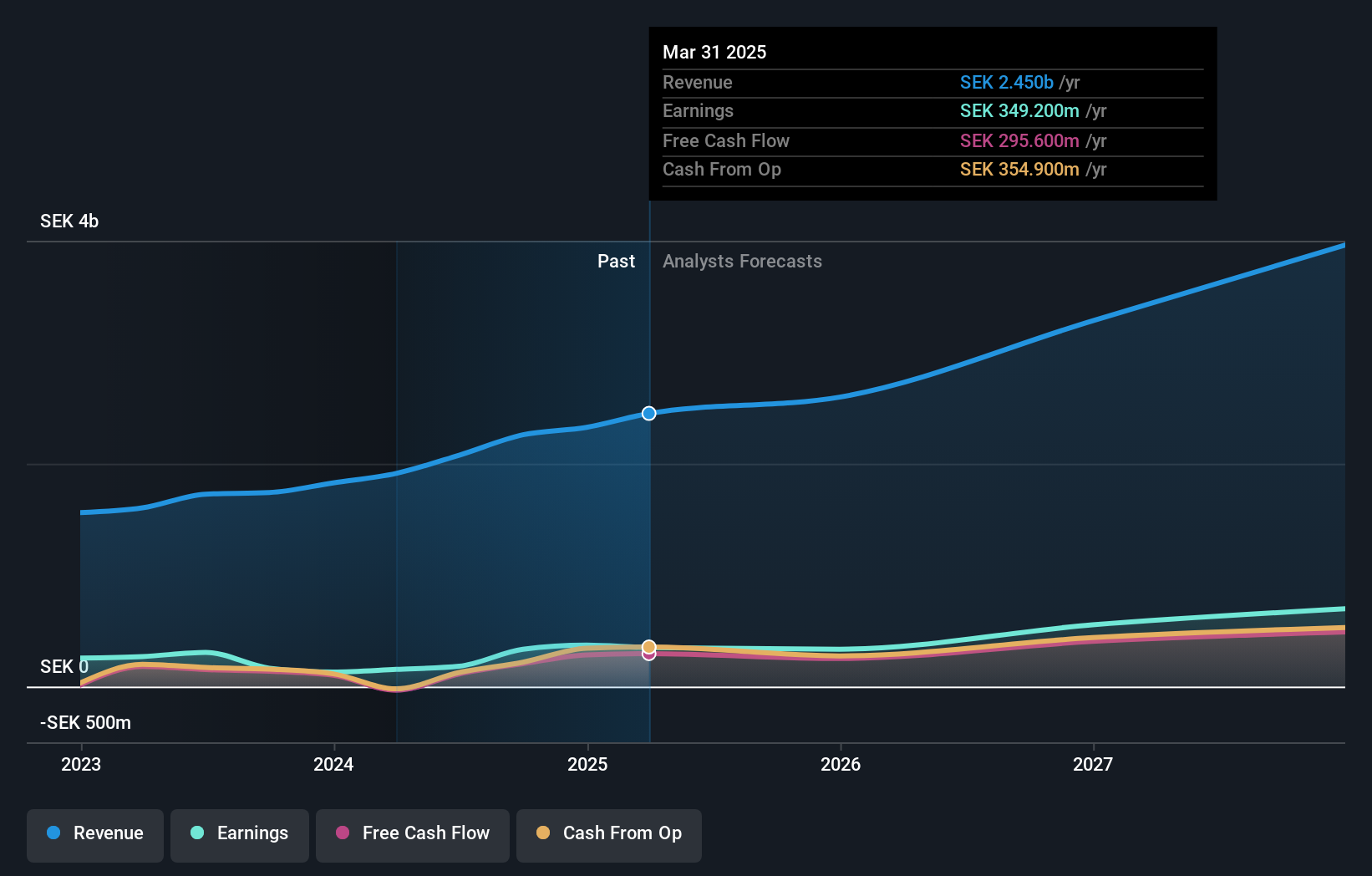

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK16.00 billion.

Operations: The company generates revenue of SEK2.33 billion from its Security Software & Services segment.

Insider Ownership: 36.5%

Earnings Growth Forecast: 25.7% p.a.

Yubico's earnings surged by 184.6% last year, and revenue is forecast to grow at 20.1% annually, outpacing the Swedish market's growth rate. Analysts predict a stock price rise of 42.2%, with earnings expected to grow significantly over the next three years. Recent integration with Intercede and Microsoft enhances Yubico's product offerings in secure authentication systems, potentially driving further growth. Despite no recent substantial insider trading activity, high insider ownership aligns interests with shareholders' long-term goals.

- Delve into the full analysis future growth report here for a deeper understanding of Yubico.

- The analysis detailed in our Yubico valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Dive into all 213 of the Fast Growing European Companies With High Insider Ownership we have identified here.

- Curious About Other Options? Uncover 19 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Salmon Evolution, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SALME

Salmon Evolution

Operates as a land-based salmon farming company in Norway and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives