- Sweden

- /

- Construction

- /

- OM:SWEC B

3 Swedish Stocks Trading At Up To 48.7% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's recent rate cut, European indices have shown mixed results, reflecting cautious investor sentiment. Amid this backdrop, the Swedish market presents unique opportunities for discerning investors seeking undervalued stocks. In today's environment, a good stock often exhibits strong fundamentals and resilience in uncertain economic conditions. Here are three Swedish stocks currently trading up to 48.7% below their intrinsic value that may warrant closer examination.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Concentric (OM:COIC) | SEK221.00 | SEK407.15 | 45.7% |

| Husqvarna (OM:HUSQ B) | SEK68.96 | SEK125.55 | 45.1% |

| Svedbergs Group (OM:SVED B) | SEK42.60 | SEK77.37 | 44.9% |

| Lindab International (OM:LIAB) | SEK284.60 | SEK530.49 | 46.4% |

| Dometic Group (OM:DOM) | SEK58.10 | SEK106.26 | 45.3% |

| Securitas (OM:SECU B) | SEK133.55 | SEK260.22 | 48.7% |

| Mentice (OM:MNTC) | SEK27.90 | SEK50.98 | 45.3% |

| MilDef Group (OM:MILDEF) | SEK83.70 | SEK160.21 | 47.8% |

| BHG Group (OM:BHG) | SEK13.90 | SEK26.27 | 47.1% |

| Lyko Group (OM:LYKO A) | SEK114.20 | SEK214.69 | 46.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Securitas (OM:SECU B)

Overview: Securitas AB (publ) provides security services across North America, Europe, Latin America, Africa, the Middle East, Asia, and Australia with a market cap of SEK76.51 billion.

Operations: The company's revenue segments include SEK68.62 billion from Security Services Europe (Including Mobile & Monitoring), SEK63.72 billion from Securitas North America, and SEK14.67 billion from Securitas Ibero-America.

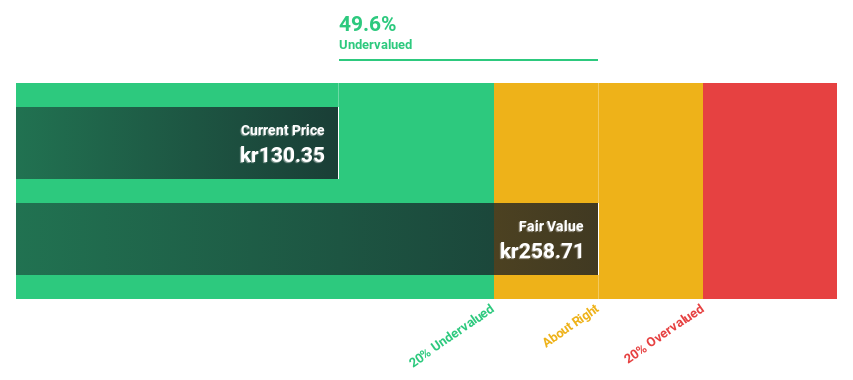

Estimated Discount To Fair Value: 48.7%

Securitas AB appears undervalued based on cash flows, trading at SEK133.55, significantly below its estimated fair value of SEK260.22. Despite a low forecasted Return on Equity (16.6%) and profit margins dropping to 1% from 3% last year, the company's revenue is expected to grow faster than the Swedish market at 3.8% per year. Earnings are projected to grow significantly by 41.26% annually over the next three years, outpacing market growth rates.

- According our earnings growth report, there's an indication that Securitas might be ready to expand.

- Take a closer look at Securitas' balance sheet health here in our report.

Sweco (OM:SWEC B)

Overview: Sweco AB (publ) offers architecture and engineering consultancy services globally and has a market cap of SEK63.13 billion.

Operations: Sweco's revenue segments (in millions of SEK) are as follows: UK: 1.47 billion, Norway: 3.50 billion, Sweden: 8.74 billion, Belgium: 3.97 billion, Denmark: 3.24 billion, Finland: 3.67 billion, Netherlands: 3.00 billion and Germany & Central Europe: 2.71 billion.

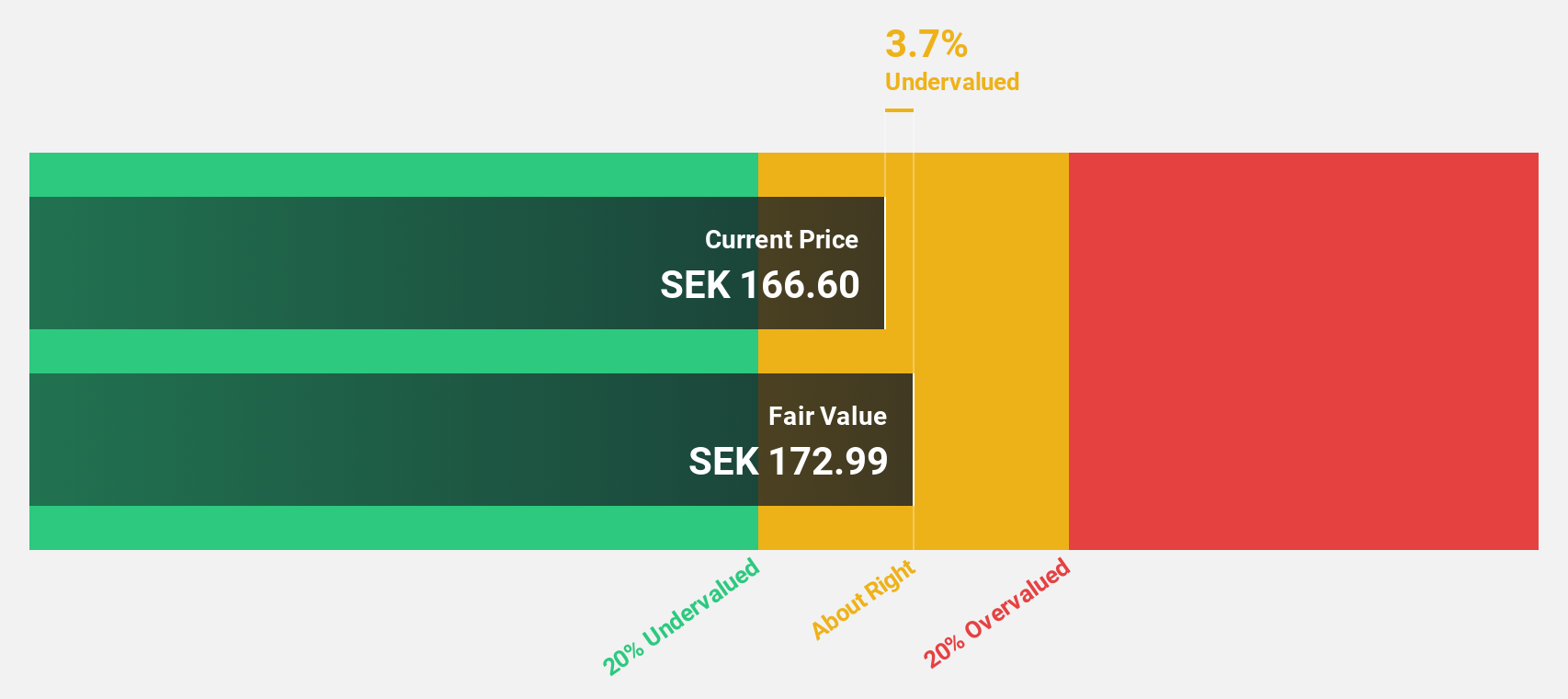

Estimated Discount To Fair Value: 25.4%

Sweco AB appears undervalued based on cash flows, trading at SEK175.5, below its estimated fair value of SEK235.28. Recent earnings reports show solid performance with Q2 sales at SEK8.08 billion and net income rising to SEK540 million. New contracts, including a EUR 4.2 million project for Enifer and a significant rail expansion project worth about SEK400 million, bolster future cash flow prospects despite an unstable dividend track record and moderate revenue growth forecasts (5.5% annually).

- Our expertly prepared growth report on Sweco implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Sweco's balance sheet by reading our health report here.

Yubico (OM:YUBICO)

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK20.88 billion.

Operations: Yubico's revenue from Security Software & Services amounts to SEK2.09 billion.

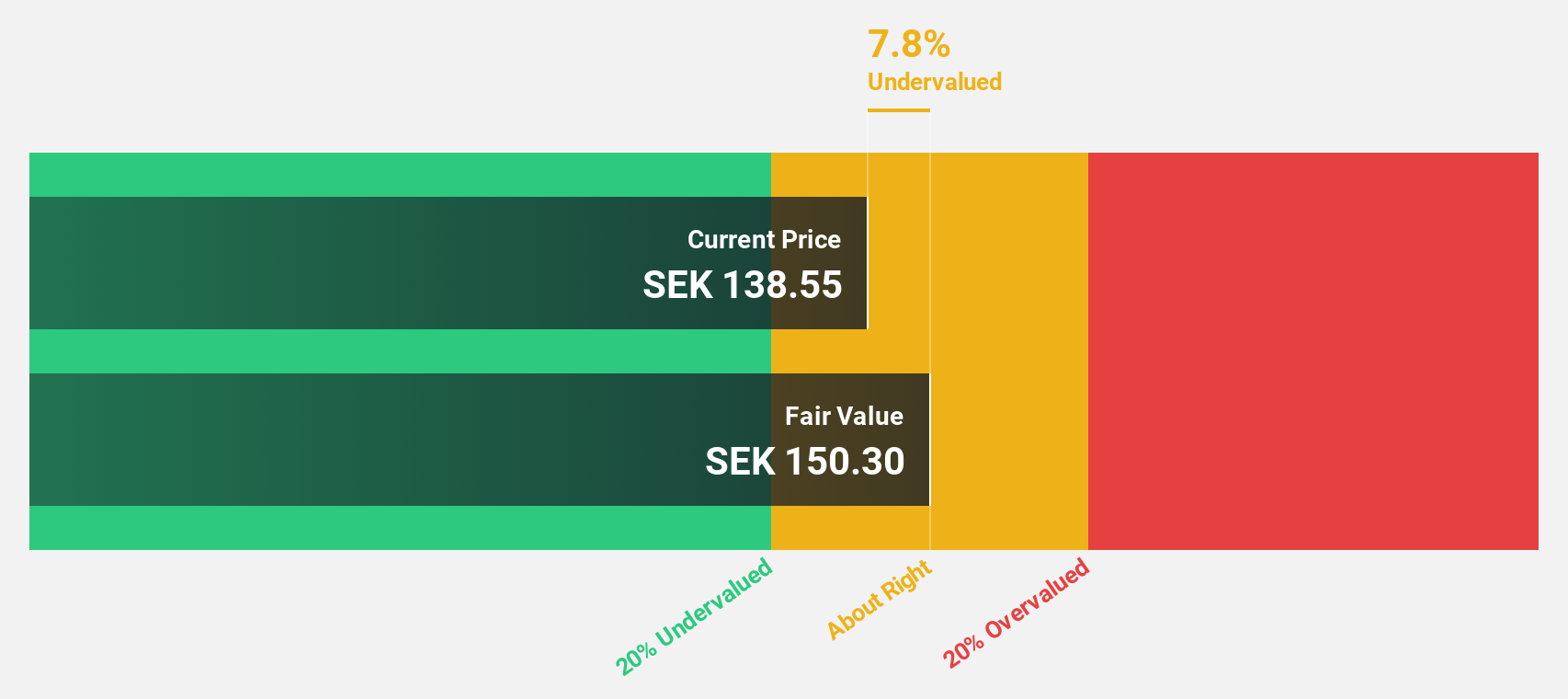

Estimated Discount To Fair Value: 13.1%

Yubico, trading at SEK242.5, is undervalued based on cash flows with an estimated fair value of SEK278.92. Recent earnings show Q2 sales of SEK614.4 million and net income of SEK103.6 million, reflecting solid growth from the previous year. Despite a volatile share price and lower profit margins (9.3% vs 17.8% last year), Yubico's revenue and earnings are forecast to grow significantly faster than the Swedish market, supported by strong product developments like MilSecure Mobile for the U.S Air Force.

- Our growth report here indicates Yubico may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Yubico.

Key Takeaways

- Explore the 41 names from our Undervalued Swedish Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SWEC B

Sweco

Provides architecture and engineering consultancy services worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.