We think Vitec Software Group AB (publ)'s (STO:VIT B) CEO May Struggle To See Much Of A Pay Rise This Year

Key Insights

- Vitec Software Group to hold its Annual General Meeting on 29th of April

- Salary of kr5.06m is part of CEO Olle Backman's total remuneration

- The total compensation is similar to the average for the industry

- Over the past three years, Vitec Software Group's EPS grew by 19% and over the past three years, the total shareholder return was 2.9%

Performance at Vitec Software Group AB (publ) (STO:VIT B) has been reasonably good and CEO Olle Backman has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 29th of April. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for Vitec Software Group

How Does Total Compensation For Olle Backman Compare With Other Companies In The Industry?

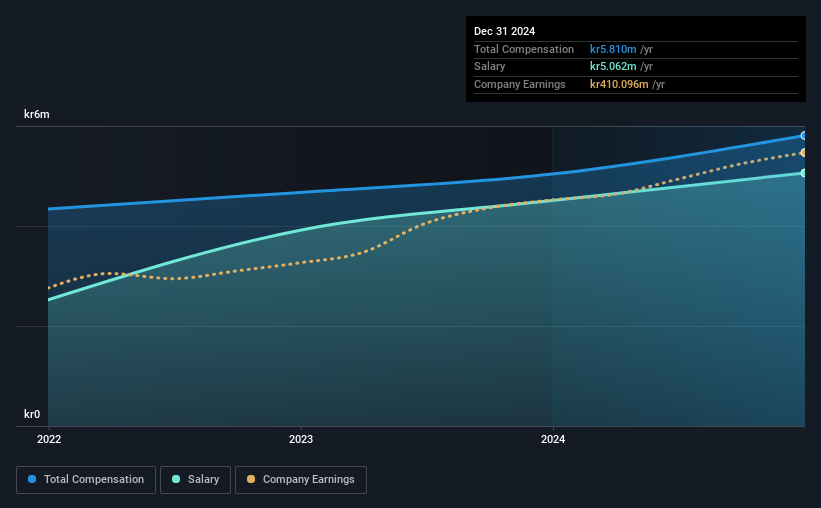

At the time of writing, our data shows that Vitec Software Group AB (publ) has a market capitalization of kr21b, and reported total annual CEO compensation of kr5.8m for the year to December 2024. That's a notable increase of 15% on last year. We note that the salary portion, which stands at kr5.06m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Swedish Software industry with market capitalizations ranging from kr9.6b to kr31b, the reported median CEO total compensation was kr6.4m. From this we gather that Olle Backman is paid around the median for CEOs in the industry. Moreover, Olle Backman also holds kr22m worth of Vitec Software Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr5.1m | kr4.5m | 87% |

| Other | kr748k | kr530k | 13% |

| Total Compensation | kr5.8m | kr5.0m | 100% |

On an industry level, roughly 80% of total compensation represents salary and 20% is other remuneration. There isn't a significant difference between Vitec Software Group and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Vitec Software Group AB (publ)'s Growth Numbers

Vitec Software Group AB (publ) has seen its earnings per share (EPS) increase by 19% a year over the past three years. It achieved revenue growth of 20% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Vitec Software Group AB (publ) Been A Good Investment?

With a total shareholder return of 2.9% over three years, Vitec Software Group AB (publ) has done okay by shareholders, but there's always room for improvement. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Vitec Software Group that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:VIT B

Vitec Software Group

Develops and delivers vertical market software solutions in Sweden, Denmark, Finland, Norway, the Netherlands, the United States, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion