As global markets grapple with cautious Federal Reserve commentary and political uncertainties, investors are closely monitoring the impact of interest rate adjustments and economic data on stock performance. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, making them a compelling option for those seeking stability in turbulent times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Softronic AB (publ) offers IT and management services mainly in Sweden, with a market cap of SEK1.23 billion.

Operations: Softronic AB (publ) generates revenue from its Computer Services segment, amounting to SEK848.52 million.

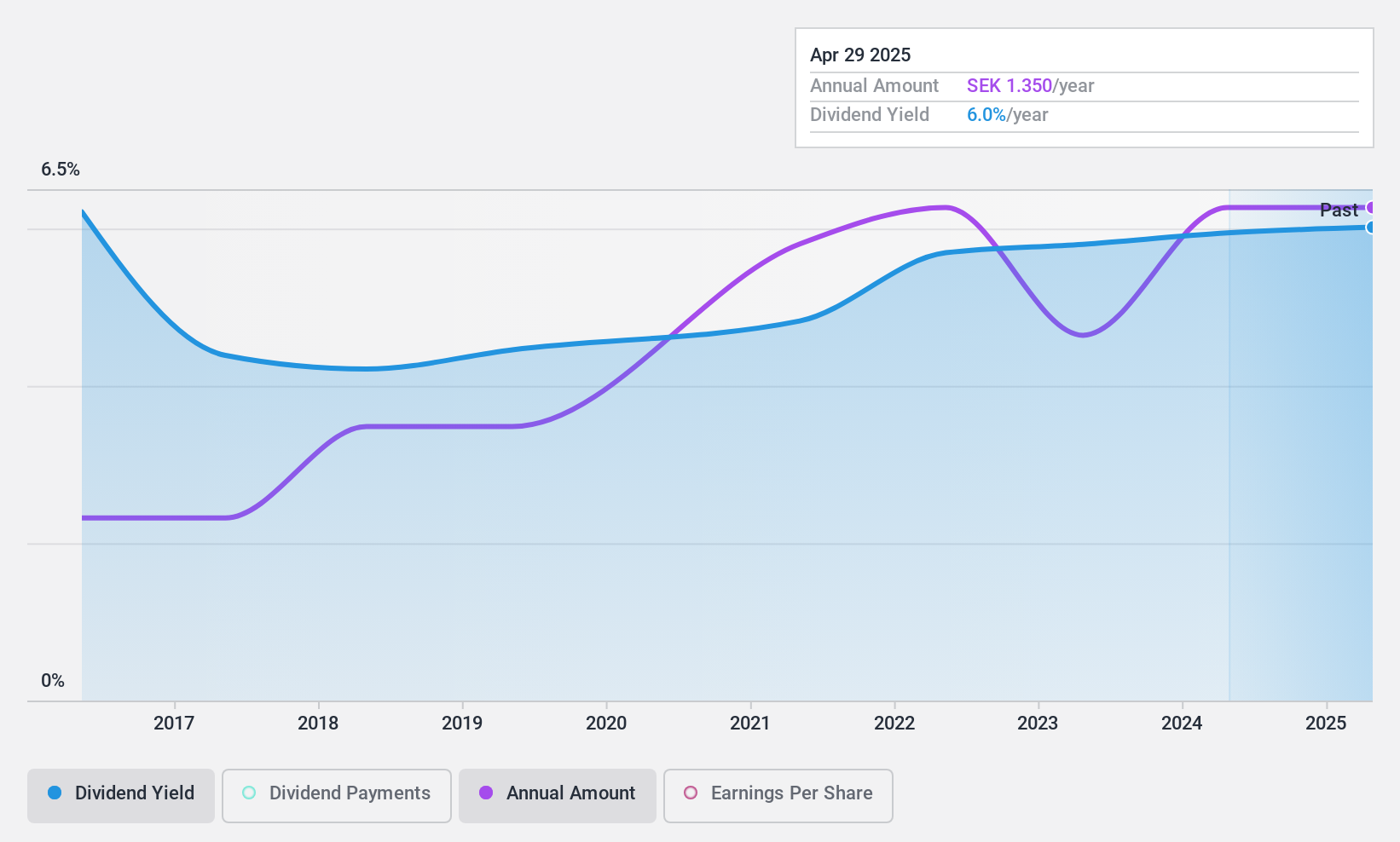

Dividend Yield: 5.8%

Softronic's dividend yield of 5.78% places it among the top 25% in the Swedish market, yet its dividends have been volatile over the past decade. The payout ratio of 82.9% indicates earnings cover dividends, supported by a cash payout ratio of 60.9%. Despite recent profit growth and undervaluation at 62% below estimated fair value, its unstable dividend history may concern some investors seeking reliability in income generation.

- Unlock comprehensive insights into our analysis of Softronic stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Softronic shares in the market.

Fuji Nihon (TSE:2114)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fuji Nihon Corporation manufactures and sells refined sugar and sugar-related products in Japan, with a market cap of ¥27.22 billion.

Operations: Fuji Nihon Corporation's revenue segments include the manufacture and sale of refined sugar and sugar-related products in Japan.

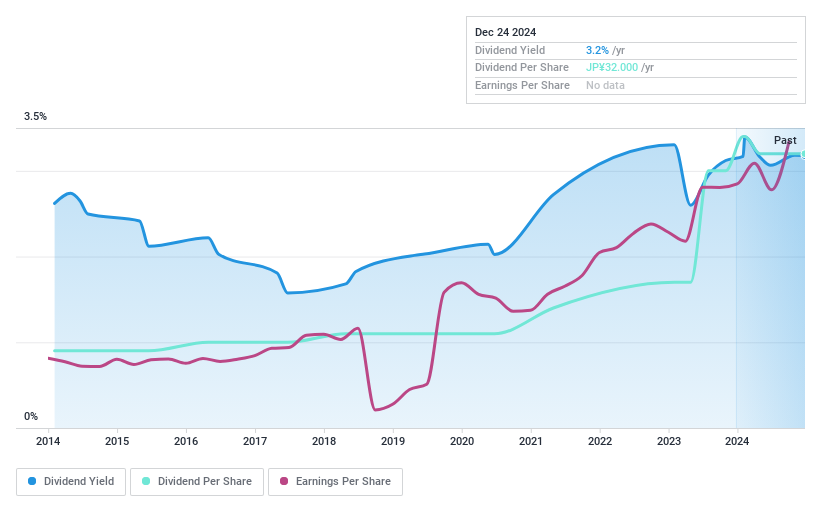

Dividend Yield: 3.2%

Fuji Nihon's dividend yield of 3.17% falls short of the top 25% in Japan, and its dividends have been unstable over the past decade despite growth. With a low payout ratio of 17.8%, earnings comfortably cover dividends, supported by a cash payout ratio of 30.7%. Recent share buybacks aim to enhance shareholder returns, while expansion into cassava starch manufacturing in Thailand reflects strategic growth initiatives under its 'NEXT VISION 2040'.

- Click here and access our complete dividend analysis report to understand the dynamics of Fuji Nihon.

- Our comprehensive valuation report raises the possibility that Fuji Nihon is priced lower than what may be justified by its financials.

Amada (TSE:6113)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Amada Co., Ltd. and its subsidiaries operate in the manufacturing, sales, leasing, repair, maintenance, checking, and inspection of metalworking machinery, software, and peripheral equipment across Japan and international markets with a market cap of ¥512.70 billion.

Operations: Amada Co., Ltd.'s revenue segments include the manufacturing, sales, leasing, repair, maintenance, checking, and inspection of metalworking machinery, software, and peripheral equipment across various global markets.

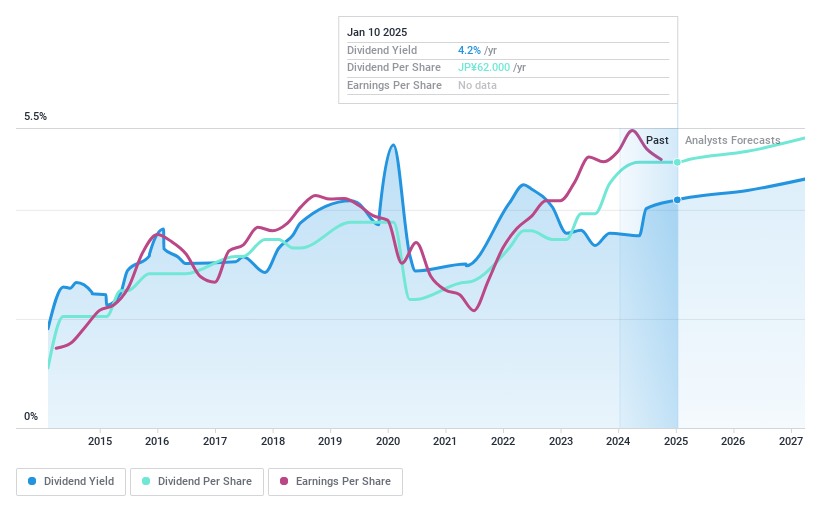

Dividend Yield: 4.2%

Amada's dividend yield of 4.2% ranks in the top 25% of Japan's market, with recent increases from ¥25.00 to ¥31.00 per share reflecting growth efforts. Despite historical volatility and an unstable track record, dividends are covered by earnings (payout ratio: 84.7%) and cash flows (cash payout ratio: 56%). Recent buybacks totaling ¥8.15 billion indicate a focus on shareholder returns, while revised earnings guidance suggests positive financial momentum for the fiscal year ending March 2025.

- Dive into the specifics of Amada here with our thorough dividend report.

- Our expertly prepared valuation report Amada implies its share price may be lower than expected.

Taking Advantage

- Click here to access our complete index of 1968 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2114

Fuji Nihon

Engages in the manufacture and sale of refined sugar and sugar-related products in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives