As global markets navigate a landscape marked by accelerating inflation and near-record highs in U.S. stock indexes, investors are increasingly seeking stability and income through dividend stocks. In this environment, selecting dividend stocks with strong yields can offer a reliable source of returns, especially when market volatility is a concern.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.37% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.93% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

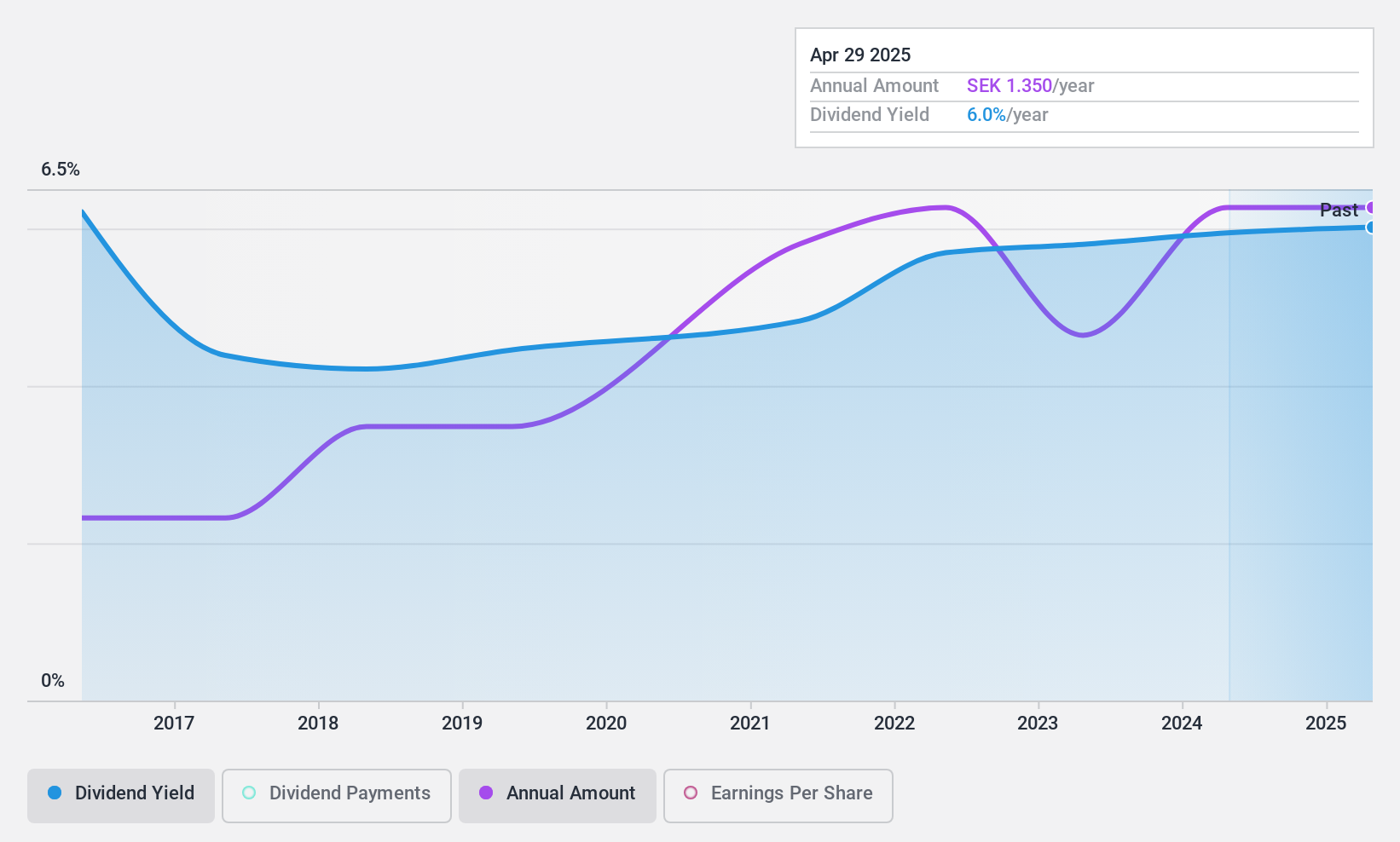

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Softronic AB (publ) is a Swedish company offering IT and management services, with a market cap of approximately SEK 1.24 billion.

Operations: Softronic AB (publ) generates revenue through its provision of IT and management services within Sweden.

Dividend Yield: 5.7%

Softronic's dividend yield of 5.74% places it in the top 25% of Swedish dividend payers, with a payout ratio of 82.9%, indicating dividends are covered by earnings and cash flows. However, its dividend history is volatile and unreliable over the past decade, despite recent earnings growth of 29.7%. The stock trades at a significant discount to its estimated fair value, but investors should be cautious due to its unstable dividend track record.

- Unlock comprehensive insights into our analysis of Softronic stock in this dividend report.

- Our valuation report unveils the possibility Softronic's shares may be trading at a discount.

Simplo Technology (TPEX:6121)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Simplo Technology Co., Ltd. produces and sells battery packs globally, with a market cap of NT$68.44 billion.

Operations: Simplo Technology Co., Ltd. generates revenue primarily from its Batteries / Battery Systems segment, amounting to NT$82.29 billion.

Dividend Yield: 5.6%

Simplo Technology offers a dividend yield of 5.62%, ranking in the top 25% of Taiwanese payers, but its dividends are not well covered by cash flows, with a high cash payout ratio of 119.1%. Despite trading at a significant discount to fair value and analysts predicting price growth, its dividend history is volatile and unreliable over the past decade. Recent announcements include a reduced cash dividend for early 2025, highlighting potential sustainability concerns.

- Click to explore a detailed breakdown of our findings in Simplo Technology's dividend report.

- Our comprehensive valuation report raises the possibility that Simplo Technology is priced lower than what may be justified by its financials.

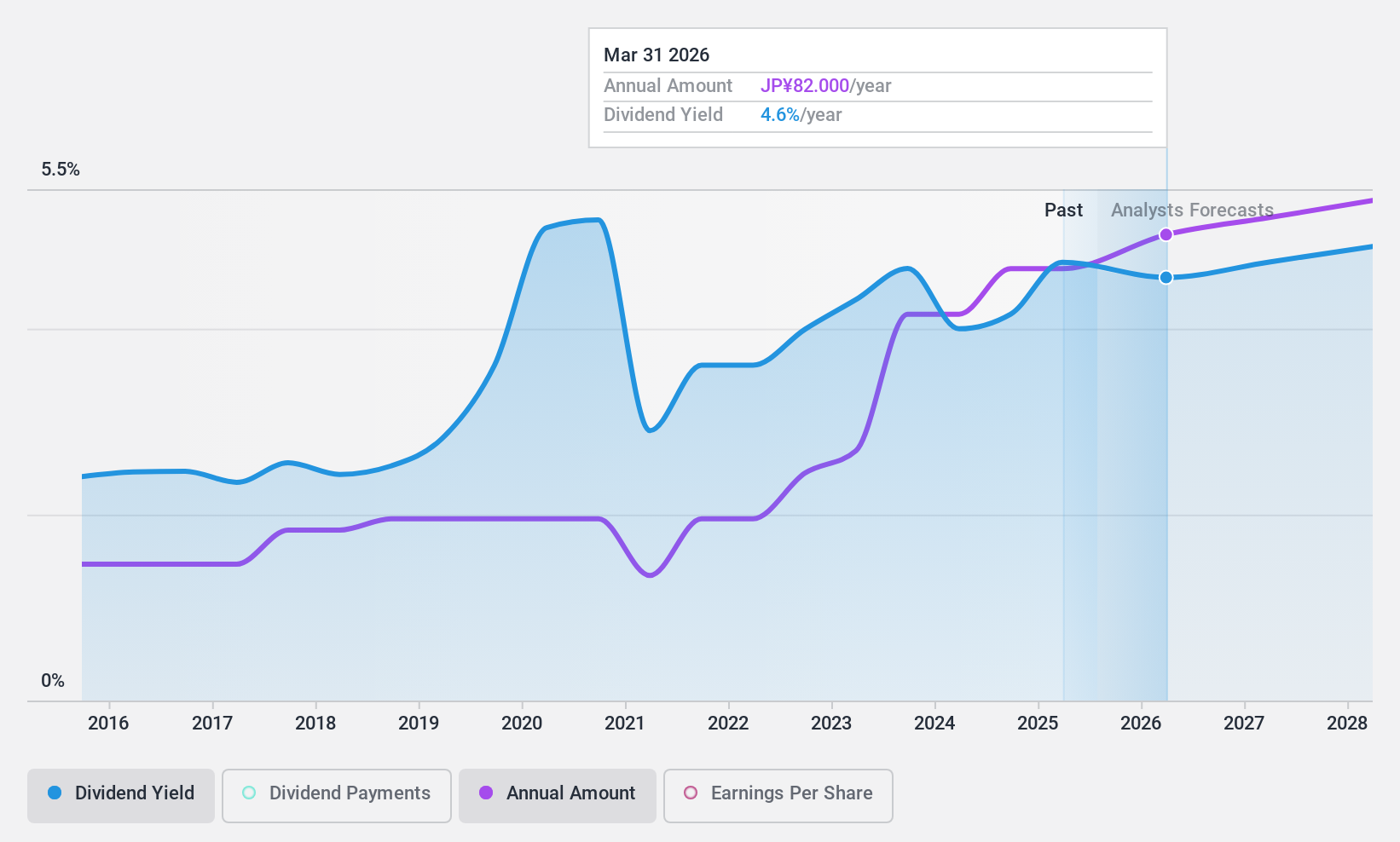

Bando Chemical Industries (TSE:5195)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bando Chemical Industries, Ltd. manufactures and markets belts and belt-related products across Japan, China, the rest of Asia, Europe, America, and internationally with a market cap of ¥73.63 billion.

Operations: Bando Chemical Industries, Ltd. generates revenue through the production and sale of belts and belt-related products across various regions including Japan, China, other parts of Asia, Europe, America, and international markets.

Dividend Yield: 4.3%

Bando Chemical Industries' dividend yield of 4.33% ranks in the top 25% of Japanese payers, supported by a payout ratio of 59.7% and a cash payout ratio of 34.1%, indicating coverage by earnings and cash flows. However, its dividend history is unstable with significant volatility over the past decade, despite recent increases. The company's share buyback program completed in December may signal confidence but doesn't mitigate concerns about dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Bando Chemical Industries.

- Insights from our recent valuation report point to the potential overvaluation of Bando Chemical Industries shares in the market.

Where To Now?

- Dive into all 1985 of the Top Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bando Chemical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5195

Bando Chemical Industries

Manufactures and sale of automotive parts, industrial materials and high-performance elastomer products in Japan, China, Asia, Europe, America, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion