Amidst a backdrop of economic uncertainty and fluctuating indices, the European market has been navigating challenges such as U.S. trade tariffs and monetary policy shifts, with the pan-European STOXX Europe 600 Index ending slightly lower due to these pressures. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability to evolving market conditions, making them potential candidates for exploration in March 2025.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Bonesupport Holding | 30.48% | 50.17% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Devyser Diagnostics | 26.50% | 94.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

We'll examine a selection from our screener results.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★★☆

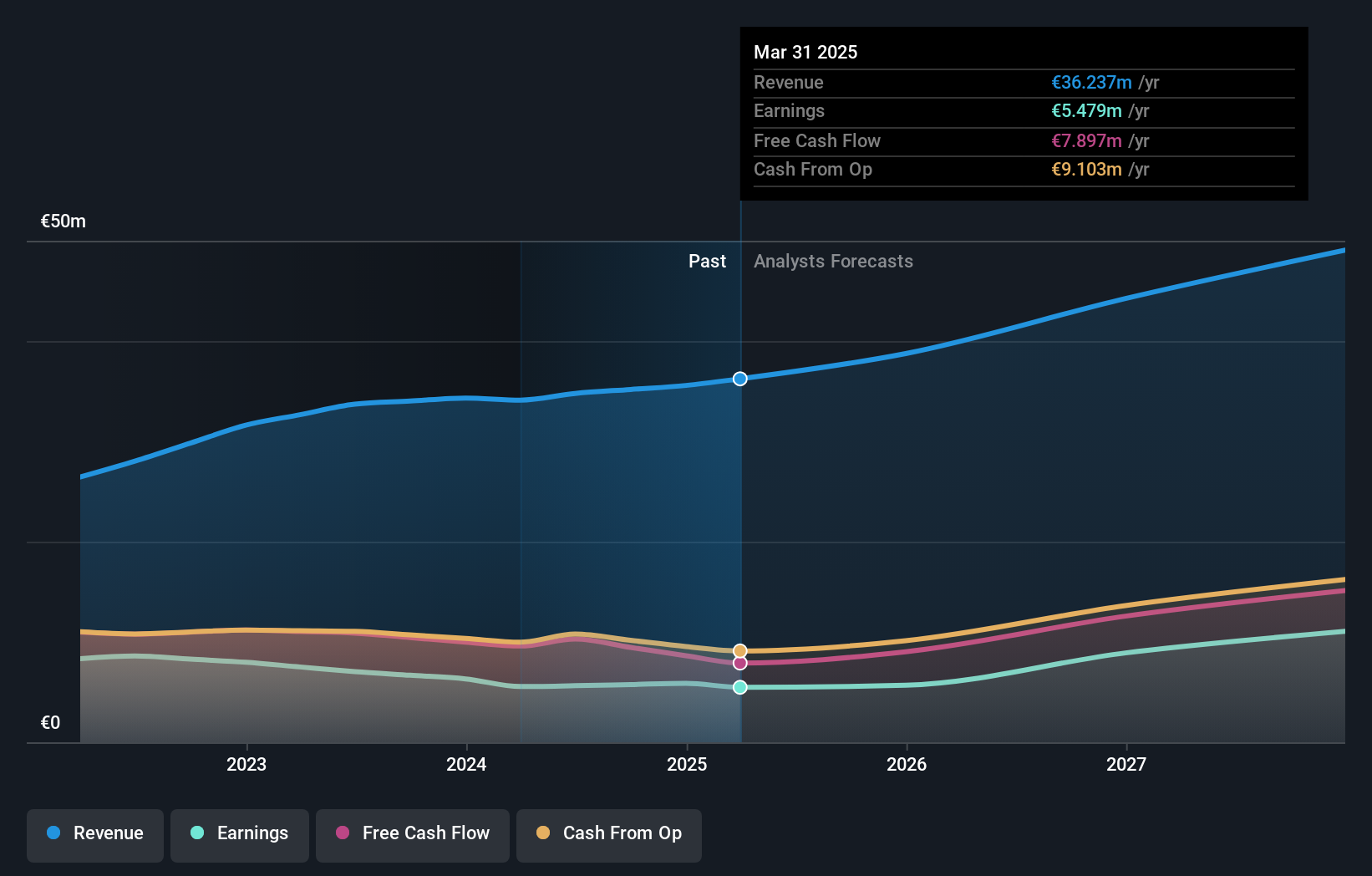

Overview: Admicom Oyj provides cloud-based software and business process automation solutions in Finland, with a market capitalization of €248.33 million.

Operations: The company focuses on delivering cloud-based software and business process automation solutions, generating €35.57 million in revenue from its Software & Programming segment.

Admicom Oyj, a European tech contender, reported a slight revenue increase to €35.57 million from €34.32 million year-over-year as of December 2024, although net income dipped to €5.87 million from €6.32 million in the same period. Despite this fluctuation, the company's forecast suggests robust growth with expected earnings to surge by 22% annually and revenue growth outpacing the Finnish market at 10.7% per year compared to 3.6%. This performance is underpinned by significant R&D investments that align with industry shifts towards more sustainable and advanced software solutions, positioning Admicom for potential leadership in high-growth sectors within Europe's tech landscape.

- Dive into the specifics of Admicom Oyj here with our thorough health report.

Examine Admicom Oyj's past performance report to understand how it has performed in the past.

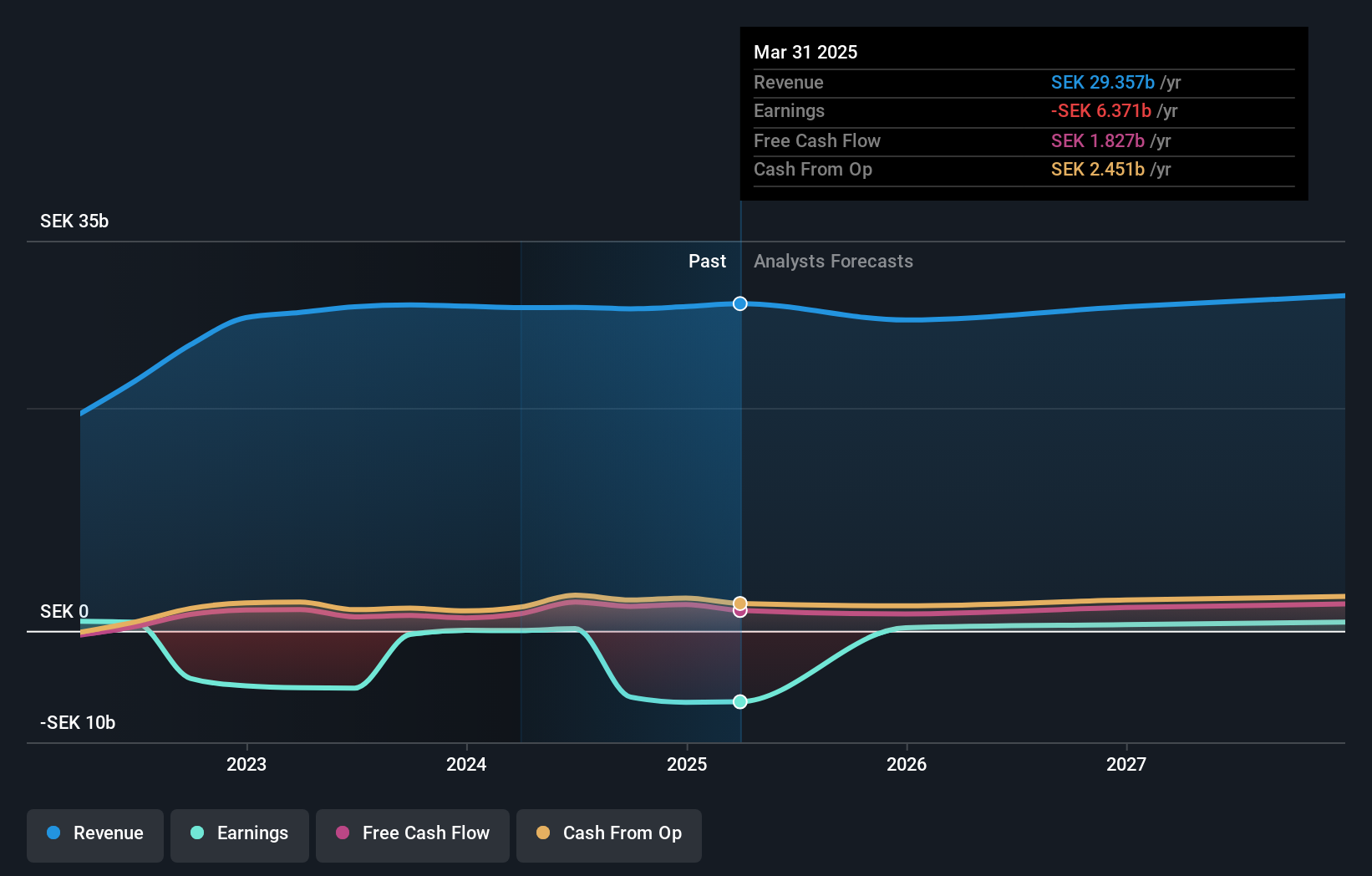

Sinch (OM:SINCH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sinch AB (publ) is a company that offers cloud communications services and solutions to enterprises and mobile operators across various countries, with a market capitalization of approximately SEK18.80 billion.

Operations: Sinch generates revenue primarily from its operations in the Americas (SEK18.11 billion), followed by EMEA (SEK6.64 billion) and APAC (SEK3.96 billion). The company's business model focuses on providing cloud communications services to enterprises and mobile operators across multiple regions globally.

Sinch's recent strategic alliance with Aduna and leadership restructuring, including the appointment of Jonas Dahlberg as CFO, underscore its commitment to enhancing global digital communication services. Despite a challenging Q4 in 2024 where sales slightly increased to SEK 7.73 billion from SEK 7.53 billion but swung to a net loss of SEK 324 million from a prior net profit, Sinch is poised for recovery. The company's focus on expanding innovative network API solutions and improving verification services through partnerships signals robust potential for revitalizing its market position and driving future growth in the tech sector.

- Click here to discover the nuances of Sinch with our detailed analytical health report.

Gain insights into Sinch's past trends and performance with our Past report.

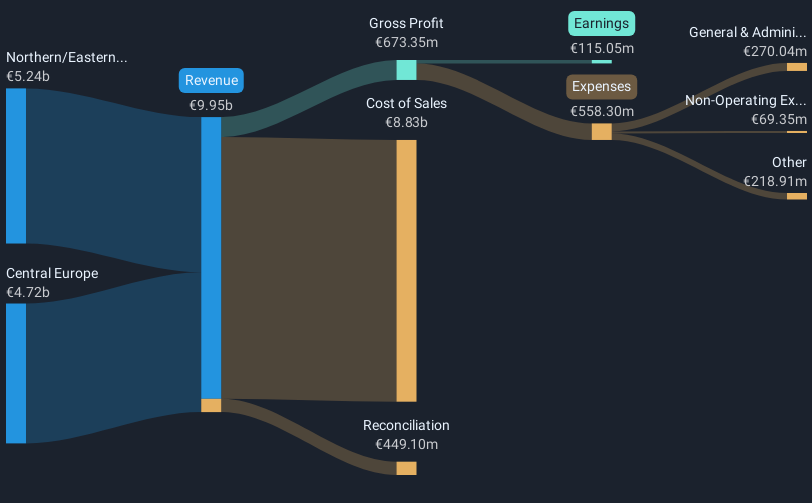

ALSO Holding (SWX:ALSN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ALSO Holding AG is a technology services provider for the ICT industry, operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF3.21 billion.

Operations: The company generates revenue primarily from its operations in Central Europe (€4.72 billion) and Northern/Eastern Europe (€5.24 billion). The business focuses on providing technology services within the ICT industry across various international markets.

ALSO Holding AG, amidst a challenging fiscal year with a slight dip in net income to EUR 115.05 million from EUR 123.66 million, is steering towards enhancing operational excellence and scalability through significant IT investments and system upgrades. The company's strategic shift towards a cloud-based ERP solution SAP S/4HANA across its operations by 2029 underscores its commitment to future-proofing its business model against evolving tech landscapes. This move, coupled with an annual revenue growth rate of 8.6% and an impressive earnings growth forecast of 21.1%, positions ALSO well within the competitive European tech sector despite the current earnings contraction of -7%. These initiatives are expected to bolster ALSO's market position by improving productivity and integrating advanced AI applications for process optimization, setting a robust foundation for sustained growth.

- Unlock comprehensive insights into our analysis of ALSO Holding stock in this health report.

Assess ALSO Holding's past performance with our detailed historical performance reports.

Where To Now?

- Navigate through the entire inventory of 243 European High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALSN

ALSO Holding

Operates as a technology services provider for the ICT industry in Switzerland, Germany, the Netherlands, Poland, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives