Thinking about what to do with Sinch stock? You are definitely not alone. After all, the past year has been a rollercoaster, and if you have been watching Sinch’s price chart, you know the ups and downs demand a closer look. In just the last week, Sinch shares have jumped 6.2% and continued to edge higher through the month, contributing to a standout year-to-date surge of 51.5%. However, if you zoom out, the picture gets more complicated. Over the last 12 months, Sinch is actually down 2.1%, and that cuts deeper when you look at the last five years, where it is off by a striking 57.4%. Interestingly, though, anyone who bought in three years back is still sitting on a 117.0% return. This highlights how quickly sentiment can swing when markets recalibrate risk and growth expectations.

Much of this movement traces back to shifting narratives in the broader tech and communications services sector. Investors seem to be recalibrating what counts as sustainable growth, while Sinch’s core business and perceived risks get reassessed, sparking both moments of optimism and caution.

To help investors make sense of today’s market value, Sinch currently scores a 5 out of 6 on our valuation checklist, suggesting it screens as undervalued across almost every metric we track. So, how does one arrive at that conclusion? Let us break down the usual approaches to valuation and see which ones really matter, and why some thinkers believe there is an even sharper way to find out what Sinch is truly worth.

Sinch delivered -2.1% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: Sinch Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model calculates the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s value. In the case of Sinch, this model centers on the company’s Free Cash Flow (FCF), which is a key measure of underlying business strength. According to the latest data, Sinch generated SEK 1.46 billion in Free Cash Flow over the last twelve months.

Analyst estimates underpin growth projections for the next five years, after which long-term trends are extrapolated. For example, projections suggest Sinch’s Free Cash Flow could rise to SEK 2.52 billion by 2028. In addition, Simply Wall St’s model anticipates annual FCF surpassing SEK 2.9 billion within the next decade. These forecasts signal expectations for continued, albeit moderating, growth over time.

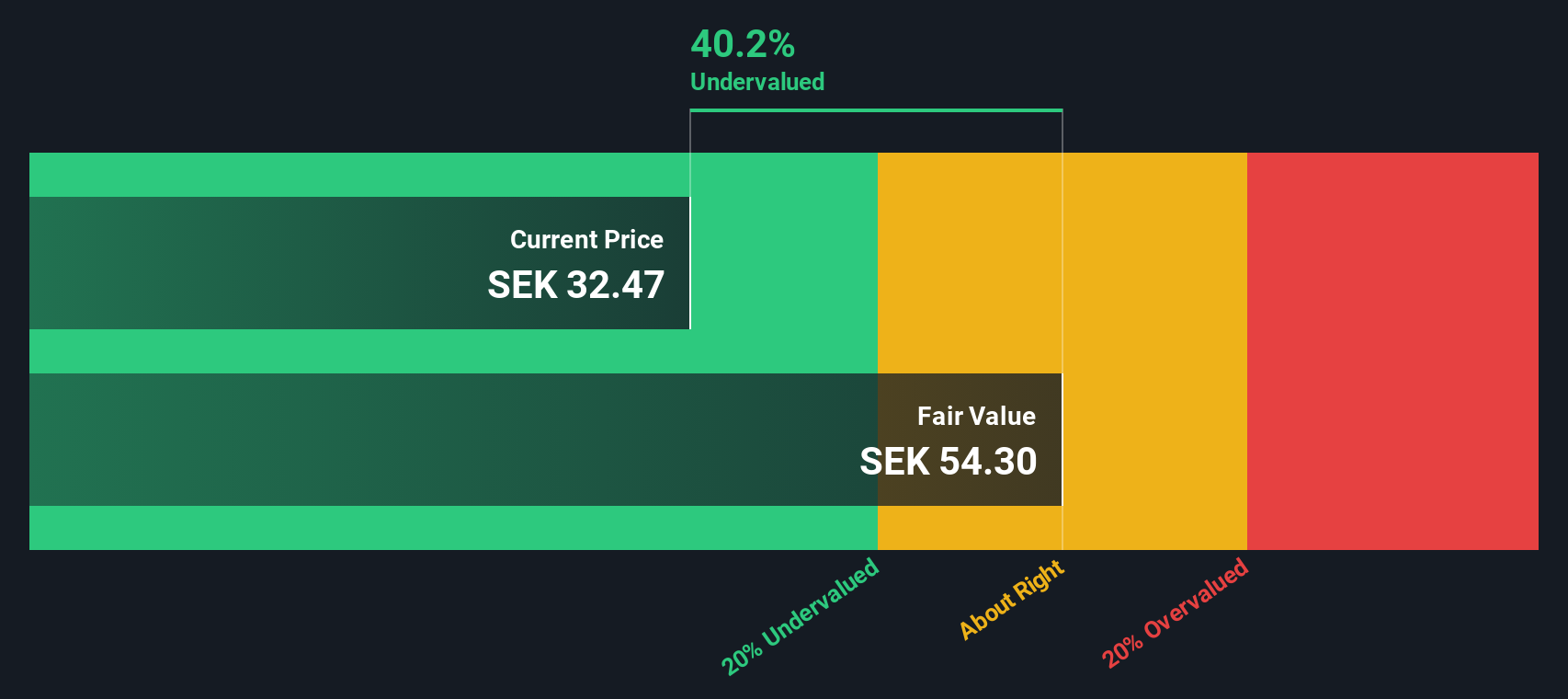

The result of this analysis is an estimated intrinsic value of SEK 53.95 per share for Sinch. With the DCF model indicating the stock is trading at a 40.9% discount to intrinsic value, Sinch currently appears to be substantially undervalued based on anticipated cash flows.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Sinch.

Approach 2: Sinch Price vs Sales

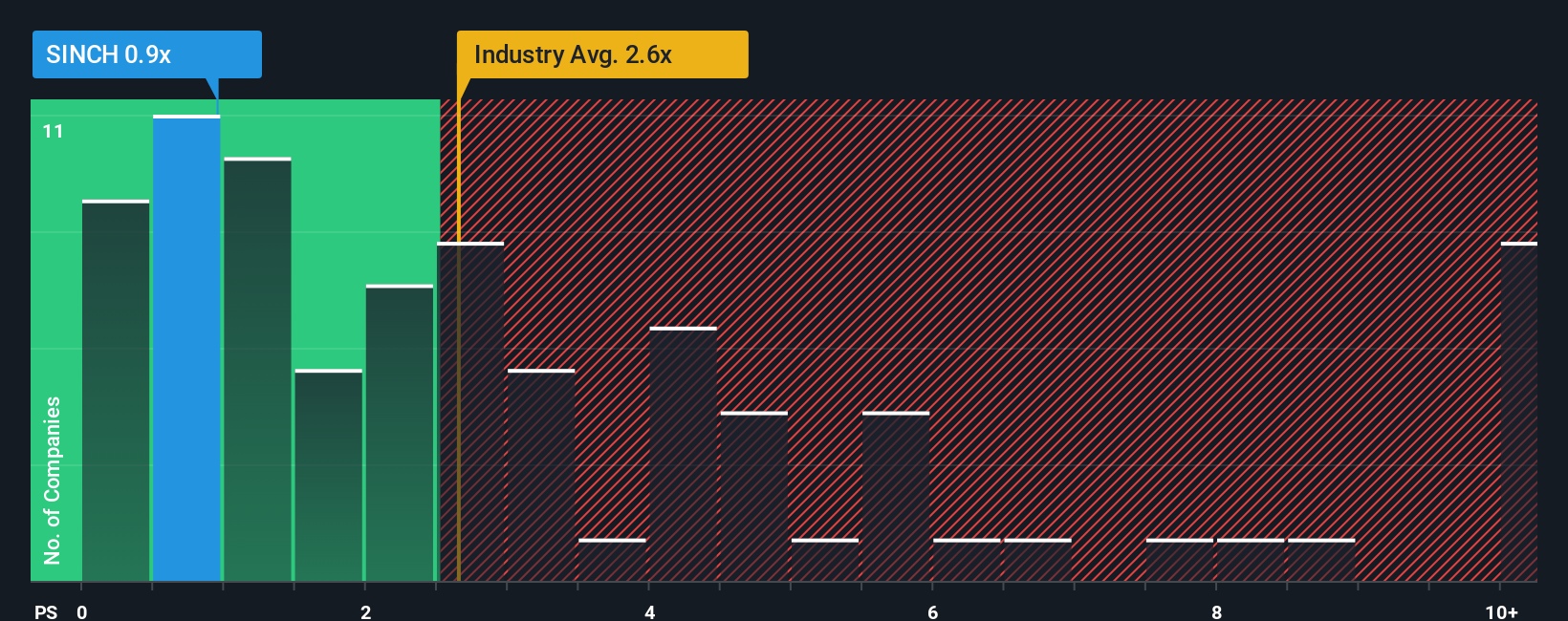

For companies like Sinch, which may not report consistent earnings but still generate substantial revenue, the Price-to-Sales (PS) ratio is a practical valuation tool. The PS ratio is especially useful for software and growth-focused firms, as it offers a glimpse of how the market values every krona of revenue, independent of profitability.

A company’s fair PS multiple is typically shaped by expectations of future growth and perceived risk. High-growth, low-risk firms generally command a higher PS ratio, while companies facing more uncertainty or slowing growth see a lower multiple. Comparing this against industry standards can help identify outliers, but context always matters.

Currently, Sinch trades at a PS ratio of 0.93x. That stands out when compared to the Software industry average of 2.53x and a peer average of 5.38x, both considerably higher. However, Simply Wall St’s Fair Ratio model, which factors in growth outlook, profit margins, industry trends, company size, and risks, sets a fair PS ratio for Sinch at 2.27x. This is a more tailored benchmark than comparing with generic peers or the sector, since it focuses on the company’s specifics instead of one-size-fits-all averages.

Since Sinch’s current PS multiple is well below its Fair Ratio, this suggests the stock is undervalued on this basis and reinforces the story from the DCF approach.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Sinch Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story or perspective on a company like Sinch, including the reasoning and outlook behind your numbers, such as your assumed fair value and forecasts for future revenue, earnings, and margins.

Narratives connect a company’s story to your financial forecast, and from there to a calculated fair value. This makes the investment process both transparent and personal. On Simply Wall St’s platform, used by millions of investors, creating or exploring Narratives is easy and accessible and is available right within the Community page.

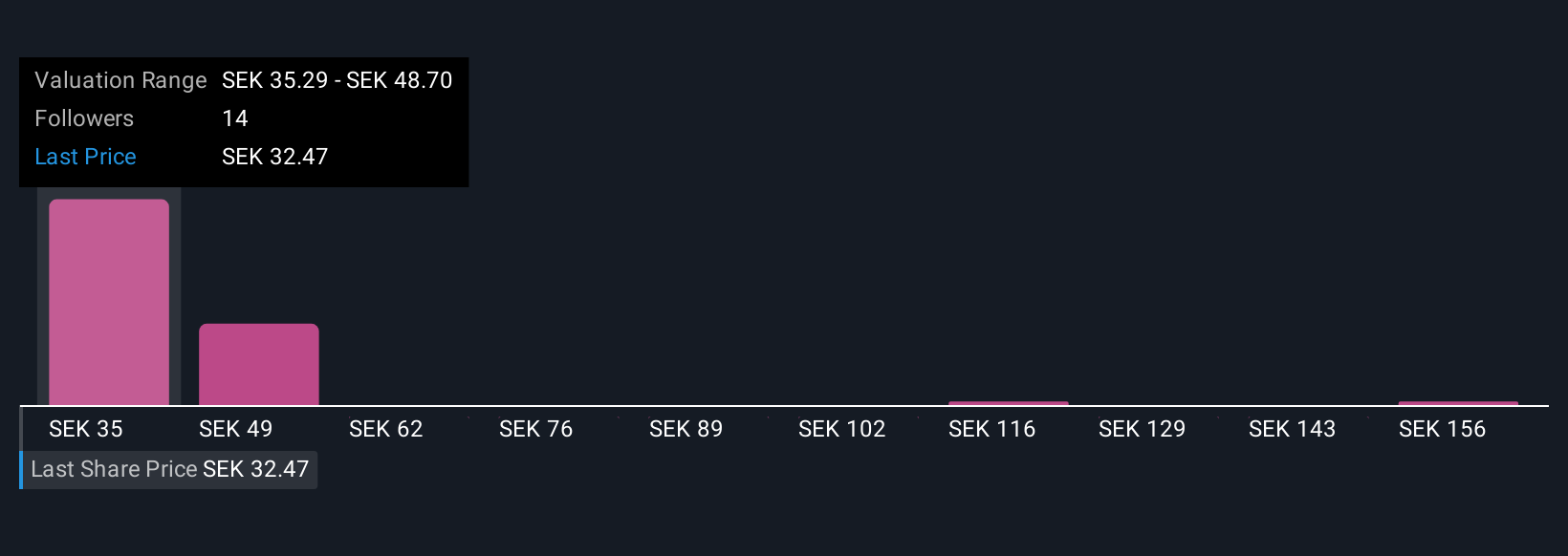

This approach helps you make smarter buy or sell decisions by clearly comparing your Fair Value to the current Price. Since Narratives update dynamically with new news or earnings, your assumptions remain current as the facts change. For example, for Sinch, some investors project a fair value as high as SEK44.0, expecting rapid AI-led growth and margin expansion. Others see risks and set a fair value as low as SEK21.5, reflecting concerns about slow messaging adoption and competitive headwinds.

With Narratives, you are empowered to track, test, and update your own story as new information arrives, guiding investment decisions in a smarter, more connected way.

Do you think there's more to the story for Sinch? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SINCH

Sinch

Provides cloud communications services and solutions for enterprises and mobile operators.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)