- Sweden

- /

- Entertainment

- /

- OM:MTG B

3 Swedish Stocks Estimated To Be Undervalued In September 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, the Swedish market has shown resilience amidst broader European trends influenced by interest rate cuts and cautious economic forecasts. In this environment, identifying undervalued stocks can present unique opportunities for investors looking to capitalize on potential growth. When considering undervalued stocks, it is important to focus on companies with strong fundamentals and robust financial health that may be temporarily overlooked by the market. Here are three Swedish stocks estimated to be undervalued in September 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK40.60 | SEK79.94 | 49.2% |

| Husqvarna (OM:HUSQ B) | SEK68.02 | SEK125.64 | 45.9% |

| QleanAir (OM:QAIR) | SEK25.50 | SEK50.79 | 49.8% |

| Concentric (OM:COIC) | SEK222.00 | SEK408.40 | 45.6% |

| Biotage (OM:BIOT) | SEK182.30 | SEK360.61 | 49.4% |

| Lindab International (OM:LIAB) | SEK275.00 | SEK523.55 | 47.5% |

| Tourn International (OM:TOURN) | SEK8.52 | SEK16.49 | 48.3% |

| Sinch (OM:SINCH) | SEK32.32 | SEK64.40 | 49.8% |

| MilDef Group (OM:MILDEF) | SEK85.70 | SEK160.93 | 46.7% |

| Lyko Group (OM:LYKO A) | SEK116.20 | SEK216.45 | 46.3% |

Let's review some notable picks from our screened stocks.

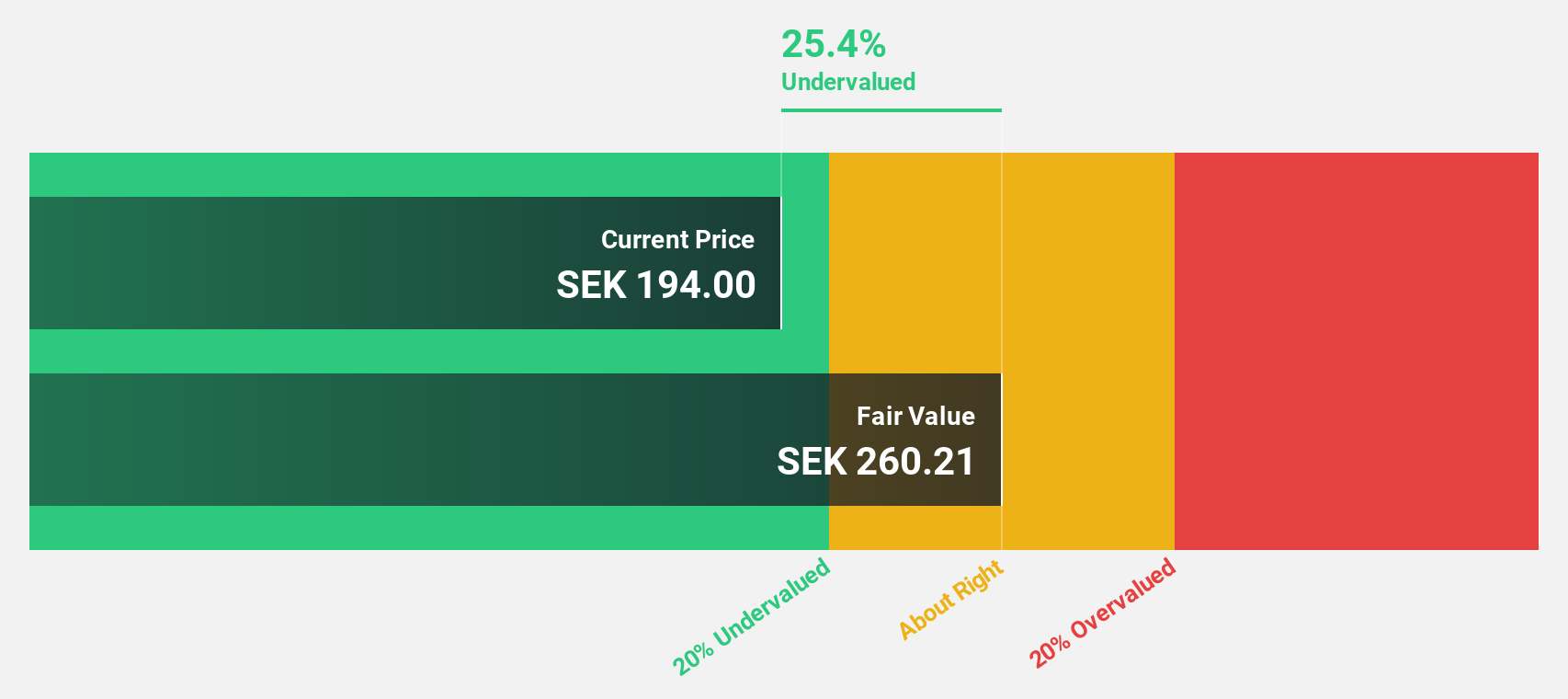

CellaVision (OM:CEVI)

Overview: CellaVision AB (publ) develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally, with a market cap of SEK6.63 billion.

Operations: CellaVision's revenue primarily comes from automated microscopy systems and reagents in the field of hematology, amounting to SEK726.40 million.

Estimated Discount To Fair Value: 23.4%

CellaVision, trading at SEK278, is currently 23.4% below its estimated fair value of SEK363.05, indicating it may be undervalued based on cash flows. The company has shown strong financial performance with earnings growing by 50.2% over the past year and revenue expected to grow at 13.6% annually, outpacing the Swedish market's 0.9%. Despite significant insider selling recently, CellaVision's earnings are forecast to grow significantly at 24.1% per year over the next three years.

- Insights from our recent growth report point to a promising forecast for CellaVision's business outlook.

- Click here to discover the nuances of CellaVision with our detailed financial health report.

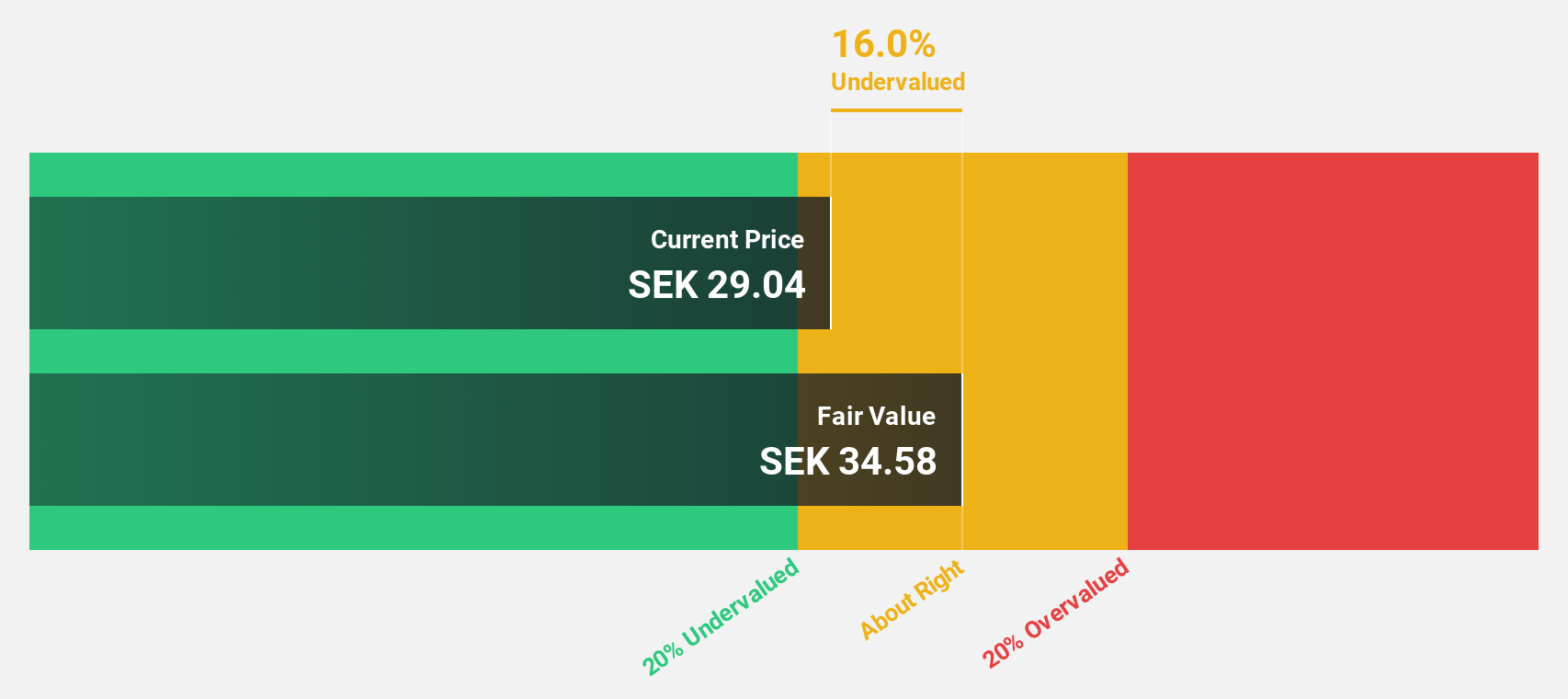

Modern Times Group MTG (OM:MTG B)

Overview: Modern Times Group MTG AB (publ) operates through its subsidiaries to provide game franchise services across Sweden, the United Kingdom, Germany, the rest of Europe, Singapore, India, the United States, and New Zealand with a market cap of SEK9.25 billion.

Operations: The company's revenue from broadcasting services is SEK5.95 billion.

Estimated Discount To Fair Value: 26.4%

Modern Times Group MTG, trading at SEK77.25, is considered undervalued with a fair value estimate of SEK104.99. Despite reporting a net loss of SEK142 million for the first half of 2024, the company has completed significant share buybacks totaling SEK350 million this year. Analysts forecast revenue growth at 4.1% annually and expect profitability within three years, outpacing the Swedish market's growth rate while maintaining a low return on equity forecast at 4.4%.

- Our earnings growth report unveils the potential for significant increases in Modern Times Group MTG's future results.

- Navigate through the intricacies of Modern Times Group MTG with our comprehensive financial health report here.

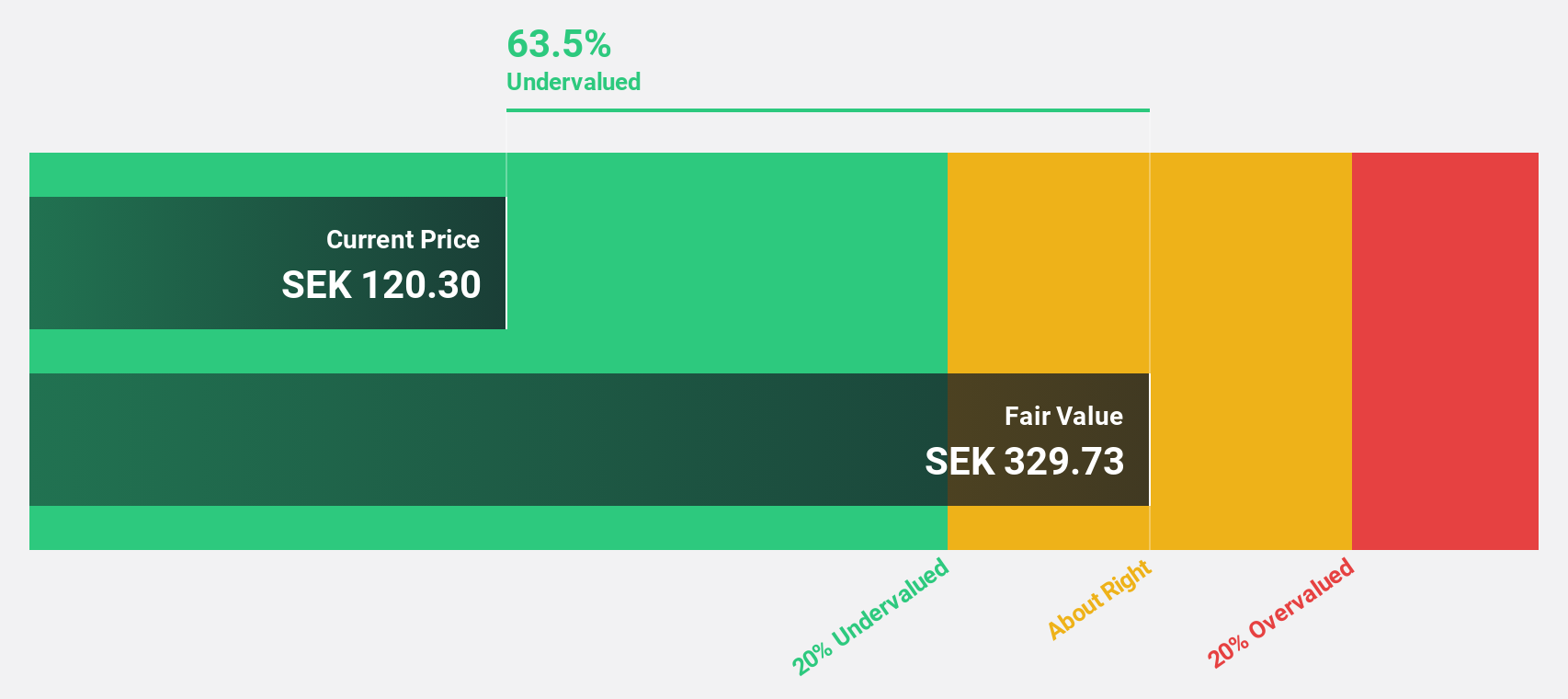

Sinch (OM:SINCH)

Overview: Sinch AB (publ) offers cloud communications services and solutions for enterprises and mobile operators across various countries, including Sweden, France, the United Kingdom, Germany, Brazil, India, Singapore, other European nations, the United States, and internationally; it has a market cap of SEK27.28 billion.

Operations: Sinch AB (publ) generates revenue from providing cloud communications services and solutions to enterprises and mobile operators across a diverse range of countries, including Sweden, France, the United Kingdom, Germany, Brazil, India, Singapore, other European nations, the United States, and internationally.

Estimated Discount To Fair Value: 49.8%

Sinch (SEK32.32) is trading at 49.8% below its estimated fair value of SEK64.4, suggesting it may be undervalued based on cash flows. Despite a highly volatile share price recently, Sinch's earnings are forecast to grow significantly at 48.5% per year, outpacing the Swedish market's growth rate of 15.1%. However, its return on equity is expected to remain low at 2.7%. Recent client wins and product advancements in AI-driven solutions highlight potential future revenue streams and operational efficiencies.

- The growth report we've compiled suggests that Sinch's future prospects could be on the up.

- Take a closer look at Sinch's balance sheet health here in our report.

Key Takeaways

- Explore the 43 names from our Undervalued Swedish Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTG B

Modern Times Group MTG

Through its subsidiaries, engages in the provision of game franchises in Sweden, the United Kingdom, Germany, rest of Europe, Singapore, India, the United States, and New Zealand.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives