- Hong Kong

- /

- Entertainment

- /

- SEHK:2306

Promising Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, major indices have reached record highs, driven by investor optimism about potential economic growth and tax reforms. Amid this backdrop of market enthusiasm, penny stocks continue to attract attention for their potential to uncover hidden value in smaller or newer companies. Despite the term's vintage feel, these stocks can offer surprising opportunities when backed by solid financial foundations and balance sheet strength.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.84 | THB1.49B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6025 | A$70.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.20 | £840.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.76 | £386.39M | ★★★★☆☆ |

Click here to see the full list of 5,797 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Precise Biometrics (OM:PREC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Precise Biometrics AB (publ) provides identification software for secure identity authentication across Sweden, Taiwan, Denmark, Finland, Norway, and internationally, with a market cap of SEK226.33 million.

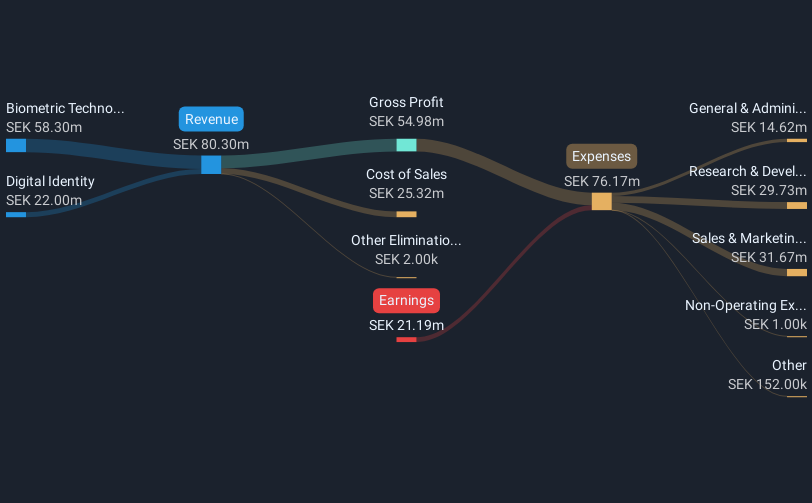

Operations: The company generates revenue from two main segments: Digital Identity, contributing SEK22.00 million, and Biometric Technologies, accounting for SEK58.30 million.

Market Cap: SEK226.33M

Precise Biometrics, with a market cap of SEK226.33 million, operates in the digital identity and biometric technology sectors, generating revenue from these segments. Despite being unprofitable and experiencing increased losses over five years, it maintains a debt-free status and has sufficient cash runway exceeding one year. Recent strategic moves include an extended partnership with Infineon Technologies for automotive products and launching BioLive's embedded AI-driven security solution. These initiatives aim to enhance its product offerings across various industries while addressing evolving security needs through advanced biometric technologies. The management team is relatively new, indicating potential shifts in strategic direction.

- Click here and access our complete financial health analysis report to understand the dynamics of Precise Biometrics.

- Review our growth performance report to gain insights into Precise Biometrics' future.

YH Entertainment Group (SEHK:2306)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: YH Entertainment Group primarily engages in artist management in China and has a market cap of HK$561.29 million.

Operations: The company's revenue is primarily derived from Artist Management at CN¥646.62 million, followed by Music IP Production and Operation at CN¥75.71 million, and Pan-Entertainment Business at CN¥15.80 million.

Market Cap: HK$561.29M

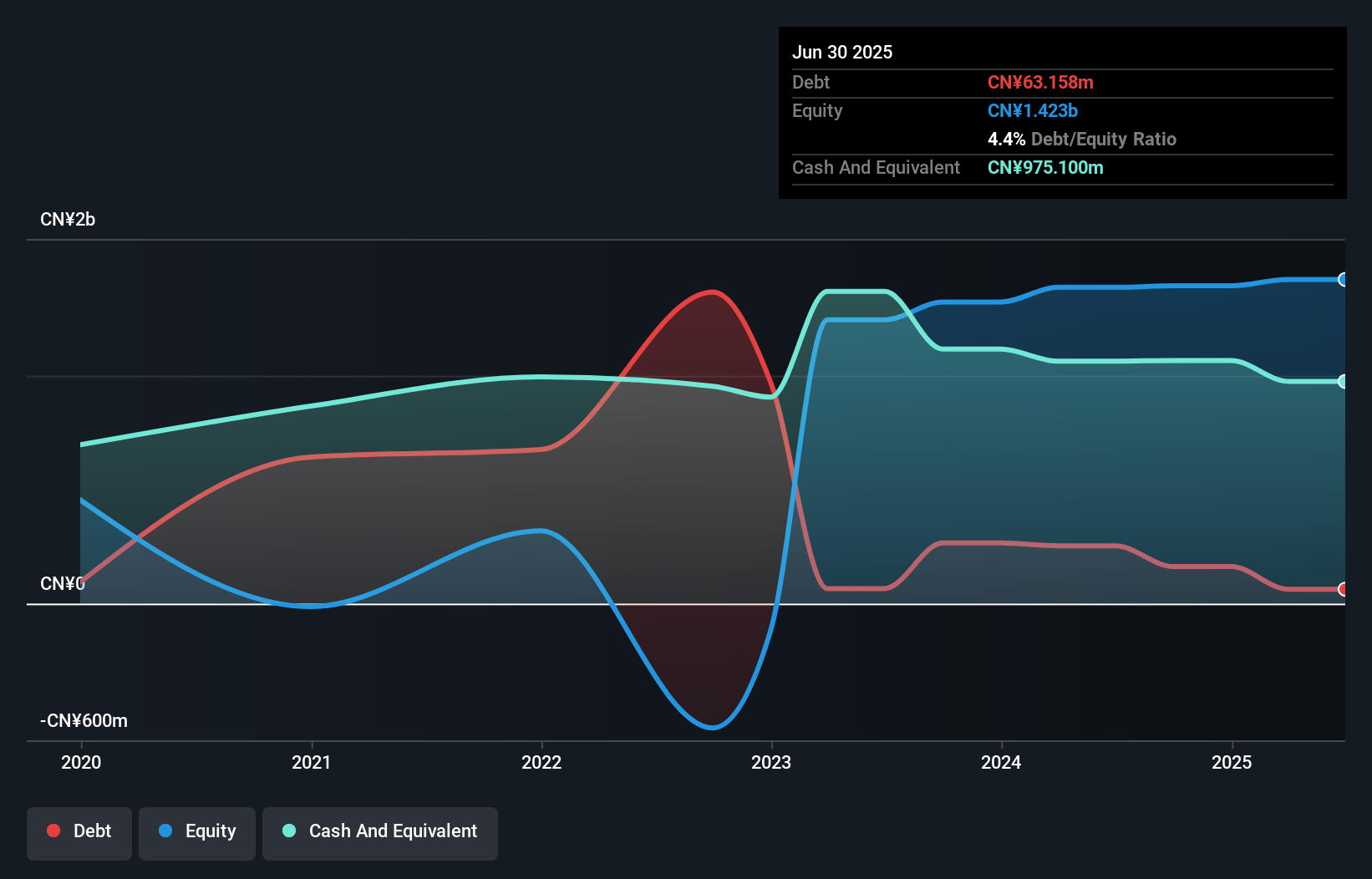

YH Entertainment Group, with a market cap of HK$561.29 million, primarily derives its revenue from Artist Management at CN¥646.62 million. The company reported a net income of CN¥30.8 million for the first half of 2024, recovering from a previous net loss, though profit margins have declined to 8.9%. Its Price-To-Earnings ratio is favorable compared to the Hong Kong market average, and it maintains strong liquidity with short-term assets exceeding both short and long-term liabilities by significant margins. Despite low Return on Equity and negative earnings growth over the past year, it benefits from high-quality earnings and manageable debt levels covered by cash flow.

- Navigate through the intricacies of YH Entertainment Group with our comprehensive balance sheet health report here.

- Gain insights into YH Entertainment Group's past trends and performance with our report on the company's historical track record.

Multitude (XTRA:E4I)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Multitude P.L.C., along with its subsidiaries, offers digital lending and online banking services to consumers and small to medium-sized businesses in Finland, with a market cap of €99.47 million.

Operations: The company generates revenue through its Consumer Banking segment, which accounts for €194.24 million, and its SME Banking segment, contributing €22.44 million.

Market Cap: €99.47M

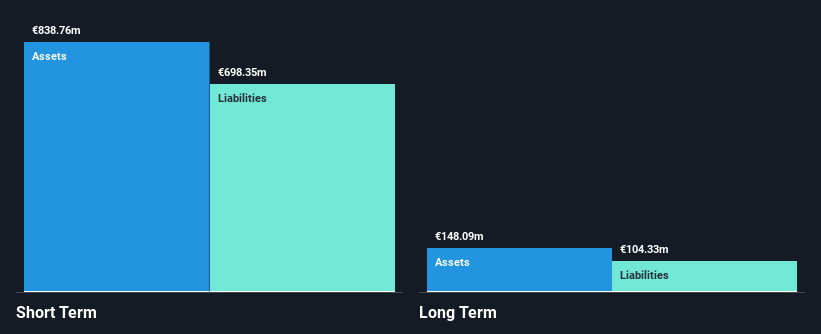

Multitude P.L.C. has shown resilience in its financial performance, with a market cap of €99.47 million and diverse revenue streams from Consumer Banking (€194.24 million) and SME Banking (€22.44 million). The company reported a net income of €5.45 million for Q3 2024, slightly up from the previous year, reflecting stable earnings per share at €0.18. Despite high volatility in share price and negative earnings growth over the past year, Multitude's short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity management amidst challenges such as low Return on Equity (8.7%) and negative operating cash flow impacting debt coverage.

- Take a closer look at Multitude's potential here in our financial health report.

- Assess Multitude's future earnings estimates with our detailed growth reports.

Where To Now?

- Click through to start exploring the rest of the 5,794 Penny Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2306

Flawless balance sheet low.

Market Insights

Community Narratives