We Think Oneflow (STO:ONEF) Needs To Drive Business Growth Carefully

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Oneflow (STO:ONEF) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Oneflow

When Might Oneflow Run Out Of Money?

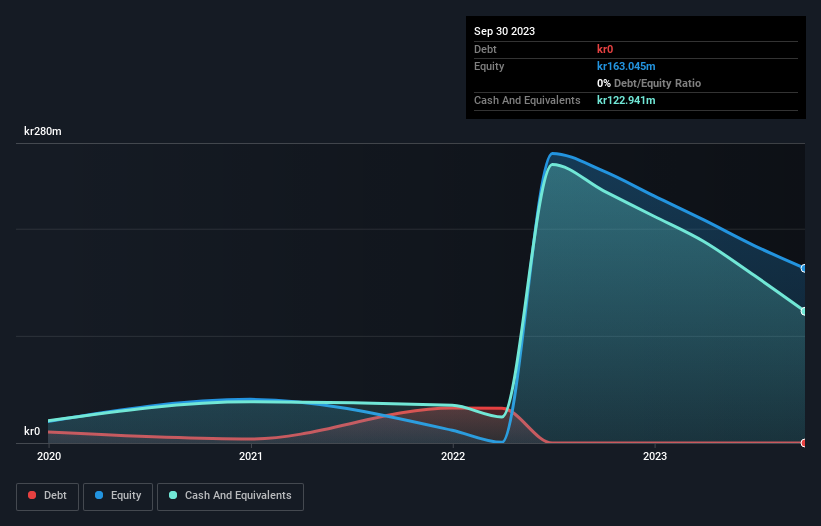

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Oneflow last reported its balance sheet in September 2023, it had zero debt and cash worth kr123m. Importantly, its cash burn was kr105m over the trailing twelve months. So it had a cash runway of approximately 14 months from September 2023. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Importantly, if we extrapolate recent cash burn trends, the cash runway would be a lot longer. You can see how its cash balance has changed over time in the image below.

How Well Is Oneflow Growing?

Notably, Oneflow actually ramped up its cash burn very hard and fast in the last year, by 120%, signifying heavy investment in the business. But the silver lining is that operating revenue increased by 27% in that time. Considering both these factors, we're not particularly excited by its growth profile. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Oneflow Raise Cash?

Even though it seems like Oneflow is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Oneflow's cash burn of kr105m is about 16% of its kr676m market capitalisation. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Oneflow's Cash Burn A Worry?

On this analysis of Oneflow's cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Taking an in-depth view of risks, we've identified 3 warning signs for Oneflow that you should be aware of before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ONEF

Oneflow

A software company, develops, sells, and implements digital contract management and automation systems in Sweden, Norway, North America, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives