Is Modelon (STO:MODEL B) In A Good Position To Invest In Growth?

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Modelon (STO:MODEL B) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Modelon

Does Modelon Have A Long Cash Runway?

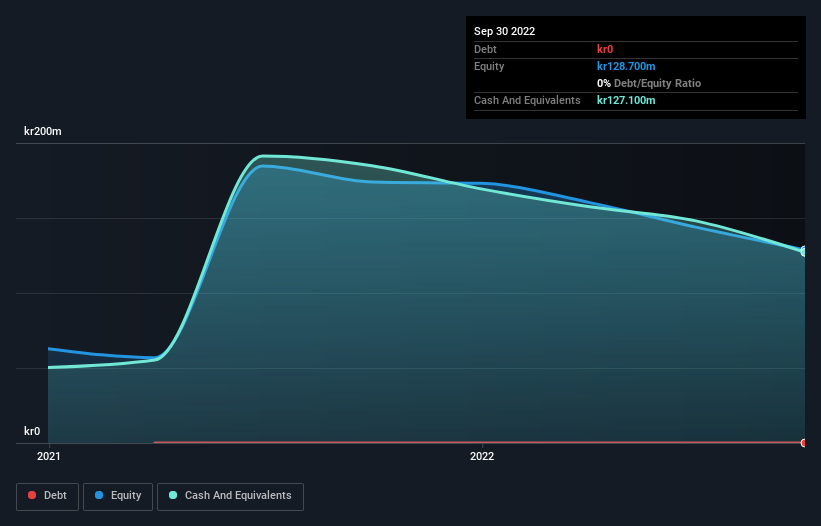

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at September 2022, Modelon had cash of kr127m and no debt. In the last year, its cash burn was kr56m. Therefore, from September 2022 it had 2.2 years of cash runway. That's decent, giving the company a couple years to develop its business. Importantly, if we extrapolate recent cash burn trends, the cash runway would be noticeably longer. The image below shows how its cash balance has been changing over the last few years.

How Well Is Modelon Growing?

It was quite stunning to see that Modelon increased its cash burn by 290% over the last year. While that's concerning on it's own, the fact that operating revenue was actually down 21% over the same period makes us positively tremulous. In light of the above-mentioned, we're pretty wary of the trajectory the company seems to be on. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Modelon Raise More Cash Easily?

Modelon seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Modelon's cash burn of kr56m is about 27% of its kr209m market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Modelon's Cash Burn Situation?

On this analysis of Modelon's cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. Summing up, we think the Modelon's cash burn is a risk, based on the factors we mentioned in this article. Separately, we looked at different risks affecting the company and spotted 2 warning signs for Modelon (of which 1 is significant!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MODEL B

Modelon

Provides systems modeling and simulation software solutions in Sweden and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)