What Lime Technologies AB (publ)'s (STO:LIME) 27% Share Price Gain Is Not Telling You

Lime Technologies AB (publ) (STO:LIME) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 52%.

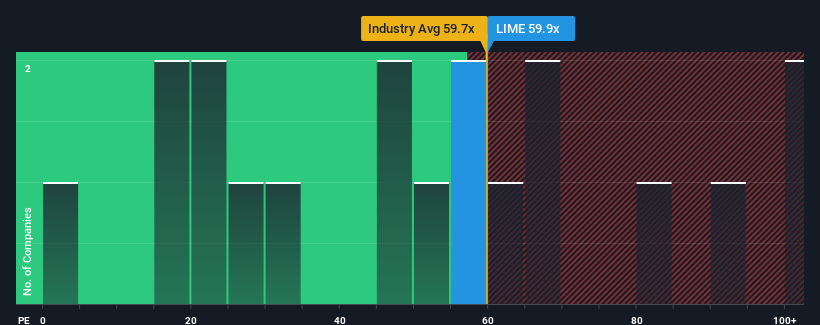

Following the firm bounce in price, Lime Technologies' price-to-earnings (or "P/E") ratio of 59.9x might make it look like a strong sell right now compared to the market in Sweden, where around half of the companies have P/E ratios below 22x and even P/E's below 14x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for Lime Technologies as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Lime Technologies

How Is Lime Technologies' Growth Trending?

Lime Technologies' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 19% gain to the company's bottom line. Pleasingly, EPS has also lifted 32% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 20% per annum during the coming three years according to the three analysts following the company. That's shaping up to be similar to the 19% each year growth forecast for the broader market.

With this information, we find it interesting that Lime Technologies is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Lime Technologies' P/E

Shares in Lime Technologies have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Lime Technologies currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Lime Technologies that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LIME

Lime Technologies

Provides software as a service (SaaS) based customer relationship management (CRM) solutions in the Nordic region.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion