Lime Technologies (STO:LIME) Will Pay A Larger Dividend Than Last Year At kr2.60

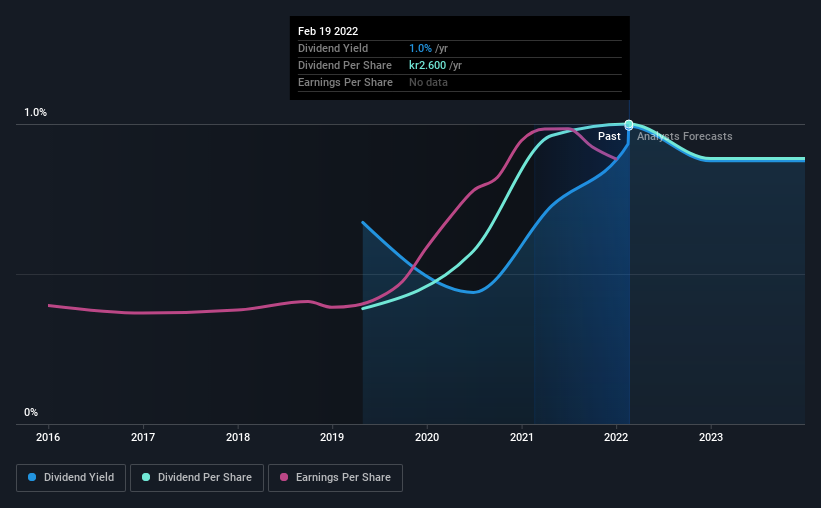

Lime Technologies AB (publ)'s (STO:LIME) dividend will be increasing to kr2.60 on 3rd of May. This will take the dividend yield from 1.0% to 1.0%, providing a nice boost to shareholder returns.

Check out our latest analysis for Lime Technologies

Lime Technologies' Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Lime Technologies was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Over the next year, EPS is forecast to expand by 33.1%. Assuming the dividend continues along recent trends, we think the payout ratio could be 36% by next year, which is in a pretty sustainable range.

Lime Technologies Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2019, the dividend has gone from kr1.00 to kr2.60. This means that it has been growing its distributions at 38% per annum over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Lime Technologies has impressed us by growing EPS at 19% per year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

Lime Technologies Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Earnings are easily covering distributions, and the company is generating plenty of cash. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Lime Technologies that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LIME

Lime Technologies

Provides software as a service (SaaS) based customer relationship management (CRM) solutions in the Nordic region.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion