- France

- /

- Capital Markets

- /

- ENXTPA:ANTIN

European Stocks Trading Below Estimated Value In October 2025

Reviewed by Simply Wall St

As the European stock markets continue to show resilience with the pan-European STOXX Europe 600 Index rising by 1.68% and major indices such as Germany's DAX and the UK's FTSE 100 also posting gains, investors are keenly assessing opportunities that may be trading below their estimated value. In this environment of improved business activity and consumer confidence, identifying stocks that are undervalued can provide potential avenues for growth, especially when considering companies with strong fundamentals amidst favorable economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talgo (BME:TLGO) | €2.59 | €5.12 | 49.4% |

| Pandora (CPSE:PNDORA) | DKK889.60 | DKK1750.62 | 49.2% |

| Nordisk Bergteknik (OM:NORB B) | SEK12.05 | SEK23.59 | 48.9% |

| Mentice (OM:MNTC) | SEK9.92 | SEK19.58 | 49.3% |

| Lingotes Especiales (BME:LGT) | €5.65 | €11.06 | 48.9% |

| Hanza (OM:HANZA) | SEK129.60 | SEK258.05 | 49.8% |

| doValue (BIT:DOV) | €2.828 | €5.64 | 49.9% |

| Cicor Technologies (SWX:CICN) | CHF194.00 | CHF385.33 | 49.7% |

| ArcticZymes Technologies (OB:AZT) | NOK30.30 | NOK59.56 | 49.1% |

| Aquafil (BIT:ECNL) | €1.93 | €3.85 | 49.8% |

Here's a peek at a few of the choices from the screener.

Antin Infrastructure Partners SAS (ENXTPA:ANTIN)

Overview: Antin Infrastructure Partners SAS is a private equity firm focused on infrastructure investments, with a market cap of €1.98 billion.

Operations: The firm generates revenue primarily from its asset management segment, totaling €319.65 million.

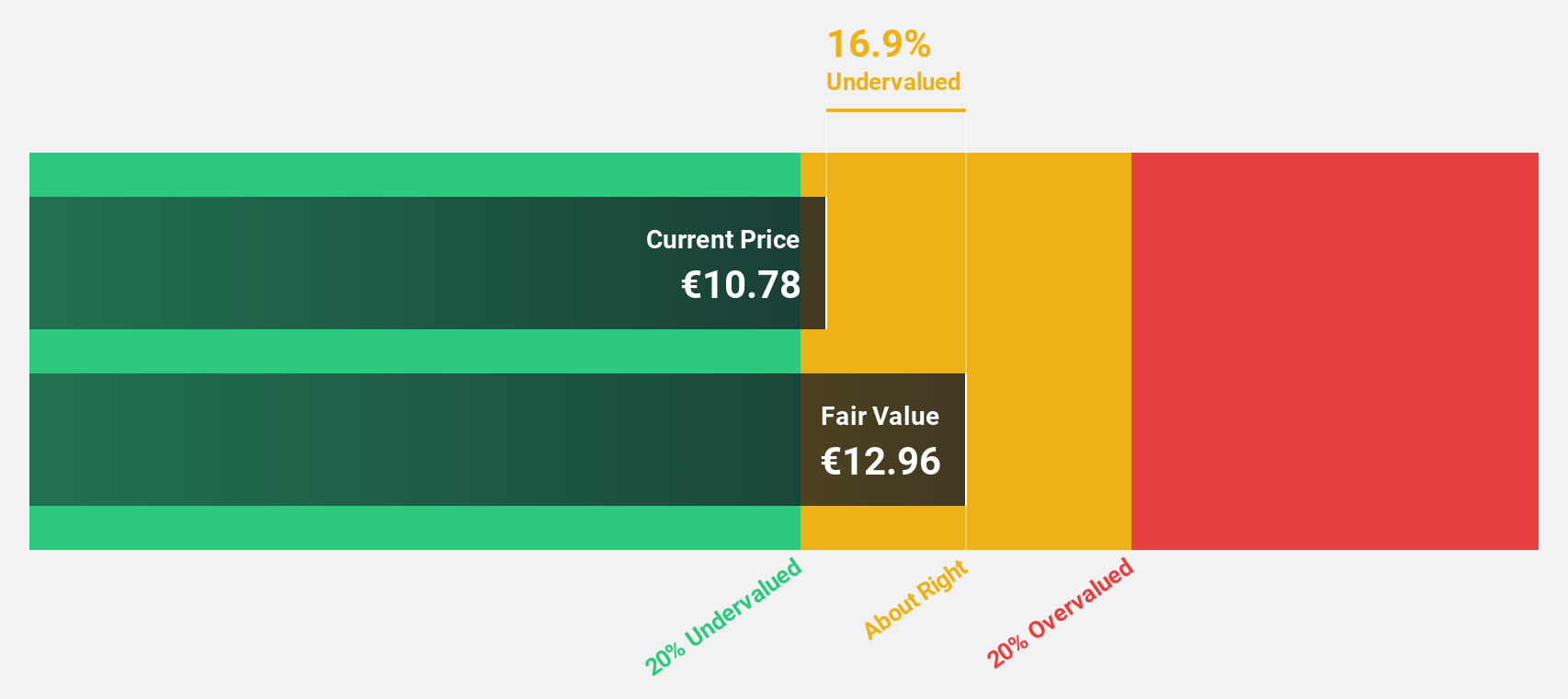

Estimated Discount To Fair Value: 13.8%

Antin Infrastructure Partners SAS is trading at €11.08, below its estimated fair value of €12.86, representing a 13.8% discount. Despite its revenue and earnings growth forecasts of 11.3% and 13.8% annually, respectively, outpacing the French market averages, the dividend yield of 6.41% lacks coverage by earnings or free cash flows, posing sustainability concerns. Recent inclusion in CAC indices may enhance visibility while executive changes could influence strategic direction positively in the long term.

- The growth report we've compiled suggests that Antin Infrastructure Partners SAS' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Antin Infrastructure Partners SAS stock in this financial health report.

AutoStore Holdings (OB:AUTO)

Overview: AutoStore Holdings Ltd. offers robotic and software technology solutions globally, with a market cap of NOK31.58 billion.

Operations: The company generates revenue from its Industrial Automation & Controls segment, amounting to $529 million.

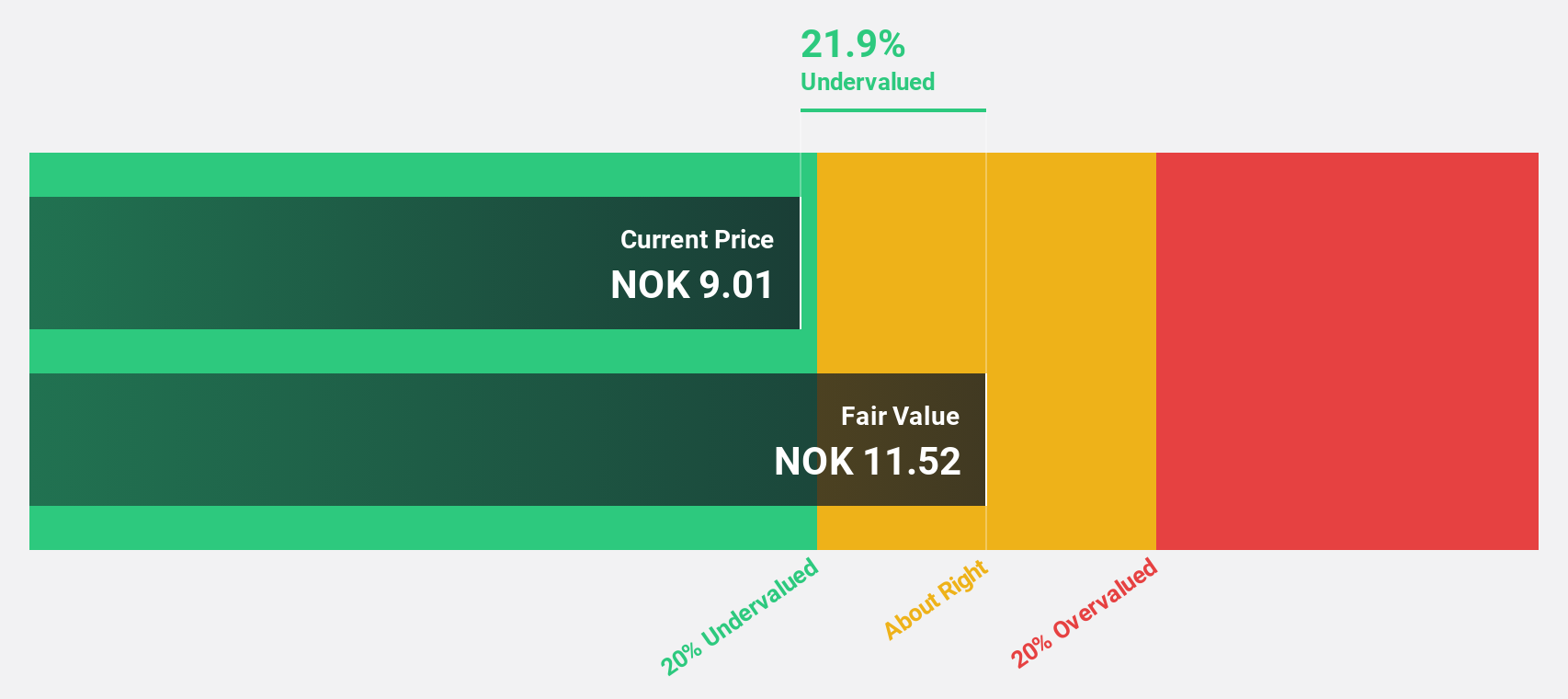

Estimated Discount To Fair Value: 17%

AutoStore Holdings, trading at NOK9.4, is undervalued by 17% compared to its estimated fair value of NOK11.33. Despite a drop in profit margins from 26.3% to 15.1%, earnings are projected to grow significantly at 30.8% annually for the next three years, outpacing the Norwegian market's growth rate of 13.9%. A strategic partnership with Rehrig Pacific enhances AutoStore’s position in warehouse automation, potentially boosting future cash flows despite recent volatility and lower revenues.

- According our earnings growth report, there's an indication that AutoStore Holdings might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of AutoStore Holdings.

Lime Technologies (OM:LIME)

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region, with a market cap of approximately SEK4.68 billion.

Operations: The company's revenue segment includes selling and implementing CRM systems, generating SEK731.63 million.

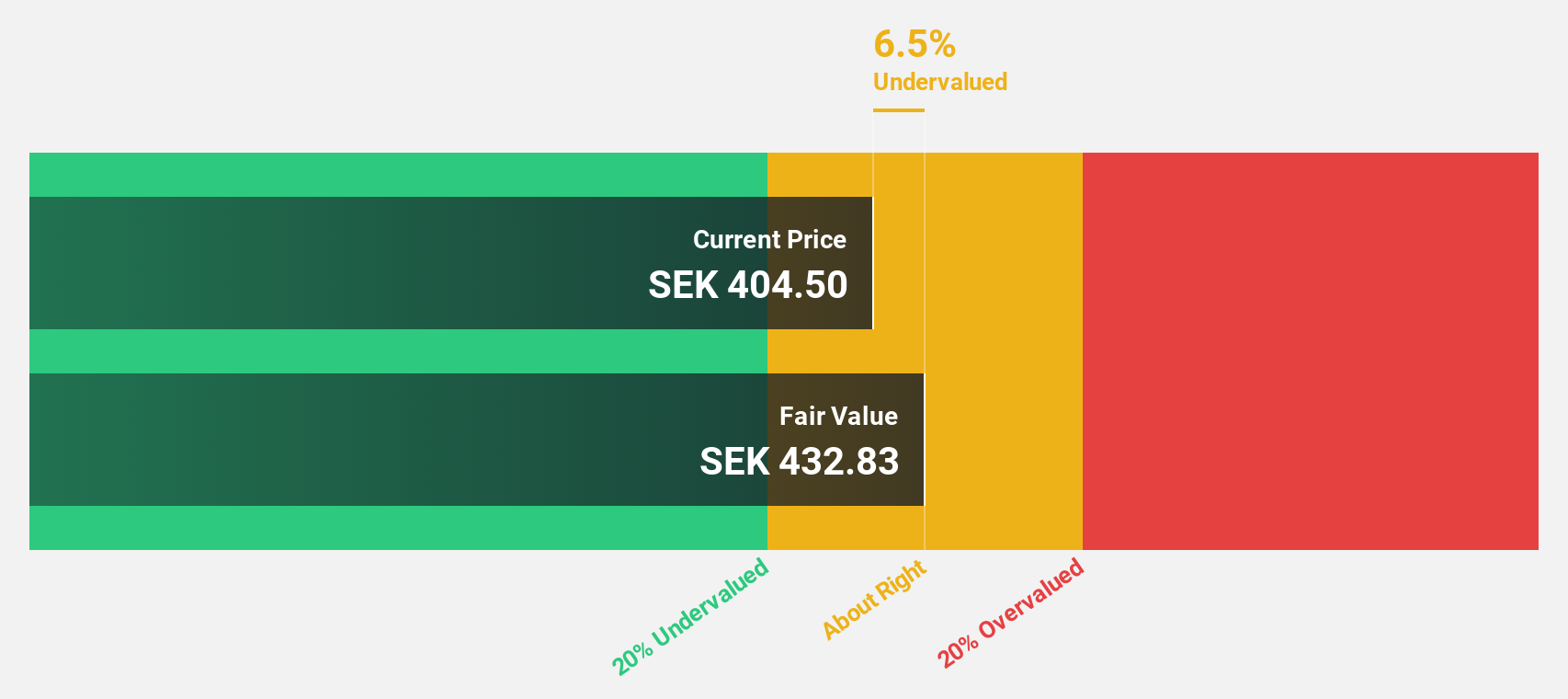

Estimated Discount To Fair Value: 22.3%

Lime Technologies, trading at SEK351.5, is undervalued by over 20% compared to its fair value of SEK452.38. Despite revenue growth forecasts of 11.6% annually being slower than earnings growth expectations, which are significant at 22.18%, the company remains attractive due to its high projected return on equity of 33.9%. Recent earnings reports show a steady increase in net income and sales, supporting its potential for robust cash flow generation in the future.

- In light of our recent growth report, it seems possible that Lime Technologies' financial performance will exceed current levels.

- Take a closer look at Lime Technologies' balance sheet health here in our report.

Taking Advantage

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 211 more companies for you to explore.Click here to unveil our expertly curated list of 214 Undervalued European Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ANTIN

Antin Infrastructure Partners SAS

A private equity firm specializing in infrastructure investments.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives